hankyoreh

Links to other country sites 다른 나라 사이트 링크

<font color=#006699><b>Lee administration tax cuts benefited only households in top 20 percent income bracket</b></font>

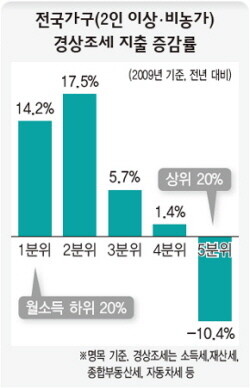

A report by the National Statistical Office on March 12 confirms that only households in the upper 20 income bracket have enjoyed tax cut benefits pursued by the Lee Myung-bak administration, while other households’ tax burden increased.

According to the National Statistical Office (NSO) report, the ordinary tax payment in 2009 decreased to 94,541 Won ($84) per month by 4.4 percent compared to that of 2008 (98,857 Won per month). The year 2009 was the first year the government enacted its tax revision plan created in 2008, in which the income tax and comprehensive tax rates for some income brackets decreased.

Although overall household taxes decreased, the benefits were focused on households in the upper 20 percent income bracket. Households in the bottom 20 percent of income bracket in 2009 experienced an increase in taxes of 16,181 Won, a 14.2 percent increase from 2008 (14,171 Won). With the exception of households in the top 20 percent of household income, who enjoyed a 10 percent decrease in taxes from 310,610 Won to 278,367 Won, every household experienced a tax increase last year.

An NSO official said, “Households in the upper 20 percent income bracket were most affected by the income tax decrease, while other households’ tax increase were due to increased taxes on automobiles.”

Please direct questions or comments to [englishhani@hani.co.kr]

Editorial・opinion

![[Column] Has Korea, too, crossed the Rubicon on China? [Column] Has Korea, too, crossed the Rubicon on China?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/9317135153409185.jpg) [Column] Has Korea, too, crossed the Rubicon on China?

[Column] Has Korea, too, crossed the Rubicon on China?![[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/2317135166563519.jpg) [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2After 2 months of delayed, denied medical care, Koreans worry worst may be yet to come

- 3Hong Se-hwa, voice for tolerance whose memoir of exile touched a chord, dies at 76

- 4[Column] Has Korea, too, crossed the Rubicon on China?

- 5[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- 6Samsung barricades office as unionized workers strike for better conditions

- 7All eyes on Xiaomi after it pulls off EV that Apple couldn’t

- 8[Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- 9[News analysis] After elections, prosecutorial reform will likely make legislative agenda

- 10US overtakes China as Korea’s top export market, prompting trade sanction jitters