hankyoreh

Links to other country sites 다른 나라 사이트 링크

Hyundai Motor locked in a tense battle amid the “super dollar”

Hyundai Motors is struggling with profits and market share in North America after failing to take advantage of the US economic recovery and resulting “strong dollar” trend.

Instead, it is finding itself flanked in the US automobile market by Japanese and European car makers buoyed by the low yen and depreciation of the euro, along with US domestic models resurging with the post-financial crisis recovery.

The “strong dollar” phenomenon refers to South Korea‘s ostensibly more competitive exports with a strong dollar and weak won. But this situation has not been advantageous for Hyundai.

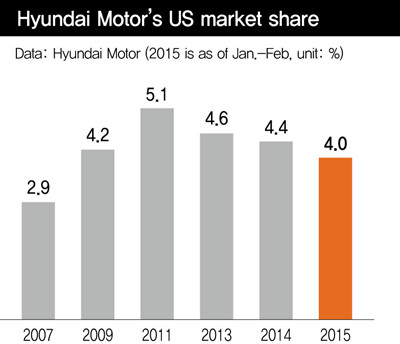

Perhaps ironically, it was in the wake of the 2008 crisis that Hyundai Motors began seeing a clear jump in its North American market share. As the struggling economy combined with high oil prices, US consumers started showing a clear preference for the smaller Hyundai models, which had the advantage of good gas mileage. Market share rose sharply, from 2.9% in 2007 (460,000 vehicles sold) to 3.3% in 2008 (400,000), and 4.2% in the immediate wake of the crisis in 2009 (435,000). Hyundai, which had been stuck in the lower part of the world’s top ten through the early 2000s, made a sudden leap into the top five in 2009. Market share grew further to 4.6% in 2010 (538,000 vehicles), before eventually peaking at 5.1% in 2011 (645,000). With sales for US, Japanese, and European models sinking sharply, Hyundai seemed to be the only automaker showing growth in the market.

Other factors were at play besides the exchange rate. Part of the rise in North American market share had to do with the US industry’s decline (including a looming bankruptcy threat for GM), and Toyota and Nissan taking a hit with large-scale recalls and declining research and development in the wake of the 2011 earthquake and tsunami in Japan.

“We lucked out in some sense,” admitted a Hyundai executive, speaking on condition of anonymity.

But US economic conditions in particular began improving amid large-scale quantitative easing, and the strong dollar trend began to emerge, with the low yen and euro and a federal fund rate hike predicted on the horizon. In 2012, Hyundai’s US sales reached 703,000, but market share was down to 4.9%. Sales remained stagnant in 2013 and 2014, while market share began to drop: 720,000 cars sold the first year for a 4.6% market share, 725,000 the second for 4.4%. January-February sales for 2015 have come out to 97,000 vehicles, or a 4% share.

Meanwhile, Nissan and Toyota have respectively ridden the low yen to sales growth of 11% and 6% over last year. In Toyota‘s case, global sales were 10,130,000 vehicles for Apr. 2013 to Mar. 2014, thanks largely to strong performance in the US. Its operating profit ratio, which had fallen as low as 1% to 2% after the crisis, rebounded all the way back to previous levels: 6% in 2013, 8.9% in 2014. The US recovery, combined with low oil prices and depreciating currency values thanks to quantitative easing of the yen and euro, has propelled Japanese and European automakers to enjoy robust growth with low prices. Meanwhile, US automakers like GM and Ford have benefited from rapidly rising demand, particularly for more expensive SUVs and mid-sized and large pickups.

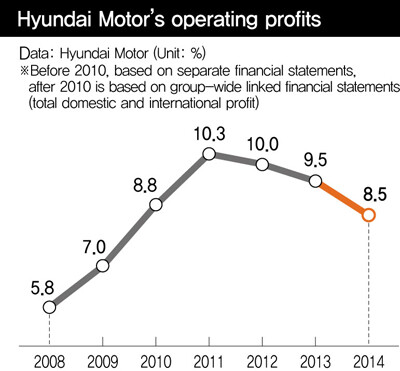

Another measure that has weakened for Hyundai since around the time the strong dollar trend emerged in 2013 is the ratio of operating profits to global sales, including domestic. For two straight years, the operating profit ratio stood in the double digits: 10.3% in 2011 and 10% in 2012. Since then, it has shown a tendential decline to 9.5% in 2013 and 8.5% last year.

Indeed, the good times Hyundai experienced in the North American market the last few year are looking more and more like an exception.

“Hyundai-Kia has reached global production and sales of eight million vehicles, but that seems like a vertex,” said the Hyundai executive. “There’s a growing sense we’ve hit a bit of a limit.”

“We’re accepting the low growth as the way things are right now, and securing profitability is starting to become a priority,” the source admitted.

One of the symbols of Hyundai‘s unrivaled growth was its “full price” strategy in the North American market: reducing incentives to intermediate dealers to increase profitability for the head offices. A change in strategy is looking increasingly inevitable now. The confidence in the North American market that allowed Hyundai to expect rising sales even with reduced incentives is a thing of the past. With Japanese and European rivals leveraging their weak currencies into an offensive rush, Hyundai now finds itself having to raise incentives again to guard its market share - even if it means lower profits.

“The full price policy appears to have reached its limits,” the executive conceded. Even with the US automobile market recovering its growth, the strong dollar is leaving Hyundai locked in a serious battle.

Next could be a “boomerang effect” from Hyundai’s on-site production strategy may be playing a part in the reversal of fortune. With production and sales rising for local US plants, Hyundai is finding itself shut out of the benefits from the strong dollar. Meanwhile, Toyota, which was never aggressive about establishing overseas plants, has reaped the rewards of a weak yen.

By Cho Kye-wan, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3‘Weddingflation’ breaks the bank for Korean couples-to-be

- 4Korea sees more deaths than births for 52nd consecutive month in February

- 546% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 6Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 7[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 8[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 9Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 10“Parental care contracts” increasingly common in South Korea