hankyoreh

Links to other country sites 다른 나라 사이트 링크

[Special series - part IV] Chemical industry suffering a ‘sandstorm’

By Kim Jeong-pil, staff reporter

In the second half of 2014, S-Oil decided to begin restructuring, switching its focus from oil refining to petrochemicals.

Generally speaking, the oil industry can be divided into two areas. There is the refining sector, which involves importing crude oil and producing and selling petroleum products such as gasoline, diesel, and naphtha. There is also the petrochemical sector, the area that processes naphtha to make chemicals that then become the building blocks for other products.

With the situation in the refining sector getting worse, companies in the industry are turning their attention to petrochemicals. However, it is uncertain whether petrochemicals will provide the breakthrough they are seeking. With the Chinese market slowing, the growth trend in the industry has been on the decline since 2012.

At South Korea’s four major oil refiners, revenue from oil refining is nine times higher than petrochemicals. However, since the petrochemical sector is more profitable, petrochemical revenue has been used to prop up operating profits, compensating for the deficit in refining. But operating profits in petrochemicals tumbled 24% to 1.65 trillion won (US$1.60 billion) in 2013, resulting in a decrease in overall corporate earnings.

Trouble is also brewing in the petrochemical industry, which is playing a crucial role in the South Korean economy as one of the country’s five most important categories of exports. In 2012, GS Caltex accepted voluntary resignations from members of its sales department (around 800 people); recently, it has been asking for voluntary resignations from all departments.

“The industry has been going downhill since the second half of 2012. Until then, it was rare for petrochemical exports to decrease in a year. The recent drop in exports is an extremely bad sign. China has been consuming around 40% of the petrochemicals that Korea produces. The recent reduction in China’s consumption is having the biggest effect on this,” one industry source explained.

This is how another industry source explained it. The main cause of the slump in the industry can be found in the Chinese market. The rapid increase of imports to China from 2009 to 2011 led to a boom in the Korean petrochemical industry. The petrochemical industry is regarded as a cyclical industry, moving through the phases of overinvestment, oversupply, falling prices, work stoppage, rising prices, and investment. This is generally seen in the industry as a five-year cycle. But recently, with China’s self-sufficiency rapidly increasing, the market’s ability to regulate itself is not working, raising concerns about a long-term slump.

The percentage of South Korean petrochemical product exports that go to China jumped from 46.4% in 2008 to 51.5% in 2009, eventually stabilizing at 47-48%. In contrast, China’s self-sufficiency rate for the three major petrochemical products (synthetic resins, synthetic fibers, and synthetic rubbers) increased from 65% in 2010 to 75% in 2013.

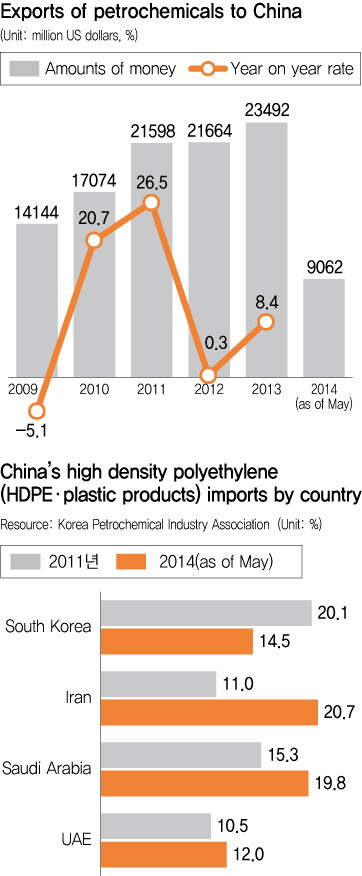

During that process, total exports to China in 2009 decreased by 5.1% year on year, with the overall value of petrochemical exports plunging by 14.5%. After that, exports to China took a turn for the better, but in 2012 the value of exports to China once again fell by 0.3% year on year, resulting in a 0.7% decrease in the total value of exports. Figures in the first five months of 2014 are also down from the previous year.

Another big strain on the industry are efforts by oil producers in the Middle East, which had previously only sold crude oil, to build petrochemical facilities and increase added value.

The “sand storm” of price competitiveness blowing from the Middle East is becoming a reality in the Chinese market.

Take China’s import rates by country for high-density polyethylene (HDPE), a kind of synthetic resin. In 2011, South Korea was China’s top importer of HDPE, accounting for 20.1% of its imports; by 2013, South Korea had slipped to third place, after Iran and Saudi Arabia. The figures in the first half of this year are similar. Since 2013, South Korea has also been pushed aside by Iran and Saudi Arabia in the area of polypropylene (PP), another synthetic resin product.

“In addition to China’s increasing self-sufficiency and the market inroads made by Middle Eastern companies relying on price competitiveness, the boom in exports of petrochemical products based on inexpensive raw materials including shale gas, ethane gas, and coal chemistry is making it more difficult for South Korean firms to complete,” said one industry source.

The general view in the petrochemical industry is that, while poor performance continued in the first half of the year among major South Korean firms, performance will improve in the second half of the year as advanced countries in Europe and North America enjoy an economic recovery. While it is not likely that there will be much growth in the short-term, there is expected to be some degree of relief from the pressure of oversupply as demand for using petrochemicals as raw materials for creating other products increases across the industry.

Industry experts are seeking to address these problems by developing technology that can lower production costs. Compared to the process of producing naphtha-based petrochemicals from crude oil, the shale gas or ethane gas processes are much more affordable.

At the beginning of 2014, Lotte Chemical signed an agreement to build an ethane cracker plant based on shale gas in the US, while Hanhwa Chemical and other companies are also planning to expand into the US. Meanwhile, LG Chem is moving to set up a production plant in Kazakhstan this year that will use ethane gas, which is cheaper than American shale gas.

Companies are also cranking up investment in the search for high value added products. The two industries that companies are most interested in are rechargeable batteries and solar energy. “In the future, the rechargeable battery industry is expected to be driven by electric cars and energy storage systems. With a sharp growth trend this year in new markets including China, Japan, and the US, demand is increasing for solar energy, which is expected to improve the supply-demand balance,” said Lee Hee-cheol, researcher at Hi Investment & Securities.

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 4‘Weddingflation’ breaks the bank for Korean couples-to-be

- 5[Reportage] On US campuses, student risk arrest as they call for divestment from Israel

- 6[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 7Korea sees more deaths than births for 52nd consecutive month in February

- 8Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 9[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 10[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent