hankyoreh

Links to other country sites 다른 나라 사이트 링크

China’s growing middle class no longer a boon for S. Korean companies

By Jung Se-ra, staff reporter

In China, Japanese fast fashion brand Uniqlo is often called “Yuiku,” (優衣庫). “Yui” means good clothing, and “ku” stands for warehouse.

In fact, Uniqlo basically serves as the clothing warehouse in China, as it dominates that country’s apparel market. In the 2014 financial year, which came to a close at the end of August, Uniqlo had added 81 new outlets in China, bringing its number of outlets in the country to 306.

Uniqlo’s phenomenal growth can be traced to a strategy of tailoring its products to the rising incomes of the Chinese middle class. The company set up its largest store in Shanghai, a 6,600 ㎡ behemoth that is 10 times larger than its average store. Thanks to such strategies, Uniqlo International - which does most of its business in the Chinese market - expects its revenue to increase by 59.2% and its operating profits by 90.7% in 2014.

Until recently, the rapid growth of Uniqlo, which makes most of its products in China, and the rest of the global fast fashion industry was a boon for the South Korean petrochemical industry. South Korean petrochemical firms exported to China large amounts of petrochemical products such as para-xylene (PX), which is used in the manufacture of polyester. Times were good for these companies, which had operating profits of nearly 20% between 2011 and 2013.

But the situation changed rapidly in early 2014. The Korean petrochemical industry had been focusing on processing trade, supplying intermediate materials to the Chinese factories of global brands such as Uniqlo. Now, though, these exporters have run into problems because of China’s strategy of developing a more advanced industrial structure and a consumption-oriented domestic market.

Almost at once, South Korean exports of petrochemical products such as para-xylene (PX), terephthalic acid (PTA), and caprolactam started receiving a cold reception in China. These chemicals, intermediate materials used to make composite fabrics like polyester and nylon, are the products of a sector of heavy industry that requires massive investment in facilities. But China has greatly increased its self-sufficiency in these intermediate materials through facility investment.

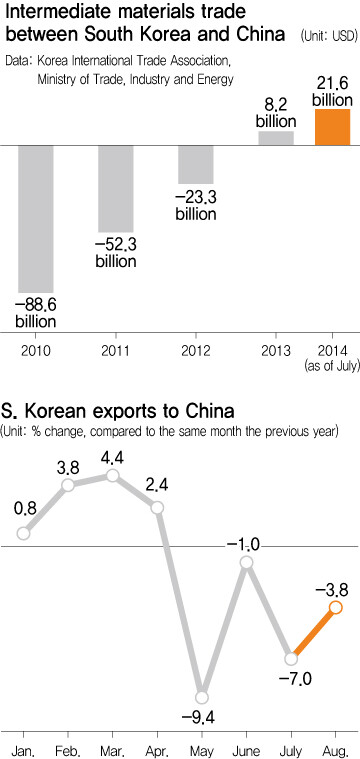

In a word, fundamental change has come to the pattern of Korea producing intermediate materials and exporting them to China, which would then use these - along with cheap labor - to create the finished apparel to be sold in the American and European markets. Since 2012, China has been exporting more intermediate materials than it has imported.

These changes have been reflected in Korean export figures to China since the start of 2014. The rate of change in exports to China has been falling for four consecutive months since May 2014, with the group of petrochemical products that are the raw materials for synthetic fabrics leading the decline.

South Korean exports to China of terephthalic acid (PTA) and caprolactam dropped by around 50% in 2014, after China reached self-sufficiency rates of 90.5% and 71.5%, respectively, in the previous year. In the case of para-xylene, the unit price is half of what it was in early 2012, as a decline in demand inside China met surplus facility investment in the industry in Korea.

“Now that China has used facility investment to become more self-sufficient in intermediate materials, it will be difficult to reverse the downward trend in exports to China,” said Choi Pil-su, China researcher at the Korea Institute for International Economic Policy (KIEP).

Until not long ago, when Uniqlo smiled, the South Korean petrochemical companies that supplied para-xylene to the Chinese market smiled as well. That was until the delicate balance of Uniqlo’s trilateral trade structure - Korea manufacturing intermediate materials, China making the finished products, and Japan handling the global brand marketing - was thrown into disarray. Now, Uniqlo may be smiling, but South Korean petrochemical companies are not.

As a result, there are increasing calls for the South Korean government to move more quickly to take measures in response. Recently, the Chinese government has been aiming to convert its economy, which has relied on exports for growth, to balanced growth between the domestic market and exports.

During the 3rd Plenary Session of the Central Committee of the Communist Party, held in Nov. 2013, the Chinese government turned to policies aimed at bolstering a consumption-focused domestic economy, such as eliminating the one-child policy. The fact is that it would be difficult to substantially improve the slump in exports from China, the global production base, given the sluggish pace of the global economic recovery following the financial crisis in Europe in 2011.

South Korean exports to China have been unable to move beyond processing trade, which assumes that China is a base for production. In fact, the percentage of exports to China accounted for by processing trade actually increased from 47.6% in 2013 to 50.2% in 2014 (January to May). This is out of step with China’s strategy of growing its domestic market. In addition, consumer goods only account for 3% of Korean exports to China, while the share of intermediate goods is excessively high at 77.2%.

“Considering the importance of exports in the Korean economy and the fact that China accounts for the largest share of Korean exports, a structural decline in exports to China should not be taken lightly. Korea needs to be exploring strategies not only for expanding exports of advanced consumer goods aimed at the Chinese domestic market but also of diversifying the export structure by developing cutting-edge parts and new materials in heavy industry and expanding transit trade,” said Jang Sang-shik, researcher with the Institute for International Trade (ITA) for the Korea International Trade Association (KITA).

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 4Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 5‘Weddingflation’ breaks the bank for Korean couples-to-be

- 646% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 7[Reportage] On US campuses, student risk arrest as they call for divestment from Israel

- 8“Parental care contracts” increasingly common in South Korea

- 9[Interview] Dear Korean men, It’s OK to admit you’re not always strong

- 10Korean government’s compromise plan for medical reform swiftly rejected by doctors