hankyoreh

Links to other country sites 다른 나라 사이트 링크

Hyundai Motor’s profits decline for fourth consecutive year

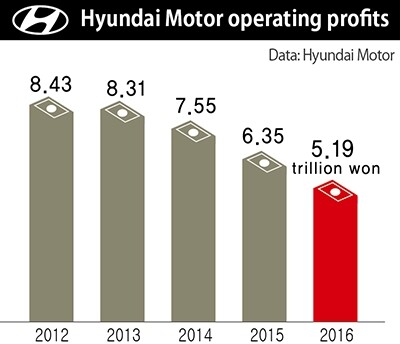

Hyundai Motor seems stuck in a swamp of sluggish performance, with its profitability in particular continuing to get worse. Company sales reached an all-time high last year, but its operating profits have been on the decline for four years in a row.

During a conference call on Jan. 25, Hyundai disclosed its performance for the fourth quarter of 2016. Its consolidated revenue (24.54 trillion won, US$21.20 billion) and operating profits (1.02 trillion won, US$881 million) were down 0.9% and 32.6%, respectively, from the same period in the previous year.

For its yearly performance, the company posted 93.65 trillion won in revenue and 5.19 trillion won (US$4.45 billion) in operating profit. The operating profit figure is 18.3% lower than the previous year, and this is the company’s worst showing since International Financial Reporting Standards (IFRS) became mandatory in 2010, when it had 5.92 trillion won in operating profits.

Hyundai’s yearly operating profit has been sliding for four years in a row, since it posted 8.44 trillion won in 2012. The company’s rate of operating profits was not much better: 5.5%, down 1.4 percentage points from 2015. Vehicle sales (4,857,933) were also down, 2.1% year on year. This is the first time that vehicle sales have fallen since the Asian financial crisis, 18 years ago.

But revenue was up 1.8% from the previous year, reaching the highest point in the company’s history. “Total revenue increased backed by higher revenue in the finance sector and by SUVs and luxury cars accounting for a greater share of sales,” Hyundai explained.

The poor performance is being attributed to sluggish domestic demand and a slowdown in emerging economies. The fact that fewer new cars were released had an impact as well. Sales were especially weak in South Korea, with domestic sales last year decreasing by 7.8%.

The problem is that the company is less profitable than it appears. Its rate of operating profits has been halved from the 10% range in 2011 to the 5% range last year. “As low-growth continues in the automobile market, competition between companies over sales promotions has intensified. Long-term production missteps have raised the cost of production, and sales have fallen because of the economic downturn in emerging markets,” said Hyundai Motor CFO Choi Byeong-cheol.

Hyundai predicted that uncertainty in the automobile industry would continue this year, influenced by spreading protectionism as the global low-growth trend continues. But Hyundai expects that its performance will be boosted by new models such as the Grandeur, released late last year, and by a small SUV to be released this year. Hyundai Motor’s sales target for the global market this year is 5.08 million vehicles, 4.6% higher than last year.

On Jan. 25, Hyundai decided to pay out dividends of 3,000 won (US$2.60) for each share of common stock. Combined with an interim dividend of 1,000 won per share paid in July 2016, this makes a dividend of 4,000 won per share. The dividends were worth 1.08 trillion won altogether. “In the mid- to long-term, we plan to align our dividend practices with the global industry average,” Choi said.

By Hong Dae-seon, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Does Yoon think the Korean public is wrong? [Editorial] Does Yoon think the Korean public is wrong?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/8517133419684774.jpg) [Editorial] Does Yoon think the Korean public is wrong?

[Editorial] Does Yoon think the Korean public is wrong?![[Editorial] As it bolsters its alliance with US, Japan must be accountable for past [Editorial] As it bolsters its alliance with US, Japan must be accountable for past](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/6817133413968321.jpg) [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

[Editorial] As it bolsters its alliance with US, Japan must be accountable for past- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

Most viewed articles

- 1‘Right direction’: After judgment day from voters, Yoon shrugs off calls for change

- 2[Editorial] Does Yoon think the Korean public is wrong?

- 3[Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- 4Where Sewol sank 10 years ago, a sea of tears as parents mourn lost children

- 5Japan officially says compensation of Korean forced laborers isn’t its responsibility

- 6Strong dollar isn’t all that’s pushing won exchange rate into to 1,400 range

- 7[Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- 8[Guest essay] How Korea turned its trainee doctors into monsters

- 9[News analysis] Watershed augmentation of US-Japan alliance to put Korea’s diplomacy to the test

- 10[Column] Brazil, Egypt and Korea