hankyoreh

Links to other country sites 다른 나라 사이트 링크

Report: three quarters of S. Korean billionaires inherited their wealth

In South Korea, 74% of billionaires did not make their own fortunes but instead inherited their wealth from their parents, a new study shows. This bucks a global trend in which new billionaires tend to be self-made.

Last month, the Peter G. Peterson Institute for International Economics (PIIE) in the US analyzed the list of billionaires published each year between 1996 and 2015 by Forbes.

Last year, Forbes recorded that there were 30 billionaires in South Korea - including Lee Kun-hee, chairman of Samsung Electronics (US$9.6 billion, No. 112); Suh Kyung-Bae, chairman of Amorepacific (US$7.7 billion, No. 148); and Lee Jae-yong, vice chairman of Samsung Electronics (US$6 billion, No. 201). Of South Korea’s billionaires, 74.1% inherited their wealth from previous generations of their family.

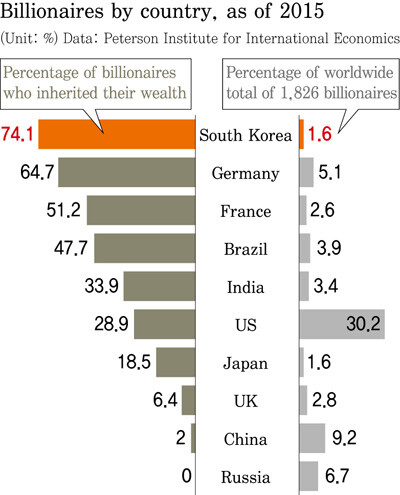

This was double the global average for the percentage of billionaires who inherited their wealth (30.4%). It also diverged from the worldwide trend for self-made billionaires (including entrepreneurs and professional managers) to outnumber those who were born into their fortune.

Around the world, the percentage of multi-generational billionaires has continued to drop, from 55.3% in 1996 to 30.4% in 2014. While there are countries with a higher percentage of inherited billionaires than South Korea - namely Kuwait (100%), Finland (100%), Denmark (83.3%) and the United Arab Emirates (75%) - all of them have five billionaires or fewer, making them statistically insignificant.

In the economic powerhouses of the US, China and Japan, the percentage of multi-generational billionaires was 28.9%, 2% and 18.5%, respectively.

European countries tend to have a high number of multi-generational billionaires, but even Germany and France (64.7% and 51.2%) had lower percentages than South Korea.

In China and Japan, the percentage of billionaires who were entrepreneurs was 40.1% and 63%, much higher than South Korea’s percentage of 18.5%.

Last year, there were 1,826 billionaires in 70 countries around the world.

“Because the South Korean economy has been oriented around chaebol and large corporations since the 1980s, it is much less likely for an individual to make it big in business unless they have capital or the backing of big business,” said Jeong Seon-seop, president of Chaebul.com, on Mar. 14.

“On top of this, nowadays chaebol use legal loopholes to hand down wealth, which appears to be why we are seeing more multi-generational billionaires.”

“In terms of society as a whole, it’s not a good idea for there to be more multi-generational billionaires. When there’s a tendency for wealth to accumulate in a specific group, this exacerbates polarization and widens the gap between the haves and the have nots,” Jeong said. “This saps the energy of the entire economy.”

“Extreme wealth is growing significantly faster in emerging markets” such as those in Asia, the Peterson Institute for International Economics reported in the paper, titled “The Origins of the Superrich: The Billionaire Characteristics Database.”

In China, for example, 10 years ago there were only two billionaires, but by last year there were 213 of them - a 100-fold increase. In Japan, in contrast, economic contraction has led to a decline in the number of billionaires over the past 20 years, from 40 to 24.

The country with the fastest increase in the number of self-made billionaires is the US, in which 27% of billionaires made their fortune in finance. The fact that the majority of these are hedge fund operators is worth noting, the report said.

By Seong Yeon-cheol, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 4[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 5‘Weddingflation’ breaks the bank for Korean couples-to-be

- 6[Reportage] On US campuses, student risk arrest as they call for divestment from Israel

- 7[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 8[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 9Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 10Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US