hankyoreh

Links to other country sites 다른 나라 사이트 링크

Samsung could run up against international regulations after involvement in bribery scandal

A heavily global market-dependent Samsung stands to face international anti-corruption regulations and the loss of key leading company workers it acquired as drivers of future growth if bribery and embezzlement charges against Samsung Electronics Vice Chairman Lee Jae-yong and other senior managers by the special prosecutor investigating the Choi Sun-sil government interference case are upheld in court, experts predicted.

According to accounts on Jan. 17 from sources at Transparency International Korea and Samsung and legal world observers, the real crisis for Samsung from its involvement in the Choi Sun-sil scandal is likely to come in the global market rather than the domestic one.

“The anti-corruption issue has already become a ‘global standard issue’ in the international community with the European Union and Organisation for Economic Co-operation and Development, and the major advanced economies the US are enacting anti-corruption legislation to impose strong regulations,” explained Lee Sang-hak, a director at Transparency International Korea.

The US Foreign Corrupt Practices Act (FCPA) states that US companies listed on the US stock market are subject to business restrictions, large fines, and other punishments for offering bribes in third countries.

An example of this came in Feb. 2016, when the US Securities and Exchange Commission and Justice Department imposed US$795 million (around 920 billion won) in fines against VimpelCom, a Dutch-based telecommunications company listed on Nasdaq. In 2015, VimpelCom’s former CEO was arrested on charges of providing US$57.5 million in bribes in the form of a consulting contract with a company bearing ties to the daughter of then-Uzbekistan President Islam Karimov in exchange for communications project rights in the country.

“While there does seem to be a tendency in South Korean society to go easy on corporate corruption, there is a serious danger of greater disaster to come for large South Korean businesses in the global market if they neglect their response to the anti-corruption issue the way they’re doing now,” said Transparency International Korea.

The argument is that the response from some business groups and conservative media to news of Lee’s arrest warrant request - asking that officials go easy on him and investigate him without detention because of the potential negative impact on the economy - show their insularity and ignorance of international trends.

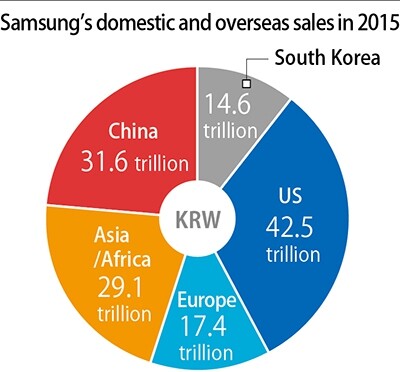

Samsung’s consulting contract with a company owned by Choi Sun-sil and her daughter Jung Yu-ra - with a value of 22 billion won (US$18.9 million) - in exchange for the National Pension’s approval of a Samsung C&T and Cheil Industries merger that was crucial for Lee’s acquisition of management authority in the group bears some similarities to the VimpelCom example. The individuals currently accused of bribery - Lee, Vice Chairman Choi Gee-sung, and president Jang Choong-gi - are all affiliated with Samsung Electronics. Overseas markets accounted for nearly 90% of Samsung Electronics’s 135 trillion won (US$115.8 billion) in sales for 2015; sales in the North American market amounted to 42.5 trillion won (US$36.4 billion), or 31.4% of that.

“I’ve been told that Samsung Electronics has been terrified for a while now about this incident dealing a damaging blow in the US market, which accounts for such a large portion of its business,” said an attorney with one major law firm.

Experts predicted the situation could also have a negative impact on Samsung‘s mergers and acquisitions with leading companies. Last year, Samsung decided to acquire the US company Harman for 9.4 trillion won (US$8.1 billion) as part of its expansion in the future growth industry of automotive electronics.

“The biggest reason for acquiring leading companies is to get the key human resources and technology needed to boost competitiveness,” explained a senior executive with one of South Korea’s top ten groups who has ample M&A experience.

“If a South Korean corporation acquiring a leading company is accused of offering bribes, there‘s a strong chance key workers at that leading company will leave ahead of time to avoid their own reputation being damaged and having difficulties finding other work in the future,” the executive added.

Doosan suffered embarrassment in the past after members of its ruling clan were punished for breach of trust and embezzlement during the 2007 acquisition of the US heavy equipment firm Bobcat.

“The Doosan CEO ended up visiting Bobcat’s head office in New York and meeting personally with around 300 staff and executives to give a sincere apology and promise fundamental reforms,” said an executive with one of South Korea‘s top five business groups.

“Samsung will also have to change to survive,” the executive said.

When asked about the possibility of charges according to the FPCA and losing key Harman workers, the Samsung Electronics public relations team said the company “is not subject to the US law and does not believe there will be any loss of Harman workers.”

By Kwack Jung-soo, business correspondent, and Lee Wan, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Has Korea, too, crossed the Rubicon on China? [Column] Has Korea, too, crossed the Rubicon on China?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/9317135153409185.jpg) [Column] Has Korea, too, crossed the Rubicon on China?

[Column] Has Korea, too, crossed the Rubicon on China?![[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/2317135166563519.jpg) [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2[Column] Has Korea, too, crossed the Rubicon on China?

- 3After 2 months of delayed, denied medical care, Koreans worry worst may be yet to come

- 4US overtakes China as Korea’s top export market, prompting trade sanction jitters

- 5[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes

- 6[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- 7Hong Se-hwa, voice for tolerance whose memoir of exile touched a chord, dies at 76

- 8Nearly 1 in 5 N. Korean defectors say they regret coming to S. Korea

- 9John Linton, descendant of US missionaries and naturalized Korean citizen, to lead PPP’s reform effo

- 10Strong dollar isn’t all that’s pushing won exchange rate into to 1,400 range