hankyoreh

Links to other country sites 다른 나라 사이트 링크

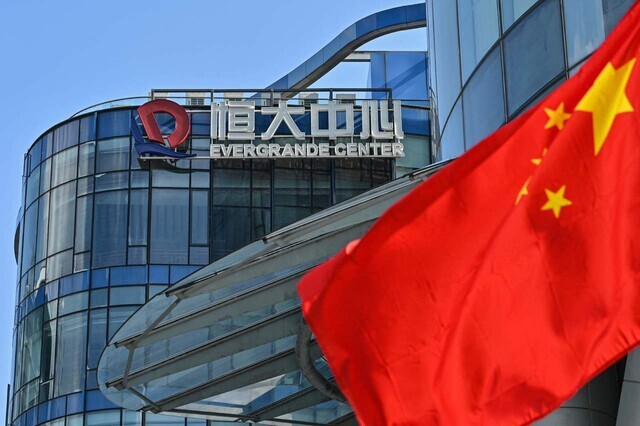

One day separates debt-ridden Evergrande from weekend default

China Evergrande Group, China’s second-largest real estate developer, is running out of options to escape a severe liquidity crisis. The breakdown of negotiations for the sale of a key unit makes it nearly impossible for Evergrande to meet the deadline for paying coupons on dollar-denominated bonds, with the grace period expiring this weekend. That’s increasing concerns about default at the real estate giant.

Reuters and other news sources reported on Thursday that Evergrande and Hopson Development, a rival developer that had been negotiating to buy out Evergrande’s stake in a subsidiary, announced in filings on the Hong Kong stock exchange on Wednesday night that the negotiations were over and that the sale would not go forward as intended.

Trading of Evergrande stock had halted when negotiations for the sale began, but the stock went into a tailspin as soon as trading resumed on Thursday.

On Oct. 1, Hopson Development said it was entering talks to buy out Evergrande’s 50.10% stake in Evergrande Property Services, a key unit in the group. Hopson had planned to buy shares worth HK$20.04 billion (US$2.58 billion), at HK$3.70 per share, but the two sides were reportedly unable to reach a deal even after the tentative deadline of Oct. 12 had passed.

Evergrande Property Services said in a separate filing that the deal “did not take place” because Hopson “had not met the prerequisite” for making the purchase.

While Evergrande did not specify what this “prerequisite” was, the South China Morning Post reported that “the deal may have blown up because of a disagreement over the payment of the purchase price,” citing a Hopson statement.

“Evergrande wanted immediate payment, while Hopson wanted to pay only after completing a due diligence to assess the payable accounts and receivables with suppliers,” the South China Morning Post said.

Evergrande, which is more than $300 billion in debt, is staring down the barrel of default after it failed to pay US$83.5 million in interest on around US$20 billion in dollar-denominated bonds on Sept. 23.

The bond contracts give the company a 30-day grace period for paying coupons after the due date, with the grace period set to end tomorrow, on Oct. 23. But Evergrande has made no progress on efforts to sell off assets to achieve liquidity.

“Chinese state-owned Yuexiu Property has pulled out of a proposed $1.7 billion deal to buy China Evergrande Group's Hong Kong headquarters building,” Reuters said in an Oct. 16 report about the cash-strapped company.

“Yuexiu, based in the southern city of Guangzhou, was close to sealing a deal in August to acquire the 26-storey China Evergrande Centre,” it continued.

Evergrande has also tried to spin off its electric vehicle unit, called Evergrande New Energy Auto, as well as a Swedish automaker acquired by that unit, but it seems there have been no takers so far.

If Evergrande fails to make its interest payment by Oct. 23, credit rating agencies will declare it to be in default.

Evergrande’s liquidity crisis has been aggravated by a sharp downturn in China’s real estate market. In September, housing prices fell in 70 cities across China for the first time in six years. The real estate slump is thought to have been one of the factors depressing China’s economic growth rate in the third quarter.

That’s another factor fueling speculation that Evergrande is on the brink of bankruptcy.

But others don’t expect Evergrande’s crisis to spiral out of control. The Nikkei observed on Wednesday that the real estate giant was still paying coupons on yuan-denominated bonds and suggested that the company hopes to minimize chaos in China even if it defaults on its dollar debt.

The Japanese newspaper added that China’s debt liquidation procedures would allow Evergrande to remain in business. “Evergrande will probably be able to continue selling off its assets while receiving funding from Chinese financial institutions,” the Nikkei predicted.

“The healthy development of the real estate market will not change,” said Chinese Vice Premier Liu He.

“Some individual problems have appeared, but overall, the danger can be controlled,” Liu said.

By Jung In-hwan, Beijing correspondent

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 2‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 3No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 4Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 5Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 6Is N. Korea threatening to test nukes in response to possible new US-led sanctions body?

- 7Korea’s 1.3% growth in Q1 signals ‘textbook’ return to growth, says government

- 8N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 9[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 10Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report