hankyoreh

Links to other country sites 다른 나라 사이트 링크

Large corporations soak up money, while households drown in debt

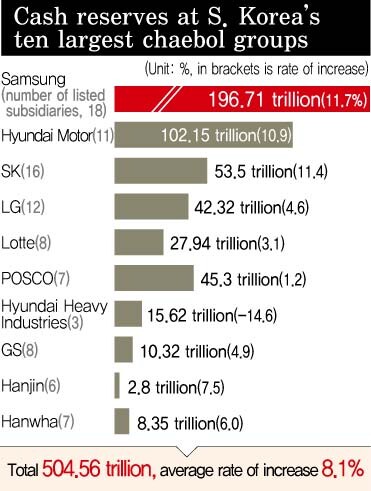

In 2014, the cash reserves at publically traded chaebol subsidiaries ballooned by nearly 40 trillion won (US$36.12 billion), topping 500 trillion won (US$451.49 billion). This calculation only includes listed subsidiaries at South Korea’s 10 biggest chaebol.

Cash reserves refer to the amount of money earned through business or investment activities that remains with the company.

During the same period, household debt increased by around 68 trillion won.

On Mar. 23, Chaebul.com published the results of its assessment of the 2014 financial statements of 96 listed companies at South Korea’s 10 biggest chaebol. The website found that, as of the end of 2014, the 96 companies had 503.9 trillion won in cash reserves, which was 37.63 trillion won (8.1%) more than the previous year.

The retention rate - which compares cash reserves to paid-in capital - also jumped 69.5 percentage points year-on-year, from 1,257.6% to 1,327.1%.

Viewed by group, cash reserves increased at all nine groups except for the Hyundai Heavy Industries Group, which ran a deficit last year.

The rate of increase was greatest at the Samsung Group, which has 18 subsidiaries. Cash reserves at the group increased by 20.65 trillion won (11.7%) from the previous year, reaching 196.71 trillion won by the end of 2014. Meanwhile, the Hyundai Motor Group, with 11 subsidiaries, recorded 102.15 trillion won in cash reserves, up more than 10 trillion won.

Cash reserves at the two groups are equivalent to 20.9% of South Korea’s nominal GDP in 2013.

Among the other groups, cash reserves at the SK Group increased by 5.43 trillion won to 53.5 trillion won, and at the POSCO Group they went up by 550 billion won to 45.3 trillion won. At the LG and Lotte Groups, cash reserves jumped 1.87 trillion won and 850 billion won, posting 42.32 trillion won and 27.94 trillion won, respectively.

Viewed by company, Samsung Electronics had 138.87 trillion won in cash reserves, up 9.8% year-on-year, making it the subsidiary of the 10 groups with the most cash on hand. This is more than three times the cash reserves at Hyundai Motor (44.94 trillion won) and POSCO (42.44 trillion won), which rank second and third on the list.

“Since cash reserves also include some forms of investment, this doesn’t mean that companies just have stacks of cash in a barn somewhere. However, when cash reserves increase like this, we can infer that these funds are pooling up inside companies,” said Chung Seon-seop, president of Chaebul.com.

The rise in company’s cash reserves is rooted in the fact that their profits have gone up while their dividends have not.

According to statistics on the national account from the Bank of Korea, profits at South Korean companies in 2013 have increased by 233% since 2000. Over the same period, household income only increased by 106%.

While household income has only increased gradually, households have been taking on debt to buy houses. As of the end of 2014, household debt had risen by 313 trillion won in the past five years alone.

As this tendency for cash to accumulate at companies and for debt to grow in households becomes more entrenched, the South Korean economic downturn is dragging on and financial insecurity is increasing.

“The government needs to tighten policies to draw out the income that is collecting inside companies and to increase household income,” said Park Jong-gyu, senior researcher at the Korea Institute of Finance (KIF).

By Kim Kyung-rok and Lee Jeong-hoon, staff reporters

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 346% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 4[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 5‘Weddingflation’ breaks the bank for Korean couples-to-be

- 6Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 7Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 8[Interview] Dear Korean men, It’s OK to admit you’re not always strong

- 9Korean government’s compromise plan for medical reform swiftly rejected by doctors

- 10[Editorial] Japan’s rewriting of history with Korea has gone too far