hankyoreh

Links to other country sites 다른 나라 사이트 링크

Business experts: policies need to go back to times of “catch-up”

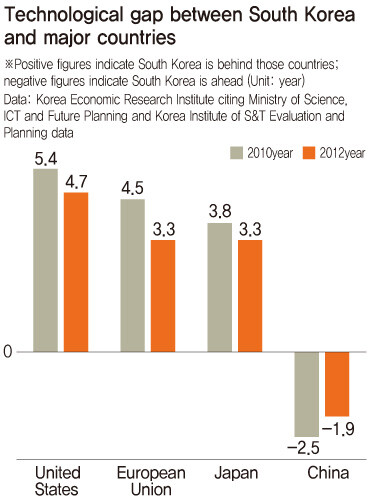

“In 2012, South Korea was 4.7 years behind the US in science and technology competitiveness, but just 1.9 years ahead of China.”

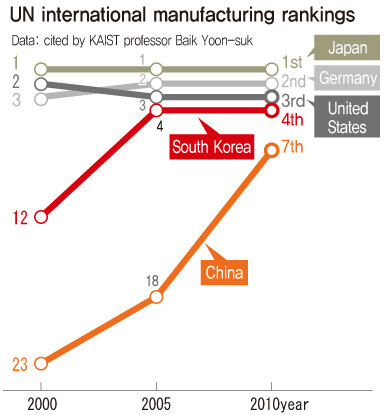

“The gap between South Korea and China on the UN international manufacturing index shrank from eleven ranking spots in 2000 to three in 2010.”

The shrinking technology gap with South Korea is being cited by experts as a key factor in China catching up in manufacturing, with Samsung Electronics’ recent mobile phone struggles sparking fears of a potential crisis.

Kim Chang-bae, a fellow at the Korea Economic Research Institute (KERI), warned of the rapidly closing gap while speaking at a seminar on Oct. 27 at the Korea Federation of Banks center in downtown Seoul’s Myeong-dong neighborhood. The seminar, titled “China’s Catch-up and the Tasks Facing South Korean Manufacturing,” was organized jointly by the Korean Economic Association, the Korea Institute for Industrial Economics and Trade (KIET), and KERI.

“People are already saying South Korea lags behind China in 13 technologies, including space launch vehicles, flight vehicle development, and other aerospace areas, as well as energy, resources, and extreme environment technology,” Kim said.

KAIST professor Baik Yoon-suk cited the UN international manufacturing rankings as evidence of China’s pursuit.

“In 2000, South Korea ranked 12th and China was 23rd, a difference of eleven spots. In 2000, South Korea was fourth and China seventh, which gave a difference of just three spots,” Baik said.

The concern is that China’s rapid strides in technological competitiveness, combined with Japan’s cost-competitiveness thanks to a weak yen, are quickly eating into South Korea’s export markets.

“In five years, China is only going to be an even bigger threat in most of [South Korea’s] mainstay industries,” predicted KIET senior research fellow Suh Dong-hyuk. “I expect us to be battling China in most of our main industries besides cars, semiconductors, and general machinery.”

With South Korea already lagging China in steel, textiles, and clothing, the prediction is that increasingly stiff competition in shipbuilding, petrochemicals, communications equipment, and display screens will force it to surrender some of its lead.

Baik offered some suggestions on how South Korea might regain its advantage.

“One area where South Korean businesses are very competitive is information and communications technology (ICT), but it’s not going to be easy to stay competitive with the open technology ecosystem, short product cycles, and fierce competition. Instead of just developing individual examples of ICT, we need to promote more convergence with technologies and industries in different areas, such as health care,” he advised.

Baik also called for a shift away from China-focused management strategies toward more technology transfers and direct investment with alternative countries that could prove pivotal in the future race for industry supremacy.

Seoul National University professor Lee Keun proposed mergers and acquisition activity as one way of staying on top.

“We need to move quickly to acquire companies with technologies or business models that could pose a potential threat,” he suggested.

Lee also offered his take on Xiaomi, the Chinese company that has overtaken Samsung in the Chinese smartphone market.

“What makes Xiaomi really scary is that it’s come out with a completely different business paradigm [from Samsung], where it gets its numbers not simply from mobile phone sales, but from additional services like software and applications,” he explained.

Lee Ji-pyung, a senior research fellow at LG Economic Research Institute, said South Korea should take a lesson from Japan‘s experience with losing industry competitiveness from core parts and material technology and personnel leaks during its overseas investment expansion.

“The [Shinzo] Abe administration is working to reduce the role of direct industry promotion policy in favor of improvements to the business environment - including the exchange rate, taxes, regulations, and labor - and making a priority of promoting venture investment and fostering new industries,” Lee explained.

“Government policy needs to be different from the past, when we were catching up,” he advised.

By Kwak Jung-soo, business correspondent

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/8317138574257878.jpg) [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father![[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms? [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/3617138579390322.jpg) [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

Most viewed articles

- 1Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 2[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 3Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 4Opposition calls Yoon’s chief of staff appointment a ‘slap in the face’

- 5[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 6[Editorial] Japan’s rewriting of history with Korea has gone too far

- 7New AI-based translation tools make their way into everyday life in Korea

- 8[Column] The clock is ticking for Korea’s first lady

- 9[Column] Has Korea, too, crossed the Rubicon on China?

- 10Terry Anderson, AP reporter who informed world of massacre in Gwangju, dies at 76