hankyoreh

Links to other country sites 다른 나라 사이트 링크

[News analysis] As global deposits near depletion, urban mining for rare metals

Around the year 2100, the earth’s deposits of mineral resources will be exhausted. Around the same time, people will probably be throwing away three times as much trash as they do today. The various technologies that are expected to dominate the society in the future - including artificial intelligence, robotics, the internet of things, self-driving cars, 3D printers and quantum computing - use an incredible amount of precious metals. Urban mining, or the industry of extracting minerals from waste products, is the driver of the Fourth Industrial Revolution.

Cobalt, a silverfish metal with atomic number 27, was just a substance used to add a bluish color to pottery in Egypt and China until 1735, when it was found to be a unique element by Swedish chemist Georg Brandt. The name of the element came from “kobold,” a German word meaning “goblin” or “demon.” Since cobalt resembles silver ore, disappointed silver miners called it “goblin ore” from the belief that goblins had stolen the silver and only left behind a nasty stench.

Tantalum, a bluish-gray metal with atomic number 73, was discovered by another Swedish chemist, Anders Gustaf Ekebery, in 1802. The element was named for Tantalus, a son of Zeus in Greek mythology whose punishment in hell is everlasting thirst: he is immersed in water that recedes whenever he bends down to drink it. Tantalum’s connection with the mythological figure is its unusual resistance to oxidation, which is to say that it does not absorb oxygen easily.

One thing that cobalt and tantalum have in common is that they are both largely mined in Africa. 51% of cobalt is mined in the Congo, and 67% of tantalum is mined in Rwanda and the Congo. Since uranium is found in both of these ores, the workers who are mining them are exposed to radiation. Tantalum serves as a source of cash for armed groups in the DRC Congo, which has led the US government to designate it a “conflict mineral” and ban its use. Officially, half of tantalum is produced in Rwanda, but reports suggest that a substantial amount is actually produced in the Congo and then routed through Rwanda.

Another thing that the two metals have in common is that they are both used as a primary material in smartphones and tablet computers. Cobalt is a material used in lithium secondary batteries, and tantalum is used to make capacitors (a device used to store an electric charge in electronic circuits).

Cobalt and tantalum are only two of more than twenty metals found in smartphones. These include precious metals like gold and silver and rare metals like palladium and lithium. The term “rare metals” refers to metals that have important industrial applications but are only found in a small number of underground reserves concentrated in a very small number of countries.

The technologies that Klaus Schwab, executive chairman of the World Economic Forum, believes will drive the Fourth Industrial Revolution (namely, artificial intelligence, robotics, the internet of things, self-driving cars, 3D printing and quantum computing) depend on these metals as well. In their book “The Sixth Wave,” futurists James Bradfield Moody and Bianca Nogrady argue that while growth in the global economy has been fueled by the consumption of resources such as cotton, steel, coal, petroleum and integrated circuits since the Industrial Revolution in the 18th century, the efficient use of resources will be the engine of development in a new age of limited resources. In short, they believe that a time is coming in which waste materials will be recycled until even our excrement will be a source of money.

Natural silver and gold will be exhausted in two decades

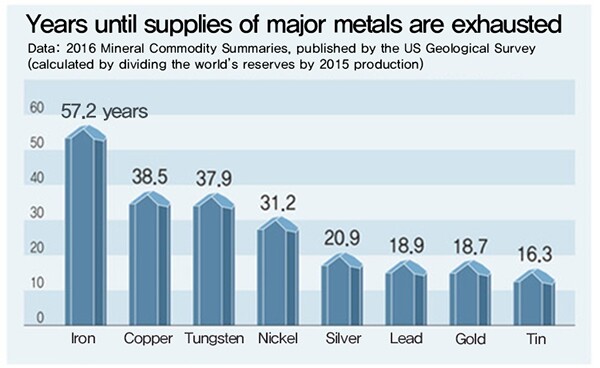

The 2016 Mineral Commodity Summaries, part of a yearly series published by the US Geological Survey (USGS), makes the situation readily apparent. There are 18.7 years of mineable reserves of gold (calculated by dividing the world’s gold reserves by 2015 production). There is not much time left before we run out of the major metals, including silver (20.9 years), iron (57.2 years) and copper (38.5 years). Mineable reserves of cobalt will only last for 57.3 years, while tantalum reserves will be exhausted in 83 years.

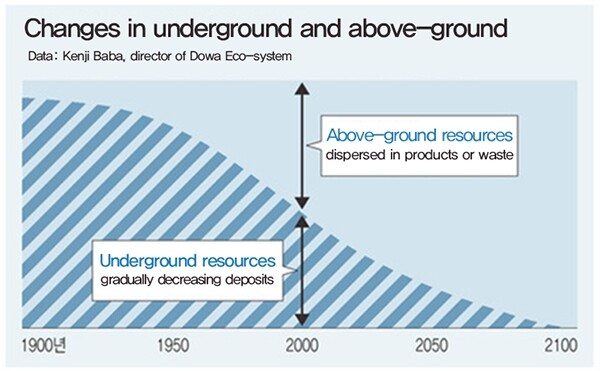

Meanwhile, our cities are overflowing with trash. In 2100, people are likely to throw away three times the amount of trash they do at present. Kenji Baba, director of Dowa Eco-system, a Japanese waste material recycling company, argues that the earth’s total resources are fixed and that by 2100 the earth‘s underground resources will almost entirely disappear, while above-ground resources located in our cities will make up the difference.

The US, Japan and European countries are already moving to extract minerals from waste materials. Michio Nanjo, professor at the Research Institute of Mineral Dressing and Metallurgy at Tohoku University, coined the term “urban mining” in 1980 to refer to waste materials in cities. Even though Japan has as few natural resources as South Korea, it’s no longer resource-poor. According to Japan’s National Institute for Materials Science, the country’s urban mineral deposits are worth 40 trillion yen (US$339.14 billion). Japan has 16.4% of global gold deposits and 22.4% of silver. In 2014 alone, Japan extracted 143kg of gold, 1,566kg of silver and 700kg of copper from urban mines. The UK put the spotlight on recycling resources in the 2012 London Olympics by making its medals from metal extracted from waste materials. Japan is also planning to make the medals for the 2020 Tokyo Olympics from metals extracted from urban mining.

Two global companies that have found success in urban mining are Japan’s Dowa Holdings and Belgium’s Umicore. Dowa Holdings has successfully used subsidiaries like Dowa Eco-System, Dowa Metals and Mining and Dowa Electronics Materials to manage the separate stages in a process running from the collection of raw materials to the recovery, refining and processing of metals and the production of parts and materials. The company has the technology for recovering 22 metals altogether, including germanium, ruthenium, gallium and selenium. Dowa Metals and Mining, which is mainly involved in metal collection, saw its operating profits increase from 4.2 billion yen in 2011 to 13.3 billion yen last year - an increase of 200% in just five years.

28% of the revenues (14.3 trillion won) at Umicore, which has the world‘s largest recycling plant, derive from urban mining. Urban mining represents an even higher percentage of the company’s operating profits, at 42%. The company extracts dozens of metals and uses these as the raw materials for producing a variety of materials. The company‘s unique rare metal recovery technology enables it to place mobile phones that are only 60% disassembled into the smelter and extract rare metals that other companies cannot recover at all.

Going overseas to dig while ignoring domestic opportunities in South Korea

As a global consumer of metals, South Korea relies on imports for 99.3% of its minerals. The adverse balance of trade for rare metals last year stood at 3.5 billion dollars.

The government gives recognition as rare metals to 56 rare elements in 35 categories that are currently in demand or likely to be in the future. South Korean companies possess recycling technology for 23 of these categories, and they are currently reclaiming metals from waste materials in 20 of them. If iron, nonferrous metals such as copper and lead and precious metals such as gold and silver are included, this rises to 27 categories of metals. In 2014, 89.5 trillion won worth of metal resources were used in South Korea. Of these metal resources, 69.9 trillion won worth were imported after being mined and the remaining 19.6 trillion won were produced through urban mining. That amounts to 22% of the total demand for metal resources.

Iron (48%), nonferrous metals (28%) and precious metals (14%) account for most of the products of urban mining, while rare metals only amount to 10%. Even worse, more than half of the 917 companies in urban mining have less than 10 billion won in revenue. 58% of them are small companies with 10 or fewer employees. Furthermore, these companies only possess about 70% or 80% of the metal recovery technological expertise found in leading countries.

“The materials used in cutting-edge precision products have to be ‘six nines fine,’ which is to say 999.999% pure. But Korean companies only have the technology to produce ‘four nines fine,’ or 99.99% pure,” said Kim Ryeong-ju, an analyst in the resource circulation technology policy department at the Korea Institute of Industrial Technology (KITECH).

Sungeel Hitech and LS-Nikko are regarded as South Korea’s leading urban mining companies. Sungeel Hitech recovers metals such as cobalt, nickel, manganese and lithium from the by-products of secondary batteries, and it uses hydrometallurgical technology to extract gold, silver and platinum. South Korea is one of only three countries (the others are Belgium and China) with battery recovery technology.

The process of extracting cobalt from smartphone batteries is complicated. First, the discarded batteries are discarded to prevent an explosion. Next, the electrolytes that convey electricity are removed. The recyclable metals are located on the electrode plate inside the battery. After the case and the bi-polar plate are physically smashed and crushed into powder, there is a preliminary stage in which magnets are used to filter out the unnecessary materials. Then the remaining materials are melted in a solution that turns them into metallic ions, and the desired metals are categorized by their specific gravity and refined. Sungeel Hitech supplies all of the materials that it extracts in this manner to domestic companies that manufacture the cathode active materials for batteries.

But in South Korea it’s not easy to acquire the used mobile phones that are needed for recycling. Not only are people reluctant to throw away old mobile phones because of the risk of leaking personal information, but the used-goods market is stagnant, making it hard to acquire the phones.

Last year, Sungeel Hitech built a factory in Malaysia for recycling secondary batteries. This factory only handles the preliminary phases of the work (such as smashing and crushing), while the actual metal recovery takes place inside South Korea.

“Because of the risk of fire, batteries are regulated under the Basel Convention, which restricts the shipment of materials between countries. We built the factory [in Malyasia] so that we could collect and disassemble mobile phones on location and then bring them into South Korea in the form of metallic powder,” said Lee Gi-ung, chief of research for Sungeel Hitech.

While the difficulty of collecting recyclable products is one factor that impedes the growth of urban mining, another problem is the immaturity of the materials industry, which ought to be putting recovered metals to use. The superalloys in power generators and airplane turbine blades contain 5% rhenium, a metal that is so expensive that it costs more than the rest of the materials combined.

“We contacted the companies that build power generators to suggest doing joint research into recovering medals from used blades, but nothing came of it. They argued that it was pointless to extract rhenium since there aren’t any South Korean companies that can use rhenium to make superalloys,” said Lee Jae-cheon, chief analyst in the department of urban mining at the Korea Institute of Geoscience and Mineral Resources. Lee explained that as long as South Korea only has the technology to recover metals without the technology to turn those recovered metals into the necessary materials, the only application will be primary-industry exports of raw materials.

Held back by red tape, South Korean companies lose business opportunities to other countries

The legal system is another issue that needs to be resolved. Since the recycled materials used in urban mining are all classified as waste materials, it‘s easy enough to export them, but it’s far from easy to bring them into the country.

Even though Japan is an urban mining powerhouse, there is a domestic shortfall in demand for batteries and so it imports some of them from South Korea. Used batteries are classified as waste materials in South Korea but as recyclable resources in the countries to which it exports the batteries, and it can take between three and six months for companies to acquire the necessary documentation. During that time, business opportunities are sometimes snapped up by China and other countries.

On May 29, the Basic Act for Resource Circulation took effect, inspired by the Act for Promoting Resource Circulation and other bills that had been submitted and debated by lawmakers and the government. But critics are already arguing that the new law needs to be revised because it does not go far enough to promote the development of urban mining.

“The fact that the individual act was upgraded to a basic act looks like progress, but when it comes to the nuts and bolts it still functions more like an individual act. The concept of circular resources is still based on waste materials. They need to create a concept of circular resources that exists separately from waste materials,” said Kang Hong-yun, director of KITECH’s resource circulation technology support center.

When waste resources that can be recycled through urban mining are classified as waste instead of being converted into circular resources, they are subject to many more restrictions. Special vehicles must be used to transport them, which increases their cost by 70%, and these resources cannot be stored for more than 30 days.

In Japan, all trash is categorized into waste and circular resources, and circular resources are exempted from a number of regulations, including the need for permits. Germany also distinguishes between waste that can be converted into resources and waste that must be disposed of.

By Lee Keun-young, senior staff writer

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 346% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 4Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 5‘Weddingflation’ breaks the bank for Korean couples-to-be

- 6[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 7Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 8Korea sees more deaths than births for 52nd consecutive month in February

- 9“Parental care contracts” increasingly common in South Korea

- 10[Interview] Dear Korean men, It’s OK to admit you’re not always strong