hankyoreh

Links to other country sites 다른 나라 사이트 링크

Concerns rising that Hyundai Merchant Marine may be another financial black hole

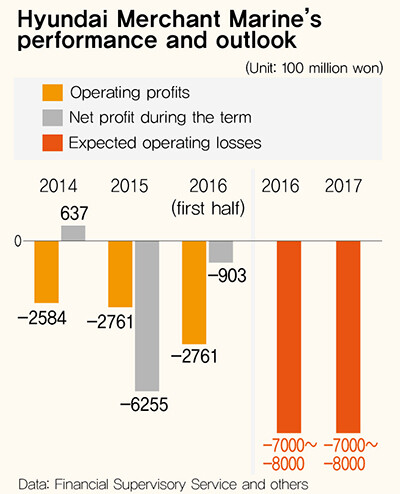

With Hanjin Shipping’s financial difficulties landing it in corporate rehabilitation (court receivership), Hyundai Merchant Marine posted an operating deficit of more than 400 billion won (US$361.93 million) in the first half of the year, and the company is expected to post a massive operating deficit in excess of 1.5 trillion won (US$1.36 billion) over this year and the next.

Hyundai Merchant Marine has so far barely managed to stay afloat thanks to a debt-for-equity swap by its creditors. If it fails to find a way to navigate the downturn in the shipping market on its own steam, it will ultimately have to ask its creditors for another huge round of assistance. This is leading to growing concerns that Hyundai Merchant Marine is becoming another version of Daewoo Shipbuilding and Marine Engineering, with good money being thrown after bad.

Hyundai Merchant Marine’s business report for the first half of the 2016 financial year, released on Sept. 4, shows a net loss of 90.3 billion won (US$81.7 million; on an individual basis) from January to June. This was just half of the 175.7 billion won (US$158.9 million) in losses posted in the first half of 2015.

But the company’s operating deficit was 429.7 billion won (US$388.5 million), more than five times higher than last year’s deficit of 83.3 billion won (US$75.3 million). The company managed to report a deceptively low net loss for the term by papering over the operating deficit with nearly 500 billion won (US$452 million) brought in by selling off equity in Hyundai Securities.

If current trends persist, say insiders at Hyundai Merchant Marine, the company’s total operating deficit for the year will reach 700 or 800 billion won (US$633 million or 723 million). “Since they don’t have any other assets worth selling off, they’ll have no choice but to write off their huge operating deficit as a net loss for the term,” said a source who is familiar with affairs at the company.

Even more serious is the fact that there are no signs of recovery in the global shipping industry, which means it is unlikely that the company’s performance will improve next year, either. “Chances are low that the shipping industry will be any better next year than this year, which means that it’s likely that next year’s operating deficit will be even higher than this year’s,” said a source at Hyundai Merchant Marine.

In the end, operating losses at the company between this year and the next are expected to top 1.5 trillion won (US$1.36 billion).

Since Hyundai Merchant Marine has little cash in reserve, continuing to suffer major operating losses could ultimately force it to once again ask its creditors for help. According to Solidarity for Economic Reform, as of the end of June, Hyundai Merchant Marine only had 376.4 billion won (US$340.4 million) in cash and cash equivalents. Thus, if they continue to post big operating losses in the second half of this year and the next without receiving external funding, they will run out of money

A 700 billion won debt-for-equity swap by the company’s creditors in early August brought its debt ratio down from 900% at the end of last year to less than 200%, but the company would have trouble raising external funds given its current credit.

“If the government and creditors provide additional assistance to Hyundai Merchant Marine when its future is uncertain, they will have to deal with allegations of squandering tax revenues on a hopeless project. The question of whether to provide additional support will be decided after the company requests court receivership, after the courts determine whether rehabilitation is possible and after the company’s existing liabilities have been consolidated and its financial structure improved,” said Jeon Seong-in, a professor of economics at Hongik University.

In June, the South Korean government and the Bank of Korea announced a support package that involved setting up a fund worth 11 trillion won (US$9.9 billion) to help state-operated banks raise enough capital to restructure the shipping and shipbuilding industries.

Experts argue that Hyundai Merchant Marine needs to take drastic measures to get back on its feet by dropping out of routes on which it is not competitive, instead of simply waiting for a recovery in the global shipping industry.

“Since there’s no telling when the ‘chicken game’ in the global shipping industry that has been going on since 2011 will come to an end, you’re only going to get limited results from acquisitions of high-quality assets at Hanjin Shipping Company and from the government-backed aid package that involves creating a ship fund, building ships and renting ships for low fees.

Right now, mid-sized domestic shipping firms are making money on routes in Southeast Asia,” said a former senior executive at a global shipping firm. The “chicken game” mentioned by the former executive refers to firms slashing their shipping fares in an attempt to run competitors out of business.

This former executive also brushed aside the argument that South Korea needs a world-class shipping company of its own because of the security situation and the importance of imports and exports. “The US is a leading importer and exporter, and it only has coastal shipping companies. It doesn’t have a global shipping company,” the former executive said.

By Kwack Jung-soo, business correspondent

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/8317138574257878.jpg) [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father![[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms? [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/3617138579390322.jpg) [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

Most viewed articles

- 1[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 2Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 3Terry Anderson, AP reporter who informed world of massacre in Gwangju, dies at 76

- 4[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 5[Column] The clock is ticking for Korea’s first lady

- 6Opposition calls Yoon’s chief of staff appointment a ‘slap in the face’

- 7Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 8New AI-based translation tools make their way into everyday life in Korea

- 9[Editorial] Japan’s rewriting of history with Korea has gone too far

- 10[Column] Are chaebol firms just pizza pies for families to divvy up as they please?