hankyoreh

Links to other country sites 다른 나라 사이트 링크

Big corporations still receiving generous government support

By Ryu Yi-geun, Lee Wan and Song Gyung-hwa, staff reporters

How much of the government’s money is going to the country’s largest corporations each year? It’s an important question that is closely tied to the amount of resources it can afford to spare for other players in the economy - smaller companies and the middle and working classes.

The Hankyoreh analyzed data on Feb. 2 from different state institutions, including the Ministry of Science, ICT and Future Planning, the National Tax Service, and the Public Procurement Service, and from state-directed financial institutions like Korea Development Bank.

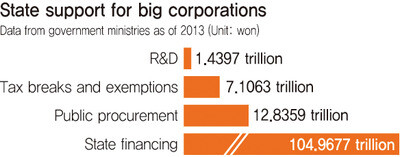

The figures showed some 21 trillion won (US$19.4 billion) in state money going to big corporations each year in budget expenditures such as subsidies, public procurement, and tax breaks. The total jumped to more than 125 trillion won (US$116.6 billion) when state-directed financial support like loans and guarantees were factored in. Big business may not be getting quite the same level of state benefits and support it did in the past, but the numbers are still high.

The budget funds going to big corporations can be broken down into subsidies - often with only minimal eligibility conditions - along with tax breaks, and procurement contracts to supply goods and services. The bulk of subsidies consisted of state research and development (R&D) funding, which ran to 16,877.7 billion won (US$15.6 billion) in 2013. The amount going to private businesses, instead of government-funded think tanks or universities, was 3,535.3 billion won (US$3.3 billion). Forty percent of this amount, or 1,439.7 billion won (US$1.3 billion), was directed by large corporations. Even such major players as Samsung Electronics and Hyundai Motor, which have more than enough to invest in their own R&D, are active participants in state-funded R&D projects.

As big corporations invest more money - the state’s or their own - in R&D, they are enjoying bigger breaks on their corporate taxes. In 2012, companies reported a total of 7.106 trillion won (US$6.6 billion) in tax breaks of various kinds, including deductions for temporary investment (the current “job creation investment” break) or investing in energy-saving facilities. This amount was just under 75% of the 9.492 trillion won (US$8.8 billion) in deductions and exemptions for all companies, SMEs included.

As the breaks get bigger, the big companies owe less in taxes. With the top ten chaebols - including Samsung, Hyundai Motor, SK, and LG - accounting for nearly half of the deductions and exemptions, a select few corporations are benefiting from tax expenditures.

The central government depends on taxes as its primary source of revenue. It also needs various goods and services to run the country - everything from pencils to dams for its Four Major Rivers Project. Big business turns out to a big part of the procurement process, too.

The public procurement market runs to over 106 trillion won (US$98 billion) a year. The Public Procurement Service spends 38.4 trillion won (US$35.5 billion) of this, and 12.8 trillion won (US$11.9 billion) of the total, or about 33%, goes to big corporations. Divvying up the biggest procurement projects according to the company’s share of the private market - assigning them by company scale, in other words - remains a deep-rooted practice.

Support from the state-directed financial institutions is also going disproportionately to big business. Last year, a total of 104,967.7 billion won (US$97.1 billion) in loans, investment, and guarantees were provided to large corporations by KDB, the Korea Finance Corporation, and Korea Exim Bank. This represented 76.18% of total financial support from the three state-directed banks.

Those state-directed financial institutions offer various benefits to companies, which can receive longer-term support at lower interest rates than commercial banks, with funding available for large-scale projects.

Big exporting businesses also took advantage of Korea Trade Insurance Corporation insurance services, to the tune of 183 trillion won (US$169.5 billion) in 2013.

As a category, “large corporations” refers to all corporate groups and businesses subject to cross-shareholding prohibitions according to the Framework Act on Small and Medium Enterprises - restrictions that do not apply to SMEs. The large corporations account for 0.09% of all businesses in South Korea.

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 3[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5Thursday to mark start of resignations by senior doctors amid standoff with government

- 6N. Korean hackers breached 10 defense contractors in South for months, police say

- 7[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 8[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 9Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South

- 10[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent