hankyoreh

Links to other country sites 다른 나라 사이트 링크

Sluggish exports the biggest factor in S. Korea’s weak economic growth

Poor export performance was the single biggest factor in South Korea’s sliding economic growth rate last year, statistics show.

Meanwhile, the prospects for 2016’s growth rate appear increasingly bleak as corporate investment, private consumption, and other domestic demand fail to make up for weak exports.

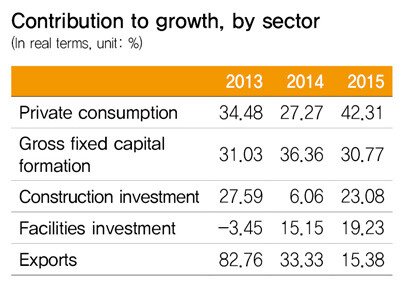

According to data gathered from the Bank of Korea’s Economic Statistics System on Apr. 3, the export sector‘s contribution to growth has been falling each year since peaking at 202.7% in 2011. The number slid to 121.7% in 2012, 82.8% in 2013, and 33.3% in 2014; in 2015, it fell by more than half again to 15.4%.

The major decline in export contributions was also a major reason for South Korea’s economic growth rate remaining at 2.6% last year - down from 3.3% the year before. A sector’s contribution rate is calculated by dividing its contribution to growth by the real economic growth rate. The resulting percentage shows the extent to which areas such as consumption, investment, and exports contributed to the total growth rate.

The steep decline in export section contributions can be read in at least two ways: as a sign of the South Korean economy’s strong dependence on exports lessening, or as an indication that a key pillar is being undermined.

At issue is the failure of corporate investment to do its part in countering the export slump’s effects. The growth contribution from private-sector gross fixed capital formation - an indicator of the level of corporate investment - stood at 30.8% last year, down nearly 6.0 percentage points from 36.3% in 2014.

At the same time, the contribution from construction investment nearly quadrupled from 6.1% in 2014 to 23.1% last year. With construction investment previously declining over a three-year real estate slump period between 2011 and 2014, analysts attributed the change to targeted economic policies by the administration and Bank of Korea to loosen loan regulations and lower interest rates in an apparent attempt to boost the real estate sector.

Private consumption - an area that in principle should be offsetting slackness in exports and investment - showed a higher contribution rate than in the past, but questions remain over the phenomenon’s sustainability. Last year, private consumption had a contribution rate of 42.3%, up fully 15 percentage points from 27.3% the year before.

Even that was not enough to make up for export underperformance. Indeed, the real rate of increase in private consumption stood at 2.2% for 2015 - significantly less than the 2.6% real growth rate. The household income underpinning consumption has been stagnant, and average propensity to consume has been sliding for five straight years amid retirement worries and heavy household debt loads. It’s a situation where private consumption is unlikely to provide enough support to bolster future growth.

By Kim Kyung-rok, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/8317138574257878.jpg) [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father![[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms? [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/3617138579390322.jpg) [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

Most viewed articles

- 1[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 2Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 3[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5Opposition calls Yoon’s chief of staff appointment a ‘slap in the face’

- 6New AI-based translation tools make their way into everyday life in Korea

- 7Terry Anderson, AP reporter who informed world of massacre in Gwangju, dies at 76

- 8[Column] The clock is ticking for Korea’s first lady

- 9Samsung barricades office as unionized workers strike for better conditions

- 10Korean government’s compromise plan for medical reform swiftly rejected by doctors