hankyoreh

Links to other country sites 다른 나라 사이트 링크

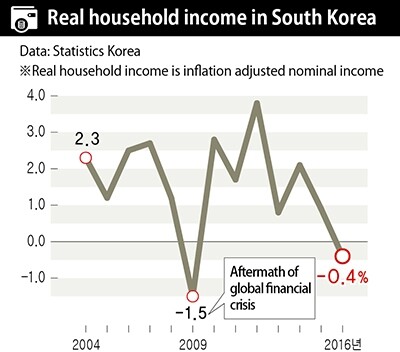

Real household income in South Korea falls for the first time since 2009

Real household income in South Korea has fallen for the first time since 2009 (in the aftermath of the global financial crisis), government figures show. Household consumer spending shrank last year, and the average propensity to consume, which reflects household spending, was at its worst point ever.

With the decrease in income concentrated among low wage earners, those who are in the worst financial position, the gap between the rich and poor is widening. Unless fundamental measures are taken to improve household income – by creating more good jobs and by raising the minimum wage – some say that it will be impossible to revive household finances, which have been devastated by household debt and collapsing income. This would inevitably exacerbate the problems facing the South Korean economy, such as the consumption cliff and the domestic downturn.

According to figures released by Statistics Korea on Feb. 24 about household trends during the fourth quarter of 2016 and over the whole year, the average household monthly income last year was 4,399,000 won (US$3,889), an increase of just 0.6% from the previous year. Real income, which accounts for inflation, was down 0.4%. This is the first time that real income has decreased since 2009 (-1.5%).

“Growth in employment has slowed because of the delay in the economic recovery and the beginning of restructuring in the shipbuilding industry. Such factors have weakened income from wages, which accounts for the greatest part of household income,” said an official with the Ministry of Strategy and Finance.

Households have started tightening their belts. With consumer sentiment taking a hit from a wavering income base and uncertainty at home and abroad, household consumer spending moved into decline last year both in the nominal and real categories. Households’ average monthly consumer spending was at 2.55 million won, down 0.5% year on year, marking the first time that nominal spending has decreased since the government started tracking the figure in 2003. Real consumer spending was also down 1.5%.

Households have cut their spending in most basic categories, from food to clothing. Spending was down in groceries (-1.3%), clothing and footwear (-2.4%), transportation (-4.3%), telecommunications (-2.5%), entertainment and culture (-0.2%) and education (-0.4%). Average propensity to consume, which means consumer spending as a percentage of disposable income, fell to 71.1%, the lowest point ever.

The pain is increasing most for households in the low-income bracket. The average monthly income for households in the first quintile decreased by 5.6% year on year to 1,447,000 million won (US$1,277), the biggest drop in history. Income also declined for the second quintile (from 20% to 40% of households) by 0.8%, down to 2,914,000 won. In contrast, income rose for high-income earners in the fifth quintile (the top 20% of households), up 2.1% to 8,348,000 won. Income in the fifth quintile was 4.48 times greater than the first quintile, higher than the previous year’s figure of 4.22, reflecting the widening wealth gap. This was the first time the multiple had increased since 2008, when it was at 4.98.

By Kim So-youn, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 4‘Weddingflation’ breaks the bank for Korean couples-to-be

- 5[Reportage] On US campuses, student risk arrest as they call for divestment from Israel

- 6[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 7Korea sees more deaths than births for 52nd consecutive month in February

- 8Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 9[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 10[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent