hankyoreh

Links to other country sites 다른 나라 사이트 링크

Smartphone sales stagnating, LG and Samsung seek new areas of business

“Smartphones have now become a commodity.”

An executive at Samsung Electronics has attributed the failure of the Galaxy S6 Edge to the “commoditization” of smartphones. The company dispensed with the replaceable battery of previously successful models and poured billions of dollars into developing a metal case and a curved screen, but the results did not live up to expectations. In the end, these big changes did not make much of a difference to consumers.

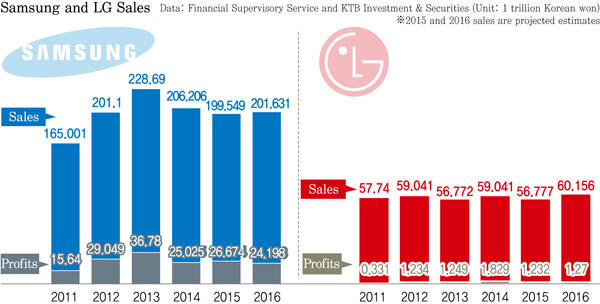

The slump in smartphones led to a drop in revenues. Revenues at Samsung Electronics last year were projected by KTB Investment & Securities to be around 200 trillion won (US$168.1 billion), or about 6 trillion won less than the previous year (206 trillion won).

The company has tightened its belt, freezing salaries for executives and employees and slashing its marketing budget. This should nudge operating profit up by about 1 trillion won.

But Samsung’s difficulties are unlikely to go away this year, because of the downturn in the market. The smartphone market posted a single-digit growth rate for the first time, and the average selling price of units continues to fall. The prices of semiconductors and displays are declining as well.

LG Electronics finds itself in a similar predicament, and revenues at the company have been stuck in the 50 trillion won (US$42 billion) range for several years in a row. The company waited too long to jump on the smartphone bandwagon, and growth has also been slow in the parts market for electric cars and other eco-friendly vehicles, an area that the company had looked to for profits.

Along with semiconductors and displays, mobile phones have been a reliable growth engine for the South Korean economy. But as the commoditization of smartphones illustrates, growth slows when breakthrough products from the past become commodities and when latecomer firms from countries like China and India join the market.

The sense of crisis was palpable in a workshop of CEOs from the Samsung Group that was held at the Samsung Human Resources Development Center in Yongin, Gyeonggi Province, on Dec. 28, 2015. The management buzzwords used in the workshop included “innovation,” “new growth,” and “challenge.” The company is seeking to promote innovation in order to find new areas of doing business.

“Our goal is to overcome through changes and innovation in the new management environment,” said a Samsung Electronics executive.

Samsung Electronics seems poised to reduce its number of smartphone models and to pursue stable growth by linking these to home appliances and televisions through the Internet of Things (IoT).

Meanwhile, LG Electronics is focusing its smartphones on emerging markets while equipping itself with premium products like OLED televisions and Twin Wash washing machines in the area of home appliances.

Both Samsung Electronics and LG Electronics are looking toward automobiles as their new area of business.

At the end of 2015, Samsung Electronics entered the automobile industry with the establishment of an “electronic equipment team.” While moving into the infotainment industry with GPS systems, Samsung is also set to expand into smart cars.

“Given that electronic equipment parts for automobiles are expected to grow more than 50% within the next five years, the expansion of Samsung Electronics into the electronic equipment business is only to be expected,” said Lee Hang-gu, senior analyst for the Korea Institute for Industrial Economics and Trade (KIET).

LG Electronics has moved more quickly than Samsung Electronics to get results in the new eco-friendly automobile parts market. Last year, it supplied 11 parts for the Chevrolet Bolt EV, an electric car by US automaker General Motors (GM).

Both Samsung Electronics and LG Electronics are taking the plunge as parts suppliers in two new markets: the self-driving car market, which has been pioneered by US companies Google and Apple, and the electric car market, in which automakers have played a leading role in line with eco-friendly trends.

Down the road, these companies could even manufacture such products themselves, and they could also enjoy synergy with affiliates from their respective groups in the areas of batteries, displays, and light-emitting diodes (LED), just as they have with smartphones.

Along with this, the two companies are investing in other areas that they hope to build into future engines for growth - Samsung Electronics in biotechnology and healthcare, and LG Electronics in solar energy and energy storage systems (ESS).

Such investments can increase the convenience for employers as society ages, and they are effectively reorienting business in line with an industrial paradigm in which climate change and concern for the environment are becoming more important on a daily basis.

The quest for new momentum amid the sluggish growth in South Korea’s industries of today is similar to the Japanese electronics industry of the past.

“Facing a protracted recession, Japanese companies worked to make their existing products stand out and took steps to blaze new trails, pioneering cutting-edge, next-generation areas of business,” said Lee Ji-pyeong, senior analyst at the LG Economic Research Institute.

“Fujifilm transformed its existing capacity into new products, while Toshiba delved into new and renewable sources of energy. As these companies did, we need to invest in and adopt future trends that correspond to the rapidly changing business environment,” Lee suggested.

By Lee Jeong-hun, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 2[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 3Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 4[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 5Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 6Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 7New AI-based translation tools make their way into everyday life in Korea

- 8Thursday to mark start of resignations by senior doctors amid standoff with government

- 9N. Korean hackers breached 10 defense contractors in South for months, police say

- 10Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South