hankyoreh

Links to other country sites 다른 나라 사이트 링크

IMF Managing Director says S. Korea has “ample fiscal space”

The managing director of the International Monetary Fund (IMF) pointed to South Korea alongside Germany and the Netherlands on Apr. 17 as a country with “ample fiscal space.”

The remarks, which came while IMF Managing Director Christine Lagarde was stressing the need for expansionary fiscal policy from governments around the world to counter sustained low growth, left Seoul in an awkward position of facing external pressures to change its current financial approach, which has placed major emphasis on fiscal soundness.

Bank of Korea governor Lee Ju-yeol cited Lagarde’s remarks to reporters in Washington on Apr. 15 while attending a meeting of finance ministers and central bank governors for the G20 nations.

“Ms. Lagarde said that countries with the financial means should actively implement fiscal expansion policies, and cited South Korea, Germany, and the Netherlands as countries with the infrastructure and fiscal soundness,” Lee explained.

It is considered unusual for the IMF managing director to single out specific countries by name when making calls for expansionary fiscal policy.

Lee went on to affirm that “[South Korea’s] fiscal soundness is indeed relatively strong.”

“The South Korean government now has to think carefully over whether to increase [fiscal expenditures] and how to manage [its finances],” he added.

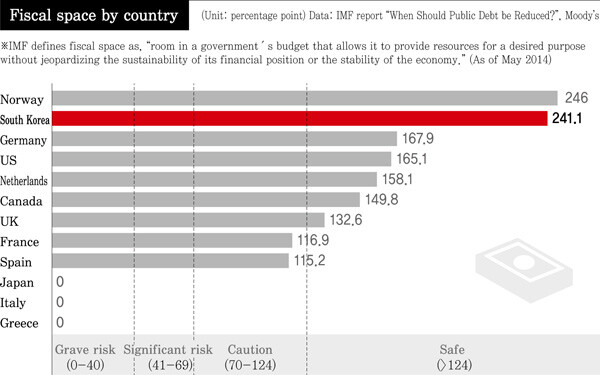

A 2014 report by the IMF listed South Korea as having a fiscal space level of 241.1, ranking it very high even among major economies. To calculate the index, the IMF uses a combination of national debt, financial scale, and interest rates on government bonds; a level of 124 or higher in considered “stable,” meaning a country has the short-term capacity to make expenditures without compromising its mid- to long-term fiscal soundness.

For now, Seoul plans to first consider expanding its main budget for next year rather than establishing a revised supplementary budget for this year or moving to cut taxes or hasten spending. The approach is a reflection of both current business conditions and the results of the Apr. 13 parliamentary elections, which left the ruling Saenuri Party (NFP) a minority in the National Assembly.

“A revised supplementary budget or tax cuts would be the easiest way of using our fiscal space right now, but this is not the time for developing a supplementary budget, and we can’t just make tax cuts indiscriminately,” Deputy Prime Minister and Minister of Strategy and Finance Yoo Il-ho said in a meeting with reporters in Washington the same day.

“In the end, we may consider increasing next year’s budget [over the original plan] and allowing for a large [fiscal] deficit,” Yoo considered. “It looks like we‘ll have to make a determination on that soon.”

Yoo also said the matter of a supplementary revised budget “has become difficult since the elections.”

“The opposition parties aren’t going to like it,” he added.

Expansionary fiscal policy was at the heart of a joint communique issued from the G20 economic meeting the same day.

“[M]onetary policy alone cannot lead to balanced growth,” the statement said, adding that fiscal policy should be used flexibly for growth, job creation, and increased trust.

The countries also agreed to establish fiscal management principles and assessment indicators for presentation at another meeting in July. It is the first time fiscal policy has received such emphasis as a means of overcoming crisis since a G20 economic meeting after the eruption of the global financial crises in 2008. Analysts interpreted it as a reflection of the weakened capacity for monetary policy approaches, with Japan and the European Central Bank (ECB) going beyond zero interest rates and into negative levels.

The meeting’s outcome suggests the side represented by the US, Japan, and the IMF, with their calls for increased fiscal expenditures and easy monetary policy, has gained the upper hand against Germany, which has emphasized the need for structural reforms first.

But the likelihood of the agreement being followed by Germany - which actually has the necessary fiscal space - appears low.

By Kim Kyung-rok, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 2Thursday to mark start of resignations by senior doctors amid standoff with government

- 3Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South

- 4[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 5N. Korean hackers breached 10 defense contractors in South for months, police say

- 6Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 7Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 8[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 9[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 10[Column] Yoon’s first 100 days should open our eyes to pitfalls of presidential system