hankyoreh

Links to other country sites 다른 나라 사이트 링크

Chaebol getting more power as they contribute less to the economy

By Kwak Jung-soo, business correspondent

After Samsung Electronics, South Korea’s best-performing company, reported lower earnings in the second quarter of the year, concerns are growing about how the so-called “Samsung risk” could have a negative impact on the South Korean economy. At the same time, the concentration of economic power in the top chaebol is intensifying polarization even among the chaebol. Furthermore, while South Korea’s most successful chaebol take up a huge share of the South Korean economy, they contribute less to the real economy.

On July 9, Kim Sang-jo, a professor at Hansung University, made a presentation titled “Seeking a New Paradigm for a Regulation Regime for Business Conglomerates” at a policy debate focusing on SMEs and the South Korean industrial ecosystem, organized by the Korea Development Economics Association and held at the Korea Institute of Finance in Myeongdong, Seoul. According to Kim’s analysis, in 2012 Samsung held 21% of the total assets of the top 30 chaebol, the Samsung family group (including Samsung, CJ, Shinsegae, and Hansol) had 25%, and the top four chaebol families (Samsung, Hyundai Motor, SK, and LG and the groups spun off from them) had 69%.

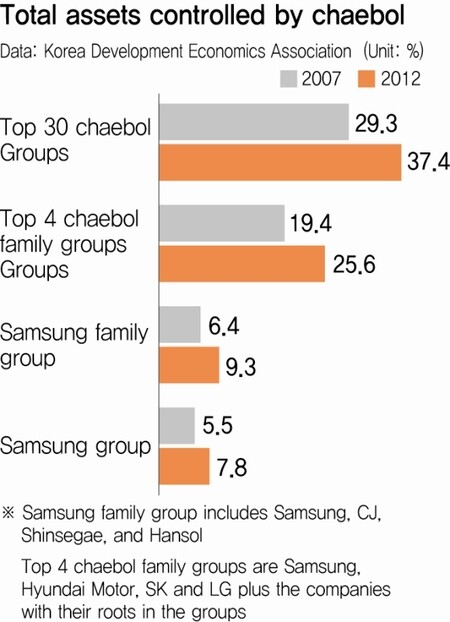

In addition, Kim said that polarization among chaebol had become more extreme. The percentage of total national assets (outside of the financial sector) held by the top 30 chaebol increased by 14% between 2007 and 2012, but this percentage grew by 22% in the top four chaebol families, and by 34% in the greater Samsung family.

Even more serious is the fact that, aside from the four largest chaebol families, half of these groups are either insolvent or are in danger of becoming insolvent. Five groups (STX, Kumho, Tongyang, Ungjin, and Taihan) are already in a workout program or are in court receivership.

There are also ten groups (Hanjin, Doosan, Dongbu, Hyundai, Hyosung, GM Korea, Dongkuk Steel, Kolon, Daesung, and Halla) that meet the two conditions for being in danger of insolvency: a debt-to-equity ratio above 200% and an interest coverage ratio (the ratio of a company’s consolidated earnings to the cost of interest) below 1. The number of such companies is increasing rapidly: there were 2 in 2010, 5 in 2011, and 10 in 2012.

“At the moment, the South Korean economy is under the thumb of chaebol groups that belong to four families,” Kim said. “Chaebol policy currently faces two challenges: suppressing the concentration of wealth in the top chaebol on the one hand, and restructuring the less successful insolvent groups on the other.”

In an analysis of how chaebol contribute to the national economy, Hong Jang-pyo and Ha Bong-chan, professors at Pukyong National University, examined the 15 chaebol with the most revenue, including Samsung Electronics and Hyundai Motor, in the five business areas of electronics, automobiles, shipbuilding, telecommunications, and system integration. Compared to their size, Hong and Ha concluded, these companies are doing little to stimulate production and employment at SMEs and large established companies in South Korea.

A considerable number of large companies in the area of manufacturing invest more money in foreign subsidiaries than domestic subsidiaries. Samsung Electronics invested 127 trillion won (US$125.51 billion) in domestic subsidiaries in 2011, and 284 trillion won in foreign subsidiaries, more than twice domestic investment. SK Hynix invests nearly 49 times more money in its overseas subsidiaries than its domestic ones. This illustrates that investment by chaebol is concentrated overseas, not in Korea.

These 15 chaebol bought 44%, or nearly half, of raw materials and parts from their own subsidiaries, and they bought 21%, or more than a fifth, from subsidiaries in other countries. This was even higher among chaebol in the manufacturing sector, which made 48% of purchases from subsidiaries, and 24.4% from overseas subsidiaries.

Samsung Electronics made 80% of its 69 trillion won (US$68.19 billion) in purchases in 2011 from its subsidiaries. Significantly, 55% of purchases were from overseas subsidiaries, even more than from domestic ones.

At Kia Motor, 62% of purchases were made from subsidiaries, while SK Hynix bought 54% of parts and supplies from overseas subsidiaries. In contrast, Hyundai Motor and LG Electronics contributed relatively more to the national economy. Only 1.4% of Hyundai’s purchases went to overseas subsidiaries, and 78.5% of purchases at LG Electronics were made at non-subsidiaries, including SMEs.

“We need to craft policies aimed at encouraging chaebols to base their procurement on domestic production by SMEs. Along with this, we need regulations against funneling work to subsidiaries,” Hong said.

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Does Yoon think the Korean public is wrong? [Editorial] Does Yoon think the Korean public is wrong?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/8517133419684774.jpg) [Editorial] Does Yoon think the Korean public is wrong?

[Editorial] Does Yoon think the Korean public is wrong?![[Editorial] As it bolsters its alliance with US, Japan must be accountable for past [Editorial] As it bolsters its alliance with US, Japan must be accountable for past](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/6817133413968321.jpg) [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

[Editorial] As it bolsters its alliance with US, Japan must be accountable for past- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Samsung barricades office as unionized workers strike for better conditions

- 3[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes

- 4[Guest essay] How Korea turned its trainee doctors into monsters

- 5Why Israel isn’t hitting Iran with immediate retaliation

- 6S. Korea, Japan reaffirm commitment to strengthening trilateral ties with US

- 7Japan officially says compensation of Korean forced laborers isn’t its responsibility

- 8[Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- 9Korea, Japan jointly vow response to FX volatility as currencies tumble

- 10‘Right direction’: After judgment day from voters, Yoon shrugs off calls for change