hankyoreh

Links to other country sites 다른 나라 사이트 링크

South Korea’s trade surplus with US dwindles alongside falling value added rate

South Korea’s trade surplus with the US has dwindled to one-fifth when calculated in terms of value added, while its export value added rate lags behind even China’s, an analysis shows.

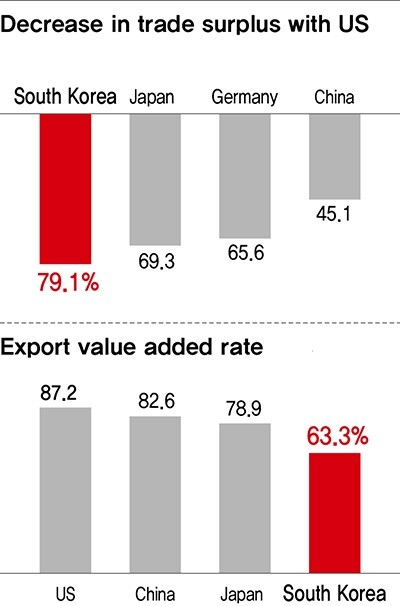

Published by the Korea International Trade Association (KITA) on Feb. 22, the report titled “South Korea’s Trade Strategy with the United States in Terms of the US Trade Structure and Its Implications” includes an analysis of the US’s 2014 trade deficit with South Korea in terms of value added. The findings showed the amount falling from US$34.5 billion (around 39.4 trillion won) to US$7.2 billion, for a decrease of 79.1%.

The drop was much sharper than those observed for other major trade partners of the US, including Japan (69.3%), Germany (65.6%), and China (45.1%), suggesting South Korea’s ability to generate value added with its trade has dropped off considerably relative to visible export values.

Because statistics tallying trade between countries in terms of simple totals result in transaction amounts for intermediate goods being counted multiple times, value added cannot be determined when raw materials, intermediate goods, and final goods are produced in different countries. KITA used a world industry linkage table to determine current practical conditions in value added generation. Its findings indicate that while trade balances calculated in terms of face value may appear impressive, they fail to live up to their billing in substance.

South Korea’s low value added export industry structure was also visible in other indicators. In 2014, its export value added rate was 63.3%, lower than levels not only for the US (87.2%) and Japan (78.9%) but also for China (82.6%).

The export value added rate represents value added generated from the exporting of finished products, divided by the export value of those goods.

“South Korea depends heavily on overseas sources to procure raw materials and intermediate goods, and much of its exports are for assembled and processed items such as electronics and machinery, which results in a relatively low value added rate,” KITA explained.

“South Korea has become increasingly dependent on imported intermediate goods with a relative decline in the percentage of domestic value added, whereas China has checked imports of intermediate goods and substituted them with its own domestic ones,” it added.

Analysis of the percentages of domestically produced and imported intermediate goods and domestic value added (in wages and other forms) in total gross domestic product (GDP) inputs for South Korea, the US, Japan, China, and Germany from 2004 to the present showed the US with the highest value added percentage at 56.1%, and both Japan and Germany with rates over 50%. South Korea and China, in contrast, had value added percentages below 40%.

Value added refers to value newly created in the different production stages of an item beyond its value in terms of raw materials and components. The sum total of value added is used to calculate GDP.

“Services inherent to the manufacturing industry are contributing greatly to generating export value added,” KITA said.

“Industry structure improvements to increase the value added rate in South Korea’s total production are urgently needed,” it added.

By Ko Na-mu and Kim Hyo-jin, staff reporters

Please direct questions or comments to [english@hani.co.kr]

trade surplus with US

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 2Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 3Thursday to mark start of resignations by senior doctors amid standoff with government

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 6[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 7N. Korean hackers breached 10 defense contractors in South for months, police say

- 8[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 9[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 10Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South