hankyoreh

Links to other country sites 다른 나라 사이트 링크

Chaebol succession moving ahead by questionable methods

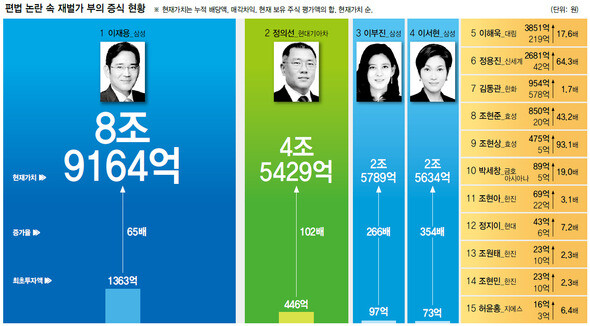

Since the health of Samsung Electronics Chairman Lee Kun-hee took a turn for the worse in May 2014, management of the company has effectively passed to his son and company vice chairman Lee Jae-yong.

Jae-yong is not alone, though. Control of a number of South Korea’s chaebol is being handed down to the grandchildren and great-grandchildren of the group founders, people like Chung Eui-sun, current vice chairman of Hyundai Motor.

During their efforts to boost their shares and assets in order to secure control of the group, these heirs have engaged in various controversial actions that were semi-legal or outright illegal, including buying up stocks at cut-rate prices, funnelling work to affiliates in the same group, and exploiting their corporate authority.

In this article, the Hankyoreh will examine the questionable methods by which these individuals have multiplied their assets in preparation for assuming the reins of the groups established by earlier generations of their families. The goal is to seek the social consensus needed to correct the dubious process of succession - still ongoing today - and to help these groups make the leap to global companies.

If you were given a thousand dollars a day, every day, from the birth of Christ until today, how much would you have? Not even a billion dollars - more like 650 million dollars. But there are people who inherited millions of dollars from their parents and, less than twenty years later, and with hardly any effort, have accrued vast fortunes worth billions of dollars.

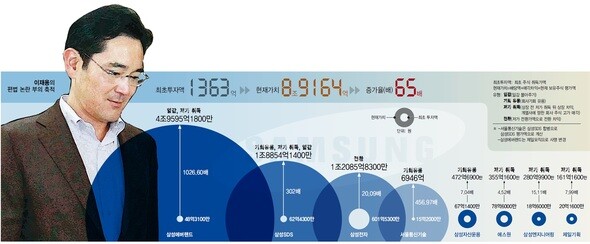

At the end of 2014, Jae-yong was estimated to hold almost 9 trillion won, or around US$8 billion, worth of stock, and Bloomberg ranked him as No. 158 on its list of the world’s billionaires. He was the second richest South Korean on the list, after his father Kun-hee, who was No. 75 with US$13.2 billion.

Jae-yong’s high ranking resulted from the jump in the value of his stock after Samsung SDS and Samsung Cheil Industries (formerly Samsung Everland) were listed on the stock exchange at the end of last year. He holds a 23.2% share in Cheil Industries and an 11.3% share in Samsung SDS.

Making the Seed Money GrowHow exactly did Jae-yong accumulate 8 trillion won? It all began with 6.1 billion won (US$5.53 million) of seed money that he inherited from his father between 1994 and 1996. The sum (actually, 4 billion won after gift taxes) was multiplied hundreds of times through a cycle of buying pre-IPO stock (bonds with warrants and convertible bonds) low and then selling them high after the IPO (Initial Public Offering).

In 1994, Jae-yong bought 2.32 billion won of S-1 stock from Samsung Everland, and in 1996 he contributed 5.56 billion won during a paid-in capital increase at the company. After S-1 went public, he sold his stock for 35.52 billion won, making 27.66 billion won in profit.

Jae-yong repeated the process with Samsung Engineering and Cheil Worldwide, once again buying bonds with warrants and convertible bonds to secure a share in the company and then selling these after the company was listed. This time, his 3.88 billion won investment had increased in value to 44.22 billion won.

In 1996, Jae-yong’s sisters - Boo-jin and Seo-hyun - used the 1.61 billion won they had inherited from their father to buy convertible bonds at Samsung Everland for 7,700 won a share (Jae-yong spent 4.83 billion won).

This discount price for bonds with warrants was much lower than when Hansol Paper sold Samsung Everland stock (85,000 won) or when Samsung Everland valued one share as being worth 100,364 won according to the Inheritance and Gift Tax Act in Apr. 1999. This is why Heo Tae-hak and Park No-bin, the two executives at Samsung Everland who supervised the legal work, were convicted of professional negligence, though this conviction was overturned by the Supreme Court.

By the end of 2014, the 8.05 billion won that the three siblings invested in 1996 had become 8.26 trillion won - not including the cash dividends paid on the stock.

Samsung SDS also helped Jae-yong and his sisters greatly increase their fortunes. The siblings acquired a share in the company, buying the stock that Samsung C&T and Samsung Electro-Mechanics had gained during the company’s paid-in capital increase in 1996, along with bonds with warrants that were issued in 1999.

The problem was the bonds with warrants. The siblings had bought them for 7,150 won a share, but their over-the-counter price at the time ranged between 53,000 won and 60,000 won.

This sparked accusations that the stock price had been set too low. The case was handed over to a special prosecutor, who ultimately won convictions against Lee Kun-hee and two other Samsung executives, Lee Hak-su and Kim In-ju.

But Lee’s children were allowed to hold on to the stock. SDS went public, and by Nov. 2014, the value of the stock had grown to 4.33 trillion won - from an original investment of just 18.90 billion won.

What enabled the two companies to enrich the Lee siblings to such a great extent was work funnelling. Samsung Everland increased its revenues between 40% and 60% by managing the buildings for Samsung’s affiliates and catering food for their employees. In the same way, Samsung SDS went public after receiving work from Samsung Electronics and other affiliates in the group.

When Jae-yong bought convertible bonds for Samsung Electronics in 1997 at a conversion price of 50,000 won, there were suspicions about the unusually low price, which was less than half of the 116,763 conversion price for convertible bonds being publicly traded overseas. The court granted that the price was “a little low,” but it cleared Jae-yong of charges.

Then there was Jae-yong’s stake in Samsung Asset Management, which he divested last year for 47.2 billion won. When he first bought his share in the company, it had only cost him 6.7 billion won.

There are also examples of the siblings selling their stock for more than its value to cut losses on failed investments.

Jae-yong had invested in a number of internet companies, including a 60% share in e-Samsung International along with stock in CQI.com and Valuenet. But when these companies tanked during the dotcom bust the following year, he sold his shares to affiliates in the Samsung Group. Thanks to his timely liquidation, he was able to recover 41.3 billion won of the 45.1 billion won he had invested into the companies - all of which have since folded.

Restructuring Control at Cheil IndustriesThere is still much to be done before Jae-yong and his sisters can inherit complete control of the group. Their father Lee Kun-hee owns around 12.34 trillion won worth of stock, including a 20.8% share in Samsung Life Insurance (which in turn has a 7.5% share in Samsung Electronics), a 3.4% share in Samsung Electronics, and a 1.4% share in Samsung C&T.

A simple calculation suggests that the inheritance tax owed on these assets will exceed 6 trillion won. This is one of the reasons why the three siblings have been multiplying their assets all this time.

It is also very likely that the control structure at Samsung will be reorganized around Jae-yong. As part of this, the group seems likely to replace the complicated system of cross-shareholding between subsidiaries with a holding company system. In fact, a large chunk of the cross-investment structure was already eliminated during business restructuring that took place at the end of 2013.

A number of scenarios have been proposed. One possibility is establishing a holding company for Samsung Electronics, which would be staffed by some of the employees at Samsung Electronics and controlled by Jae-yong and other members of the Lee family.

During this reorganization process, there is a good chance that a key role will be played by Cheil Industries, in which Jae-yong and his sisters hold a large share. That is why stock prices at the company - which were once 53,000 won a share - have been skyrocketing, peaking at 140,000 won on Feb. 11.

Management Ability and Moral Compass Still Untested“Two things need to be in place if the children of a group’s founder are to take over that group. First, there must not be any interference from the family; second, they need the endorsement of society,” Lee Kun-hee said in an interview that ran in the September 1993 issue of the Shin Dong-a magazine.

Since Jae-yong began working for Samsung in 1991, he has had plenty of interaction with the company’s executives, and he has also inherited a substantial share in the company. But it is not clear that he has gained the endorsement of society that his father described.

A spokesperson for the Samsung group said that Jae-yong’s purchase of bonds with warrants at Samsung SDS was regular and that he had both paid the gift tax and compensated the company for its loss. The spokesperson also pointed out that while the issuing of convertible bonds at Cheil Industries for a cut-rate price was controversial, the courts ruled that it did not constitute professional negligence.

The spokesperson had no comment about the general perception in South Korean society that succession at Samsung has relied on dubious means, however.

“Thus far, legally questionable means have been used to make considerable progress toward formally transferring the management rights of the group to the next generation, but the next heirs are still far from receiving the endorsement of South Korean society. The task facing Lee Jae-yong is to show that Samsung is not an exception in South Korean society, but rather that it abides by the rules that society has established,” said Kim Sang-jo, professor at Hansung University and director of Solidarity for Economic Reform.

Questions still remain about Jae-yong’s management skill as well.

“The inheritance of ownership and control at Korea’s chaebol is problematic in two respects. First, it allows individuals with unverified management ability to receive absolute power over a group, even though these individuals cannot guarantee the success of the company amid the uncertainty of an innovation-based economy. Second, it leads talented individuals to prefer government jobs instead of dreaming of becoming company CEOs,” said Park Sang-in, a professor in the school of administration at Seoul National University.

“When individuals are able to reap trillions of won in profits through work funnelling and other semi-legal or illegal methods simply because they are the children of the group owner, the groups began to focus more on the interests of these individuals than on the ordinary pursuit of profit, and the majority of members of that society lose the will to work,” Kim added.

By Lee Jeong-hoon, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Does Yoon think the Korean public is wrong? [Editorial] Does Yoon think the Korean public is wrong?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/8517133419684774.jpg) [Editorial] Does Yoon think the Korean public is wrong?

[Editorial] Does Yoon think the Korean public is wrong?![[Editorial] As it bolsters its alliance with US, Japan must be accountable for past [Editorial] As it bolsters its alliance with US, Japan must be accountable for past](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/6817133413968321.jpg) [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

[Editorial] As it bolsters its alliance with US, Japan must be accountable for past- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Samsung barricades office as unionized workers strike for better conditions

- 3[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes

- 4S. Korea, Japan reaffirm commitment to strengthening trilateral ties with US

- 5[Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- 6[Editorial] Does Yoon think the Korean public is wrong?

- 7Why Israel isn’t hitting Iran with immediate retaliation

- 8[Guest essay] How Korea turned its trainee doctors into monsters

- 9Japan officially says compensation of Korean forced laborers isn’t its responsibility

- 10[News analysis] After elections, prosecutorial reform will likely make legislative agenda