hankyoreh

Links to other country sites 다른 나라 사이트 링크

South Korean oil industry seeking ways to stop paying the “Asian premium”

“Is there any reason not to make joint purchases of crude oil?”

“What’s stopping us from using crude oil to create a win-win situation for South Korea, Japan, and China?”

This is what people in South Korea’s oil industry are saying about the “Asia premium” - the tendency for oil producing countries in the Middle East to charge Asian countries more for crude oil. Rather than focusing on the financial pros and cons of currently low oil prices, the industry is looking to come up with comprehensive ways to take advantage of this for the long term.

■ Angling for better contracts through cooperation between the energy ministers of South Korea, China, and JapanMany analysts think that the Asia premium - said to be from between US$1 to US$4 per barrel of oil - has fallen considerably as of late with oil producers squabbling over market share. The problem, however, is that there is no telling when the international oil market will become a sellers’ market once more, which means that the Asia premium could return at any time.

The first thing that needs to happen, in the view of the oil industry, is for the energy ministers of South Korea, China, and Japan to sit down for deliberations. The idea is that China (which edged aside the US last year to become the world’s biggest importer of crude oil) and South Korea and Japan (two of the world’s top five oil importers) need to work together to improve the currently unfavorable contract conditions.

“In the past, there was a strong tendency to put off efforts to cooperate out of concern about how oil producers might react. But the situation is different now, since the low oil prices give buyers an advantage in negotiations,” said Lee Dal-sok, chief of energy policy research at the Korea Energy Economics Institute.

“During the administration of former president Roh Moo-hyun - who talked a lot about the era of Northeast Asia - similar proposals were made, but I remember China and Japan didn’t show much interest. It won’t be easy for the energy ministers of the three countries to get together, but it would be good if they could,” Lee said.

“In the past, China only allowed the state-run petroleum companies Sinopec and PetroChina to import crude oil, but last year it changed this policy and gave smaller, province-level oil companies the authority to import crude oil directly,” said a source in the oil industry. “One approach would be to discuss cooperation with smaller Chinese oil companies that need lower oil prices.”

Industry insiders think that it is worth trying to adjust the conditions in contracts for importing crude oil. These conditions are unusually strict in South Korea, China, and Japan, which are banned from reselling their crude oil.

Considering that the three countries are entangled in complicated disputes about territory, historical issues, and textbooks, cooperation in the area of energy could have the added benefit of improving relations between them.

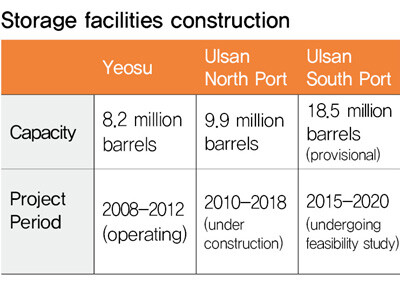

■ Oil producers could take part in plans for Northeast Asian oil hubAnother idea that the oil industry is toying around with is for the South Korean government to rent its oil storage facilities to oil-producing countries. Since the end of the 2000s, the government has built and operated facilities in the cities of Ulsan and Yeosu capable of storing 36.6 million barrels of oil. This is part of a project to turn the peninsula into a base for international petroleum deals - what the government calls the “Northeast Asian oil hub.”

But if the infrastructure for petroleum financing and trading does not materialize, the government could basically end up with huge warehouses on its hands. One solution would be to give long-term leases for these facilities to oil-producing countries. This would provide oil producers with storage facilities in the heart of the Northeast Asian market - which accounts for more than 20% of worldwide demand for petroleum - and South Korea could make money from renting the facilities while saving on the maintenance costs.

“If South Korea leased these storage facilities to oil producers while reserving priority access rights in the event of an emergency, this would be in the national interest since South Korea would get oil reserves without having to pay the maintenance cost,” a source in the oil industry said. “While oil prices are volatile, oil companies’ performance fluctuates because of the evaluated profit and loss of their oil reserves. Leasing out the oil storage facilities would lower this risk, helping oil companies improve the stability of their business.”

By Lee Soon-hyuk, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Does Yoon think the Korean public is wrong? [Editorial] Does Yoon think the Korean public is wrong?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/8517133419684774.jpg) [Editorial] Does Yoon think the Korean public is wrong?

[Editorial] Does Yoon think the Korean public is wrong?![[Editorial] As it bolsters its alliance with US, Japan must be accountable for past [Editorial] As it bolsters its alliance with US, Japan must be accountable for past](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/6817133413968321.jpg) [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

[Editorial] As it bolsters its alliance with US, Japan must be accountable for past- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Samsung barricades office as unionized workers strike for better conditions

- 3[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes

- 4Why Israel isn’t hitting Iran with immediate retaliation

- 5[News analysis] After elections, prosecutorial reform will likely make legislative agenda

- 6[Editorial] Does Yoon think the Korean public is wrong?

- 7S. Korea, Japan reaffirm commitment to strengthening trilateral ties with US

- 8[Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- 9Japan officially says compensation of Korean forced laborers isn’t its responsibility

- 10Faith in the power of memory: Why these teens carry yellow ribbons for Sewol