hankyoreh

Links to other country sites 다른 나라 사이트 링크

South Korea could be heading for its ‘Demographic Cliff’ after 2018

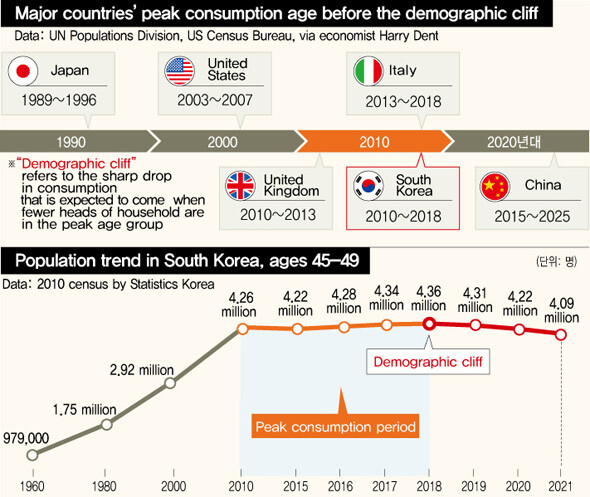

“The Demographic Cliff,” a 2014 book by the world-renowned economic forecaster Harry Dent, estimates that households with heads aged between 45 and 49 spend the most money for an average family with a yearly income of US$37,500. The number comes from Dent’s empirical analysis of spending trends by age group for some 600 categories, including housing, automobiles, and family. Dent also wrote that average propensity to consume was highest at age 46 for the head of a typical US family in 2007.

Dent’s focus is on predicting future trends for prices in real estate, stocks, and general commodities, with a focus on two indicators: population structure changes and consumption trends. The term “demographic cliff” refers to the sharp drop in consumption that is expected to come when fewer heads of household fall in the peak 45-49 age group.

Noting the total population of specific “peak consumption” age groups along the life cycle, Dent used population estimates from the OECD to calculate a peak consumption age of 47 for South Koreans. Dent’s warning is that South Korean consumption will reach a peak between 2010 and 2018, and the country can expect to face its own demographic cliff after 2018, when the population of the age group accounting for the most spending begins to decline.

A demographic cliff leads to a consumption cliff - as the US and Japan have already learned from experience. The US consumption peak came in the years 2003 to 2007, just before the global financial crisis struck. For Japan, the period came between 1989 and 1996. Plummeting consumption in the wake of the demographic cliff was an important factor in both Japan’s long-term downturn since 1989 and the global crisis that erupted in the US in 2008.

What is the situation for South Korea’s population aged 45 to 49, which is said to provide the gauge for future prices in housing and commodities? According to a 2010 population forecast by Statistics Korea, the age group, which consisted of 977,700 people in 1960, can be expected to continue its rise until 2018, at which point it will begin to fall sharply - the demographic cliff. The population is expected to hit 4.22 million this year, up from 2.92 million in 2000. By 2018, it is predicted to peak at 4.36 million before beginning its decline: to 4.31 million in 2019 and 4.22 million in 2020, and below the four-million mark to 3.96 million by 2022.

The consumption cliff that could perhaps arrive with the demographic cliff around 2018. The KB Financial Group Research Institute conducted an analysis on census, housing, and land price data from the US and Japan, concluding that their so-called “twin peaks generations” - the people in their forties and fifties with the most financial and real estate assets in the population - hit their peak in the mid-’90s for the former and 1993 in the latter, when the continued rise in housing prices gave way to a decline. The institute also predicted declining real estate prices for South Korea after its twin peaks generations reach a high of 33%.

“Past data suggest that income is a variable with a large impact on housing prices, but age group demographics have a continuous influence structurally,” said Korea Development Institute research fellow Song In-ho.

“It’s very likely that the steep rate of decline in the population aged 45 to 49 with the highest house purchasing ability will be a shock to the real estate market,” Song predicted.

By Cho Kye-wan, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Does Yoon think the Korean public is wrong? [Editorial] Does Yoon think the Korean public is wrong?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/8517133419684774.jpg) [Editorial] Does Yoon think the Korean public is wrong?

[Editorial] Does Yoon think the Korean public is wrong?![[Editorial] As it bolsters its alliance with US, Japan must be accountable for past [Editorial] As it bolsters its alliance with US, Japan must be accountable for past](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/6817133413968321.jpg) [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

[Editorial] As it bolsters its alliance with US, Japan must be accountable for past- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Samsung barricades office as unionized workers strike for better conditions

- 3[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes

- 4[News analysis] After elections, prosecutorial reform will likely make legislative agenda

- 5Why Israel isn’t hitting Iran with immediate retaliation

- 6S. Korea, Japan reaffirm commitment to strengthening trilateral ties with US

- 7[Editorial] Does Yoon think the Korean public is wrong?

- 8[Guest essay] How Korea turned its trainee doctors into monsters

- 9[Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- 10Strong dollar isn’t all that’s pushing won exchange rate into to 1,400 range