hankyoreh

Links to other country sites 다른 나라 사이트 링크

Major S. Korean companies see sales and profits drop

South Korea’s top businesses are struggling with sliding performance, recent reports show.

The list of companies suffering from low numbers includes such heavyweights as Samsung Electronics, Hyundai Motor, SK Hynix, LG Electronics, and POSCO.

Reports on 2015 performances published by major companies as of Jan. 28 showed clear signs of slowing growth and waning profitability, with both sales and operating profits down from the year before.

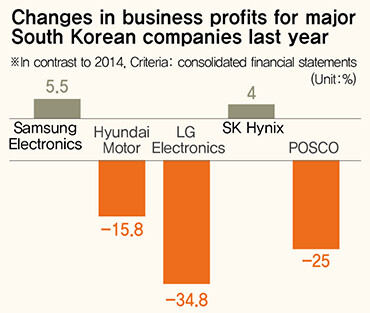

Total sales for Samsung Electronics came out to 200.65 trillion won (US$166.1 billion), a 2.7% drop from the 206.206 trillion won (US$170.7 billion) recorded for 2014. It was the second straight year of declining sales for the company. Annual operating profits rose 5.5% to 26.41 trillion won (US$21.9 billion), but overall profitability has been falling, with fourth quarter operating profits down 16.9% from the same period in 2014 at 6.14 trillion won (US$5.1 billion).

“Sales and profits have dropped because of intensifying competition in the smartphone market,” the company explained.

Hyundai Motor saw a rise in sales, but a decline in operating profits. Its 2015 sales totaled 91.958 trillion won (US$76.1 billion), up 3% from 2014, but operating profits fell for the third straight year, tumbling 15.8% to 6.357 trillion won (US$5.3 billion).

With so much of its profitability dependent on car sales, the automaker has taken a heavy hit from falling demand in the major US and China markets.

LG Electronics recorded sales of 56.509 trillion won (US$46.9 billion) and operating profits of 1.192 trillion won (US$987 million), down 4% and 35% respectively from the year before. SK Hynix had sales of 18.798 trillion won (US$15.6 billion) and operating profits of 5.336 trillion won (US$4.4 billion). While both were higher than for 2014, the fourth quarter saw sales of 4.416 trillion won (US$3.7 billion) and operating profits of 989 billion won (US$819 million), representing slides of 14% and 41% from the same period the year before, respectively. POSCO suffered consolidated losses of 96 billion won (US$79.5 million) for the first time in its history, with sales of 58.192 trillion won (US$48.2 billion) and operating profits of 2.410 trillion (US$2.0 billion) - down 10.6% and 25% from the year before, respectively.

More problematically, no signs of improvement are in sight for the companies, which are considered engines of the national economy. The smartphone market outlook is dim, with Apple’s 74.8 million units sold giving it a record-low 0.4% sales increase between the October-December quarters in 2014 and 2015. For the automobile market, the US market research company IHS predicted a rise of just 2.7% in global car sales for 2016.

“This year is really going to be a crisis,” declared LG Group chairman Koo Bon-moo at a Jan. 27 strategic meeting of chief executive officers.

Samsung Electronics announced at a corporate briefing on Jan. 28 that “weak overall demand for IT makes maintaining last year’s levels appear unlikely.”

Threatened with weak growth, companies have been moving to cut costs. Samsung Electronics plans to undertake additional restructuring in 2016 following last year. According to the US market research firm Gartner, the company is set to make US$114 billion in semiconductor investments this year, down 13.5% from 2015. POSCO also plans to cut over one trillion won (US$830 million) in costs across the group this year.

“Back in the mid-1990s, struggling Japanese manufacturers tried to cut costs by reducing staff numbers, and they ended up missing out on key technology and workers,” noted LG Economic Research Institute analyst Lee Ji-pyung.

“Even when conditions are bad, you need to make efforts toward more rational management and making efficient use of the technology and knowledge assets you have, rather than just making cuts indiscriminately,” Lee advised.

By Lee Jeong-hun and Park Hyun-jung, staff reporters

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 2‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 3Is N. Korea threatening to test nukes in response to possible new US-led sanctions body?

- 4Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 5Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 6No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 7[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 8Korea’s 1.3% growth in Q1 signals ‘textbook’ return to growth, says government

- 9N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 10Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report