hankyoreh

Links to other country sites 다른 나라 사이트 링크

Faced with weak growth, has Samsung lost its vision?

In 2009, Samsung Electronics outlined a list of aggressive goals as part of its “Vision 2020.” Its aim was to achieve US$400 billion (483 trillion won) in sales, rank first in the IT industry, and place fifth in the world for brand value by the year 2020. A brief spike in smartphone sales inspired confidence that its targets might be within reach.

Now many executives with the company are saying the vision is no longer realistic. Samsung has recently been cutting staff numbers and reducing marketing and other sales costs. Many observers are saying Samsung Electronics vice chairman Lee Jae-yong has opted for “managing the situation” since taking over the reins from his father, group chairman Lee Kun-hee, after the elder Lee’s health failed in May 2014.

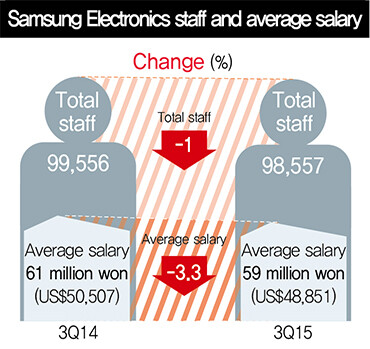

According to electronic disclosure data provided on Jan. 28 by the Financial Supervisory Service, Samsung Electronics staff numbers stood at 98,557 as of 3Q15 in the wake of restructuring efforts last year. The number, down by 1,000 positions from the year before, is now expected to drop further.

“What can we do? The company is in trouble,” said a senior Samsung executive recently.

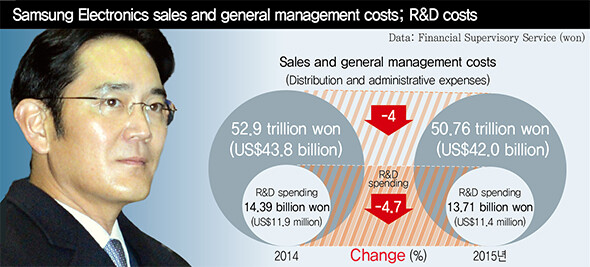

Costs are also being cut. Sales and general management costs for 2014 stood at 52.9 trillion won (US$43.8 billion); last year, they were down by over two trillion won to 50.76 trillion won (US$42.0 billion). Research and development spending dipped from 14.39 billion won (US$11.9 million) to 13.71 billion won (US$11.4 million).

Sales have been sliding for two straight years since peaking at 228.69 trillion won (US$189.3 billion) in 2013. But many analysts say the company has failed to come up with a clear path to turning its low growth around.

Growth has also been slack for five “future growth drivers” announced in 2010: solar cells, car batteries, LEDs, bio-pharmaceuticals, and medical equipment. The company did move in Dec. 2015 to set up a new electronic device project team, but its decision was one competitors had already made. The bio industry area, which it touted as a source of future growth at the time of the Samsung C&T and Cheil Industries merger, has been similarly weak. An anticipated NASDAQ listing in the second quarter for Samsung Bioepis, which develops new bio-pharmaceuticals, has been postponed, while a patent dispute has erupted with the US company Amgen.

“When you’re facing a crisis, your first priority may just be survival. Our plan is to watch the market situation closely as ‘fast followers’ rather than ‘first movers,’ and then go about investing when the opportunity is there,” said a senior Samsung source.

The “situation management” style of leadership has drawn criticisms from some observers.

“Since Lee Jae-yong took over, [Samsung Electronics’] interest has solely been in buying up companies that it can take advantage of,” said a Seoul National University professor who asked not to be identified.

“Because of failures within Samsung itself, they’ve neglected to build their own basic competitiveness through experience,” the professor added.

A securities company analyst, also speaking on condition of anonymity, noted the difference in the company from when Lee Kun-hee was leader.

“Today, you don’t see anyone looking for or talking about the way forward. It’s just managers left,” the analyst said.

Another source of concern has been the company’s “selection strategy” of selling off affiliates that are considered less essential.

“In the 1990s, Sony restructured its electronic sector because of the deficit it had racked up, and it focused instead on more profitable financial and film and music projects. It ended up losing cutting-edge technology and key talent from its restructuring in electronics projects, which accounted for 70% of its total sales,” said Kim Hyun-chul, a professor at the Seoul National University Graduate School of International Studies.

“Samsung is going to need to cut costs, but it also has to work to find markets for new growth,” Kim added.

By Lee Jeong-hun, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Has Korea, too, crossed the Rubicon on China? [Column] Has Korea, too, crossed the Rubicon on China?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/9317135153409185.jpg) [Column] Has Korea, too, crossed the Rubicon on China?

[Column] Has Korea, too, crossed the Rubicon on China?![[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/2317135166563519.jpg) [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2After 2 months of delayed, denied medical care, Koreans worry worst may be yet to come

- 3Hong Se-hwa, voice for tolerance whose memoir of exile touched a chord, dies at 76

- 4[Column] Has Korea, too, crossed the Rubicon on China?

- 5[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- 6Samsung barricades office as unionized workers strike for better conditions

- 7All eyes on Xiaomi after it pulls off EV that Apple couldn’t

- 8[Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- 9[News analysis] After elections, prosecutorial reform will likely make legislative agenda

- 10US overtakes China as Korea’s top export market, prompting trade sanction jitters