hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea still far behind Japan economically

By Kwak Jung-soo, business correspondent

Companies like Samsung Electronics and Hyundai Motor may be big enough to rival their Japanese counterparts, but South Korea’s overall economic strength is still far behind Japan’s, a study shows.

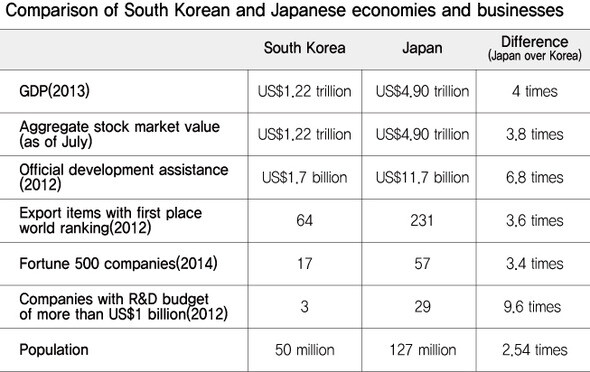

Figures released on Aug. 18 by the Federation of Korea Industries (KFI) illustrate the economic gap between the two countries. Last year, South Korea’s gross domestic product (GDP) was US$1.22 trillion, or about one-quarter Japan’s US$4.90 trillion. Aggregate market value was also one-quarter Japan’s, at 1.24 quadrillion won (US$1.22 trillion) to 4.79 quadrillion won (US$4.71 trillion). In the cases foreign currency transactions and official development assistance, the gap has grown, with South Korea’s levels roughly one-seventh Japan’s.

The overall competitiveness gap between South Korea and Japan showed a difference of roughly three to four times. South Korea had 64 items for which it ranked first in world export market share, a measure of corporation’s global competitiveness. Japan had 231.

At 50 million, South Korea’s population is far smaller than Japan’s 127 million people.

Japan also had 57 Fortune 500 companies, compared to 17 for South Korea. in terms of Nobel Prizes in the sciences, a barometer of national science and technology levels, Japan has 16 laureates, while South Korea has yet to have one.

A 2012 list of the top 2,000 world companies for research and development (R&D) published by the European Commission showed 353 for Japan, but only 56 for South Korea. As of that year, only three South Korean companies had R&D spending over one trillion won (US$980 million): Samsung Electronics, LG Electronics, and Hyundai Motor. Japan had 29, including Toyota and Honda.

In some items, including semiconductors and cars, South Korean items had the global competitiveness to rival or outpace Japanese businesses.

In semiconductor production, South Korea passed Japan for the first time last year to rank second in the world after the US. Dependence on Japan for parts and materials - one of the chief factors in South Korea’s trade deficit with the country - has also fallen sharply. And while South Korean manufacturing had an overall global market share of 2.8% to Japan’s 5.8% in 2005, a difference of roughly half, by 2011 it had narrowed the gap considerably with a 3.4% share to Japan’s 5%. Its global market share now exceeds Japan’s in shipbuilding, communications devices, and textiles.

South Korea’s leading companies have competitive levels on par with Japan’s. In electronics, Samsung Electronics had three times the sales of top Japanese electronics company Panasonic last year, and more than four times the ratio of operating profits to net sales. In cars, Hyundai also came out ahead of Toyota in its ratio of operating profits to net sales. Top companies in steel, heavy industries, and automobile parts showed similar levels to their Japanese counterparts.

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 2‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 3Is N. Korea threatening to test nukes in response to possible new US-led sanctions body?

- 4Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 5Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 6N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 7[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 8Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 9No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 10[Reportage] On US campuses, student risk arrest as they call for divestment from Israel