hankyoreh

Links to other country sites 다른 나라 사이트 링크

Eurozone slowdown could hit S. Korea hard, via China

By Jung Se-ra, staff reporter

Fears of a European economic crisis going global are spreading once again.

First the OECD and now the International Monetary Fund (IMF) have lowered their growth projections for the Eurozone economy, raising the alarm about a possible third economic downturn since 2009. Even Germany, considered the zone’s growth powerhouse, triggered concerns in August when it revealed its biggest drop in industrial production and factory orders in five years. At a time when South Korea has already been feeling the pinch this year as Chinese economic changes cut into exports to its largest trading partner, a European economic decline stands to deal a major blow to its heavily export-dependent economy.

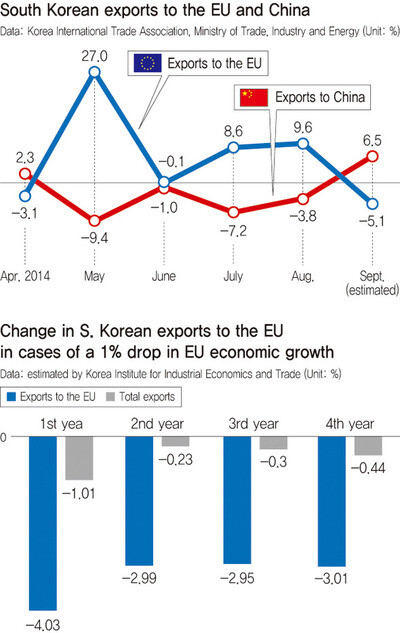

Figures released on Oct. 9 by the Ministry of Trade, Industry and Energy (MTIE) and the Korea Institute for Industrial Economics and Trade (KIET) show a moderate recovery for South Korean exports to the European Union this year. But the September performance rate of -5.1% was the worst so far in 2014.

Through last year, exports to the EU had been in the minus column since the European financial crisis first erupted in 2011. After a brief rebound in 2014 thanks to the base effect and German economic growth, they’re now showing signs of receding again.

Exports to China have already been at risk since the first half of the year. As the slack growth and export slump for Europe and the rest of the global economy became apparent, China, which typically depends on Europe as its biggest export market, sent a clear message that it was switching strategies and working to grow domestic demand. South Korean exports to China between January and August were down 1.6% from the same period last year - the biggest decline since 2009, when the global economy was contracting fastest in the throes of the financial crisis.

The concern for many now is that another European crisis could have a devastating effect not just from European exports, but indirectly through Chinese exports.

In its “World Economic Outlook” report published on Oct. 7, the IMF lowered its 2014 growth rate projection for the Eurozone by 0.3 percentage points, from 1.1% to 0.8%. Next year’s projection was also reduced from 1.5% to 1.3%.

This prediction came after the OECD lowered its own forecast in September. The 2014 projected growth rate for the Eurozone was reduced by 0.4 percentage points to 0.8% from May‘s 1.2%, and the 2015 prediction dropped all the way from 1.7% to 1.1%.

The IMF report also predicted a roughly 40% chance of a Eurozone economic decline between 3Q14 and 2Q15 - twice the odds given six months ago.

Previously, KIET used a regression model to estimate the effects on South Korean exports from declines in the EU and the world’s other advanced economies in 2012, the year when the European financial crisis has its most pronounced effects on the global economy. The report, titled “Major Variables in the Recent Export Environment and Industry Effects,” calculated a 4.03% drop in South Korean exports to the EU for every percentage-point decline in the EU’s economic growth rate that year, with a medium-term average decline rate of 2.98% between the second and fourth years. Exports to other countries were also affected, with a 1.01% decline for all exports that year and a 0.32% reduction over the medium term.

“These numbers apply to the current export structure as well,” said Kang Doo-yong, head of KIET’s trend analysis office.

“The US economy has been showing signs of recovery, so the situation is a bit better than what we saw with the 2011 European financial crisis,” Kang added. “But depending on how big this European crisis gets, we need to be concerned about possible declines in the US and global economies at the same time.”

As of late 2013, China was South Korea’s biggest export destination, accounting for 26.1%. The US represented another 11.1%, while the EU purchased 8.7% of exports and Japan 6.2%.

“From the European economic indicators, it’s obvious that after going from the minus column to the plus side, the economy is declining once again,” said Jang Sang-sik, a research fellow at the Korea International Trade Association’s Institute for International Trade. “People are particularly worried about deflation.”

“Because the South Korean economy is so dependent on exports, a crisis in Europe could be a major burden at a time when growth rates in global trade have been falling off from past levels,” Jang added.

South Korean exports have maintained a low growth rate in recent years, declining 1.3% in 2012 and rising by just 2.1% in 2013.

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 4‘Weddingflation’ breaks the bank for Korean couples-to-be

- 5[Reportage] On US campuses, student risk arrest as they call for divestment from Israel

- 6[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 7Korea sees more deaths than births for 52nd consecutive month in February

- 8[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 9Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 10[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father