hankyoreh

Links to other country sites 다른 나라 사이트 링크

[Analysis] Geopolitical tensions now posing risk to S. Korean economy

The current situation on the Korean Peninsula, including North Korea’s recent nuclear test and rocket launch, Seoul’s decision to close the Kaesong Industrial Complex, and ongoing discussions on the deployment of a Terminal High Altitude Area Defense (THAAD) system with US Forces Korea, is triggering growing concerns about the potential threat to economic security. The fear is that escalating geopolitical risks could exacerbate uncertainties for a domestic economy already weakened by a global downturn and international financial market jitters.

Threat of Chinese trade retaliation

So far, the recent inter-Korean tensions have yet to cause any serious shock to the real economy or financial market. But experts worry that a long-term standoff or a rise in tensions could leave South Korea’s economic security exposed to serious risks. A particular focus of fears is the possibility that a response from China, which has been up in arms over the THAAD deployment discussions, could end up becoming the eye of a storm battering the South Korean economy.

China’s state-run Global Times addressed the THAAD deployment discussions in an editorial on Feb. 17.

“China should make thorough preparations for the worst-case scenario in the Peninsula,” it argued, adding that the country “should strengthen its military deployment in Northeast Asia.”

Meanwhile, Foreign Minister Wang Yi invoked a Chinese proverb to obliquely criticize the US for targeting China with its THAAD deployment on the Korean Peninsula.

“When Xiang Yu’s nephew Xiang Zhuang dances the dance of swords, what he really means to do is to kill Liu Bang,” Wang said.

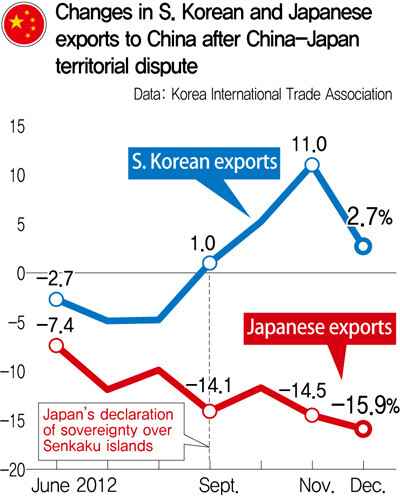

Experts see China as likely to pursue trade retaliation measures if the THAAD deployment does come to pass. Indeed, the country previously suspended salmon imports from Norway after the Nobel Peace Prize was given to Liu Xiaobo, a critic and activist Beijing views as a dissident. Rare-earth mineral exports were also halted in 2012 during a territorial dispute with Japan over the Senkaku (Diaoyu) Islands.

“China tends to use unofficial means rather than visible measures to pressure parties that it’s in territorial and other non-economic disputes with,” said Korea Institute of Finance researcher Ji Man-su.

“We should remember how Japanese exports to China fell sharply after the 2012 territorial dispute, and how South Korean exports to China increased greatly as a result,” Ji noted.

The concern is that China could use an “invisible hand” to throw the brakes on South Korean exports there. A more concrete possibility is that trade channels could shift to Japan, where 70% of trade amounts for Chinese export items overlap with South Korea.

“Japan could end up the biggest beneficiary of the conflict between South Korea and China over THAAD,” said Ji.

Fears of THAAD-driven Chinese capital outflowsSince late last year, Chinese capital in the South Korean stock market has been exiting at an increasing rate. According to Financial Supervisory Service data, outflows in terms of net sales skyrocketed from 17.2 billion won (US$14.0 million) as of Nov. 2015 to 588.5 billion won (US480.3 million) in December; as of January, the level stood at 476.2 billion won (US$388.7 million). The situation appears to be a reaction to concerns about Chinese economic conditions. Under the circumstances, the recent frictions between Seoul and Beijing and additional geopolitical risk factors could hasten the flight, experts said.

The effects could be amplified even more once Chinese capital starts leaving the market for securities, which are considered a relatively safer asset than stocks. Financial soundness for households and companies with large debt loads could weaken as interest rates rise for major securities, including government bonds. Chinese currently owns 17.4 trillion won (US$14.2 billion) in domestic bonds, which puts it second only to the US, which holds 18 trillion won (US$14.7 billion).

In a report titled “Potential Effects of the THAAD Conflict on the Financial Market,” HI Investment and Securities senior economist Park Sang-hyun observed, “As Chinese foreign exchange market worries continue, the geopolitical risks that have erupted under circumstances that already justify the flight of Chinese capital from the domestic market could serve to catalyze Chinese capital outflows.”

Worsening tensions pose credit rating risk?Perhaps the biggest worry is that the growing geopolitical risk could result in international agencies downgrading South Korea’s national credit rating. A lower rating would inevitably lead to outflows of capital not just from China but from all foreign investors, and financial market chaos as a result. Major agencies such as Moody’s and Fitch have yet to show any signs of adjusting their credit ratings for South Korea. But it’s a situation that could change if the situation drags into the long term - or an unexpected incident occurs.

“If the division of South and North Korea and North Korea‘s nuclear tests are risks that are already reflected in the national credit rating, the Kaesong Industrial Complex shutdown and THAAD deployment issue are serious risks that need to be added in now,” said Inje University unification studies professor Kim Yeon-chul.

Koh Yu-hwan, a North Korean studies professor at Dongguk University, noted that “the reason the domestic financial market responded calmly to the Kaesong Industrial Complex is because of the lessons learned from previous tensions being resolved relatively quickly.”

“If it takes too long to find an answer to the current situation, the market could be in for a big shock as expectations for a swift resolution crumble.”

By Kim Kyung-rok and Lee Je-hun, staff reporters

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 3[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5Thursday to mark start of resignations by senior doctors amid standoff with government

- 6N. Korean hackers breached 10 defense contractors in South for months, police say

- 7[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 8[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 9Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South

- 10[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent