hankyoreh

Links to other country sites 다른 나라 사이트 링크

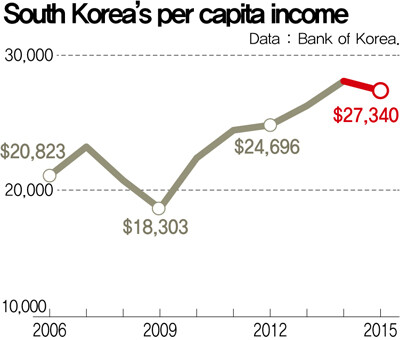

South Korea still unable to reach US$30,000 per capita income

With South Korea’s per capita income faltering for the first time in six years, it is becoming even harder for the country to escape from the $20,000 trap, where it has been stuck for 10 years. While per capita income climbed above 30 million won for the first time, a comparison with other countries shows that South Korea is having trouble catching up with advanced economies.

According to figures for 2014 from the World Bank, South Korea was ranked 42nd for per capita income, just below Spain. Italy, ranked 40th, had a per capita income of US$34,270. The fact is that South Korea cannot enter the top 30 even if the income does reach US$30,000, and the national income is shrinking, not increasing.

On average, it has taken advanced economies about 10 years to make the jump from US$20,000 to US$30,000. The time it has taken South Korea’s national income to increase feels especially slow compared to Japan (4 years), Germany (6 years) and the US (9 years).

The Bank of Korea mostly blamed this decrease on exchange rates. Since the won to dollar exchange rate rose from an average of 1,053 won in 2014 to 1,131 won last year, the value of won converted into dollars was bound to fall.

But considering that the value of currency reflects a country’s economic power, this does not seem like an adequate explanation. Turned on its head, this argument would mean that a weak exchange rate would have made the national income increase.

In broad terms, fluctuations in the exchange rate function as a technical factor.

The fundamental factor that has kept the national income from growing is the slowing economic growth rate. The rate of increase of real GDP last year was 2.6%, which was lower than the previous year (3.3%).

“Sluggish exports have also had an effect on the decrease in the gross national income,” said Jeon Seung-cheol, who is in charge of economic statistics for the Bank of Korea.

The fact that investments are down and savings are up also illustrates how the economy is wilting. Last year, total domestic investment accounted for 28.5% of gross national disposable income (1.56 quadrillion won), which was down 0.8 percentage points from the previous year. This is the lowest point since 1998 (27.9%), during the Asian Financial Crisis.

While South Korea’s gross domestic investment rate has generally remained above 30% over the past forty years, since 2013 it has dipped into the 20% range. The domestic net savings rate was 7.7%, up 1.4 percentage points from 2014. This is the highest the rate has been since 2000 (8.4%).

The wage share – which refers to the income of wage earners as a percentage of the national income – was 62.9%, nearly the same as the previous year (62.8%). In 2014, this percentage increased by 1.1 percentage points.

During her national address on Liberation Day last year (Aug. 15) President Park Geun-hye said that South Korea will become the seventh country to join the 50-30 club, referring to countries that have a population of more than 50 million and a per capita income of more than US$30,000.

South Korea reached US$10,000 in per capita income in 1994, and it took 12 years for income to reach US$20,000. But given current trends, there is no telling when South Korea will reach the US$30,000 mark. The economic growth rate this year is predicted to be around 2%, while so far this year the average exchange rate is already 6.4% higher than last year.

By Lee Bon-young, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3‘Weddingflation’ breaks the bank for Korean couples-to-be

- 4[Reportage] On US campuses, student risk arrest as they call for divestment from Israel

- 5Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 6[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 7Korea sees more deaths than births for 52nd consecutive month in February

- 8[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 9Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 10[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father