hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korean shipping firms may be left out of international alliances

Restructuring at South Korean companies Hanjin Shipping and Hyundai Merchant Marine could lead to their exit from international shipping alliances.

With shipping companies around the world teaming up in various ways for international transportation, the two companies’ absence from the alliances would have serious ripple effects on the South Korean economy. The issue is now expected to be a key variable and focus in the future debate over the direction of restructuring. It is also the reason for an “ocean alliance reorganization countermeasures meeting” staged by the Ministry of Oceans and Fisheries on Apr. 25 with shipping companies and scholars.

“It appears that worldwide alliances are going to be reduced and reorganized down to three [from four],” said Minister Kim Young-suk.

“These shipping alliance reorganizations are expected to have an impact not just on the domestic shipping market, but on all areas of ports and distribution,” Kim added.

“We are planning to take measures to respond smoothly to changes in the world shipping market,” he said.

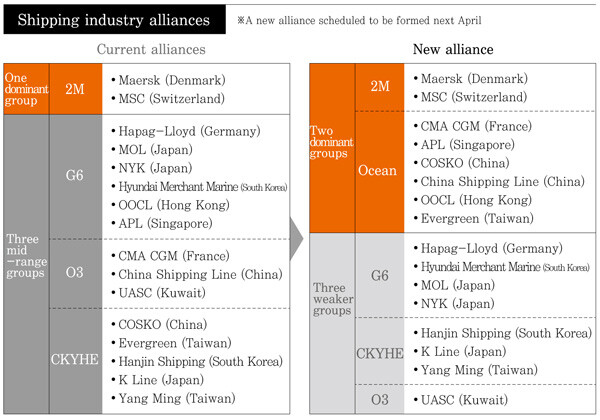

The four current ocean alliances are 2M, G6, Ocean 3, and CKYHE, which combine to account for 99% of the world’s major container ship routes. This means that those not included are unable to do container ship business in the open ocean.

Sixteen companies are members of the alliances. In basic terms, ocean-going container liners operate in a similar manner to passenger flights, in which they are required to visit set ports of call on predefined dates, even when they have no cargo to carry. With a round-trip journey between Asia and Europe or the Americas taking three to four weeks, and with several vessels required, it is beyond the capabilities of a single company to operate all lines around the world - which is the reason for forming the alliance.

The largest of the alliances, 2M, includes the world‘s top-ranked shipping company, Denmark’s Maersk, and its second, Switzerland‘s MSC. Together, they account for over 1,000 ships. The large cale translated into a large number of operable lines and increased global competitiveness.

Alliances are typically reorganized every five years or so. Recently, the Ocean alliance was formed as Chinese, French, Hong Kong, and Taiwanese companies came together to challenge 2M. The shift reduced the scale of G6, to which Hyundai Merchant Marine belongs, and CKYHE, where Hanjin Shipping is a member.

“It’s unlikely that Hyundai Merchant Marine or Hanjijn Shipping would be able to participate in the two big ones, 2M and Ocean 3,” said a ministry source. “They would have to discuss a third alliance with other shipping companies.”

But current restructuring efforts pose a potential obstacle to those discussions. Given the shared vessels and lines, management stability is key to forming alliances.

“If they’re outside the alliances, they can’t survive in the international shipping industry, and recovery is virtually impossible,” said Yang Chang-ho, a professor at the Incheon National University Graduate School of Logistics.

The decline of South Korean shipping companies also has a serious impact on imports and exports and the port industry. South Korea relies on ocean transport for 99% of its exports, while more than half of volume in the Port of Busan is transshipment cargo that merely changes vessels there for transport to another country. The absence of South Korean shipping companies from an ocean alliance would take away any reason for foreign companies to visit the Port of Busan, resulting in transshipment activity moving to other nearby ports.

“The alliance shift is still in progress right now, so there‘s not much time. South Korea’s companies can only get in if they can show that they are competitive,” said Yang Chang-ho.

“These restructuring efforts need to be done in a way that boosts competitiveness.”

By Kim So-youn, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 4‘Weddingflation’ breaks the bank for Korean couples-to-be

- 5[Column] Has Korea, too, crossed the Rubicon on China?

- 6[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 7[Reportage] On US campuses, student risk arrest as they call for divestment from Israel

- 8Korea sees more deaths than births for 52nd consecutive month in February

- 9[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 10[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father