hankyoreh

Links to other country sites 다른 나라 사이트 링크

80 percent of borrowers pay only interest on mortgages

By Kim Su-heon, Writer

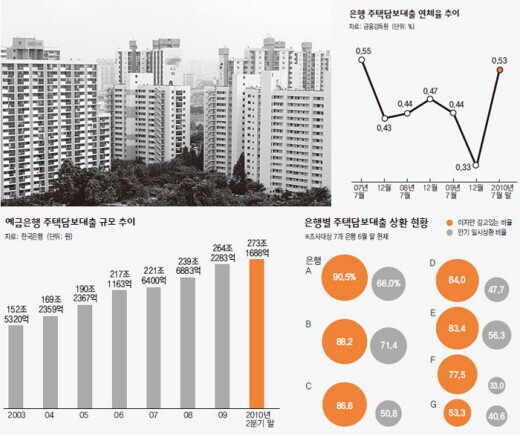

Of the total mortgages by domestic commercial banks, about 80 percent are just receiving interest payments without payments toward the principal. Of these, most borrowers are putting off paying back the principal through deadline extensions, so concern has arisen that mortgages could rapidly become insolvent in the event of a shock such as a crash in housing prices or a rise in interest rates.

On Monday, the Hankyoreh analyzed the mortgage deadline structure and repayment method data as of June received from seven commercial banks, including Kookmin, Woori, Shinhan, Hana, IBK and KEB. It found that of the 230.53 trillion Won ($196 billion) in mortgages, 106.28 trillion Won, 46.1 percent, were balloon payment mortgages, while 124.24 trillion Won, 53.9 percent, were amortizing payment mortgages.

Of the amortizing mortgages, just 39 percent (48.43 trillion Won) were loans in which the principal and interest were paid together. About 61 percent (75.81 trillion Won) were loans in which only the interest was being paid, as it was still during the term of the loan. Accordingly, for 79 percent of mortgages (182.09 trillion Won), only the interest was being paid while repayment of the principal was being delayed, including 106.29 trillion Won in balloon loans and 75.81 trillion Won in in-term amortizing loans.

South Korea’s current mortgage structure appears to be more dangerous than that of developed nations that have experienced financial crises due to real estate bubbles. In most developed nations, mortgages are either long-term, over 20 years, or amortizing mortgages in which the interest and principal are paid simultaneously. In South Korea, many people have balloon loans in which the principal is paid back all at once at the end of the loan, and even if the interest and principal is paid back simultaneously, it is usual for borrowers to pay only interest for three or more years.

Moreover, in fact, most borrowers extend the deadline or term period when it runs out. According to data announced by the Financial Supervisory Commission (FSC), 95 percent of balloon loan borrowers receive extensions. When one considers the size of balloon loans, which range from tens of millions of Won to hundreds of millions of Won, if the house is not sold, they are difficult to pay back.

“60 to 70 percent of loan borrowers ask for extensions after the term is over,” said one commercial bank loan officer. “Many people are just paying interest until they can sell their house, since paying back the interest would be too great. Ultimately, both households who borrowed money with their home as collateral and the banks that make the loans are sitting on a big powder keg growing increasingly likely to blow.”

Of all mortgages, about 80 percent of the total are just receiving interest without repayment of the principal: this is a deformity that came about as a result of the meshing of needs of domestic commercial banks and households over the last decade.

Since the 1997 foreign exchange crisis, when banks had a tough time due to business loans, banks have been busy expanding household loans with houses as collateral. As real estate prices have risen, an atmosphere has spread among families that they must buy a house, even if they build up unreasonable debts. The three-year grace period customarily given on principal repayment is given with the intention not so much of repaying the loan after three years but rather paying it back after housing prices have increased so families can sell the house and repay.

With the rise in housing prices stopping after the 2008 global financial crisis and house sales in a lull, however, this strategy has begun to experience flaws.

EduMoney director Je Yun-gyeong said, “Many borrowers, being put in a situation where they cannot sell their homes or have to sell it at a very cheap price, are ‘buying time’ through term extensions.”

Banks have also assume the attitude that they will incur no losses from this situation.

“Since banks are getting sufficient collateral value, there is no real worry about insolvency,” said one loan officer at a commercial bank. “All clients need to do is get a term extension and pay only interest until they can sell their home and pay back the loan.”

The financial authorities are also ignoring this situation. Early last year, the government instructed commercial banks to extend deadlines and terms.

Dongguk University professor Kang Kyeong-hoon said, “Borrowers who extend the term period must be seen as people who have neither the capacity nor the intention to pay the principal back.” Kang also said, “Strictly speaking, these are bad loans, and banks are evergreening, which is to say, banks are hiding insolvency behind extensions and refinance loans.”

Accordingly, if housing prices were to collapse or borrower incomes were to fall due to poor business or retirements, banks could suspend extensions and demand repayment of the principal, and borrowers could very well possibly put their homes on the market at once. In a worst case scenario, it could lead to a vicious circle of falling real estate prices, skyrocketing household bankruptcy and bank insolvency. Hanyang University Professor Ha Joon-gyeong said, “If the principal repayment is delayed, a large shock could result when real estate prices fall.”

Ha also said, “In order to prevent a hard landing, banks should quickly begin restructuring the mortgage system.”

Please direct questions or comments to [englishhani@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 3[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5Thursday to mark start of resignations by senior doctors amid standoff with government

- 6N. Korean hackers breached 10 defense contractors in South for months, police say

- 7[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 8[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 9Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South

- 10[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent