hankyoreh

Links to other country sites 다른 나라 사이트 링크

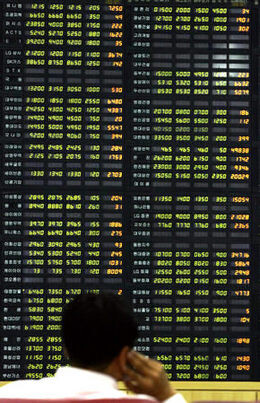

After North’s test, questions about S.K. investment

Calls have been coming in to banking centers in South Korea, placed by customers worrying that North Korea’s nuclear test will spell doom for their domestic investments.

The private banking center of a branch of Woori Bank in southern Seoul several days ago received a telephone call from a customer, who had accumulated wealth by investing in domestic real estate. He said that since North Korea’s nuclear test, "many people are talking about investing in overseas assets. I feel uneasy because I think that I will be a loser [in the long run]."

But others are seeing an opportunity in all the tumult. Shortly after Pyongyang conducted a nuclear test, the private banking center of Shinhan Bank in Seocho received a call from a customer, who said, "The stock prices are sharply falling, but they will rise eventually. Then, isn’t this a good time to invest?”

Since North Korea’s October 9 declaration that it conducted a nuclear test, private banking groups have received an increasing number of calls from wealthy customers feeling uneasy regarding their holdings, whether it be a perceived need to reduce or increase them.

Most branches of private banking groups are encouraging customers to take interest in investing in overseas assets, especially mid- and long-term funds. Park Seung-an, an official of Woori Bank’s private banking center, said, “For a long time I have advised customers to invest some of their money in overseas properties. Since the North’s nuclear crisis, it has been easier to convince people to make these kinds of investments. The attitudes of wealthy investors have changed - those who had not previously shown interest in investing abroad.”

Notwithstanding the period following the North’s test, investment in overseas funds has gained strength overall in the second half of this year. Banks are welcoming the situation because they reap higher service charges for overseas transactions.

Due to the recent escalation in the North Korean nuclear crisis, interest in investing in overseas real estate is likely to rise. As the U.S. real estate market is currently stagnant, South Korean investors are hesitant about investing there; the Middle East and Southeast Asia are emerging as alternatives. A presentation by the multi-purpose U’BORA Tower apartment complex in Dubai, organized by Bando Construction Co. on October 12, was attended by about 150 would-be South Korean investors, and in the days following, up to 200 domestic investors paid a 5 million won subscription fee to set up their investment into the apartment complex. There are some who want to buy up to five units there.

Rootiz Korea, a consulting firm, has also received many calls from those who have a keen interest in overseas real estate. Rootiz plans to hold a presentation on October 29 for about 250 doctors that want to invest in overseas properties.

Korean society in Los Angeles also expects that the North Korean nuclear crisis will prompt many wealthy South Koreans to turn their eyes to real estate there. A radio station for Korean residents in Los Angeles said that many in Los Angeles’ Koreatown expect that wealthy people in South Korea will begin to rush to the United States for real estate investment.

According to Kim Jae-han, a leader of the private banking team at Kookmin Bank in Bangbae-dong, said that investors "are watching the situation, but if the North Korean nuclear crisis becomes aggravated, people are expected to begin to invest in overseas real estate."

Editorial・opinion

![[Column] A death blow to Korea’s prosecutor politics [Column] A death blow to Korea’s prosecutor politics](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0415/7517131654952438.jpg) [Column] A death blow to Korea’s prosecutor politics

[Column] A death blow to Korea’s prosecutor politics![[Correspondent’s column] The US and the end of Japanese pacifism [Correspondent’s column] The US and the end of Japanese pacifism](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0412/1017129080945463.jpg) [Correspondent’s column] The US and the end of Japanese pacifism

[Correspondent’s column] The US and the end of Japanese pacifism- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

- [Guest essay] At only 26, I’ve seen 4 wars in my home of Gaza

- [Column] Syngman Rhee’s bloody legacy in Jeju

- [Editorial] Yoon addresses nation, but not problems that plague it

- [Column] Can Yoon and Han stomach humble pie?

Most viewed articles

- 1[News analysis] Watershed augmentation of US-Japan alliance to put Korea’s diplomacy to the test

- 2[Guest essay] How Korea turned its trainee doctors into monsters

- 3[Column] A death blow to Korea’s prosecutor politics

- 4[Photo] Cho Kuk and company march on prosecutors’ office for probe into first lady

- 5[Column] A third war mustn’t be allowed

- 6‘National emergency’: Why Korean voters handed 192 seats to opposition parties

- 7Exchange rate, oil prices, inflation: Can Korea overcome an economic triple whammy?

- 8After Iran’s attack, can the US stop Israel from starting a regional war?

- 9[Editorial] New KBS chief is racing to deliver Yoon a pro-administration network

- 10[Editorial] Stagnant youth employment poses serious issues for Korea’s future