hankyoreh

Links to other country sites 다른 나라 사이트 링크

[News analysis] Trump’s rumblings on KORUS FTA a chance to address poisonous clauses

After Donald Trump mentioned the possibility of scrapping the South Korea-US Free Trade Agreement (KORUS FTA) and then signed an executive order on Apr. 29, the 100th day of his presidency, requiring all 20 of the US’s FTAs to be reviewed, there is looming uncertainty about the status of the KORUS FTA. There are indications that it’s inevitable that the agreement will be renegotiated. While trade experts argue that it’s still too early to assess the results of the agreement, which is now in its fifth year, they say that the South Korean government needs to shift from its defense of the agreement in its current form and to prepare to strip the poisonous clauses from the agreement before sitting down for negotiations.

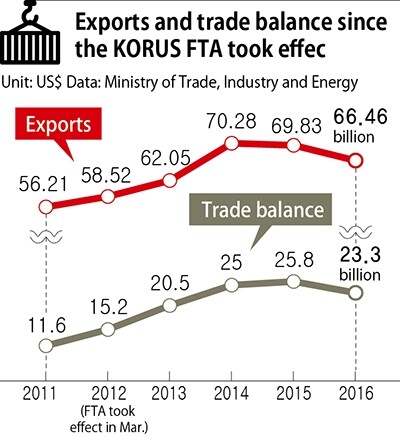

The trade balance between South Korea and the US on May 1 shows that the value of South Korean products exported to the US has increased by a yearly average of US$2.04 billion (3.4%) since the KORUS FTA took effect in Mar. 2012. In contrast, the value of American products imported to South Korea has decreased from US$44.5 billion in 2011 to US$43.2 billion in 2016, representing an average yearly decrease of 0.6% over the five years. South Korea‘s surplus in the goods balance with the US has approximately doubled during that time, from US$11.6 billion in 2011 to US $23.3 billion in 2016.

But the US’s deficit in the goods balance, which Trump has described as “awful,” cannot simply be blamed on the KORUS FTA. The US also has massive deficits, running in the tens of billions of dollars, with Japan, Germany and China - countries with which the US doesn’t have an FTA. While it’s true that South Korea‘s surplus in the goods balance has doubled over the past five years, a number of issues need to be taken into account. Three categories of products account for 40% of the US’s imports of South Korean products (which totaled US$72 billion in 2015) -- automobiles (US$18 billion), mobile phones (US$7.3 billion) and semiconductors (US$3.3 billion). But through the end of 2015, the US tariff on South Korean automobiles remained at 2.5%, the same as before the FTA took effect. Furthermore, there were no tariffs on semiconductors and mobile phones even before the FTA. This raises questions about whether the growth of this surplus can actually be attributed to the FTA. “The increase in exports to the US was led by automobiles, which are clearly unrelated to the FTA. The rest of the manufacturing industry suffered greater losses,” said Lee Jae-yeong, a professor of international relations at Hanshin University.

Tariffs will be completely rolled back on a substantial number of items, including automobiles, this year. In other words, this is the year that the FTA will really start to take effect. “We‘ll have to wait a little longer to see the FTA’s application and effectiveness, and the issue of the deficit in the trade balance, which the US is taking an interest in, probably can‘t be resolved by renegotiating the agreement,” said Kim Yeong-gwi, head of the regional trade agreements team at the Korea Institute for International Economic Policy.

Furthermore, South Korea’s shrinking imports of American products is not necessarily a good thing for the South Korean economy. Reducing imports of raw materials, parts and consumer goods can also cause a reduction of economic production and of benefits to consumers. Ultimately, it’s difficult to make a cost-benefit analysis based on short-term trends in the trade balance between two countries. The two countries’ interests become even more complicated when one considers not only the deficit in the service sector but also how the benefits enjoyed by chaebol exporters affect the South Korean economy.

Under these circumstances, the American demands are aimed not at cancelling the agreement but rather at gaining the upper hand in negotiations, analysts believe. “The remarks by Trump and US trade officials could have a number of goals - not bringing the agreement to an end so much as using that as leverage to pressure South Korean companies into increasing their investment in the US and to adjust the terms of the concessions in the favor of the US or to further open up the finance sector,” said Jeong In-gyo, an economics professor at Inha University.

The renegotiation of the KORUS FTA is expected to begin in the second half of next year, around the conclusion of the US renegotiation of the North American Free Trade Agreement (NAFTA), which will start this August. Trade experts are urging the South Korean government to plan a careful strategy rather than taking stopgap measures such as lowering its surplus in the trade balance with the US. “The US wants to change the overall framework and paradigm for free trade agreements. South Korea should follow suit by proactively taking issue with poisonous clauses connected with protecting local businesses and industries that have been harmed by liberalization,” said Choi Won-mok, a professor of law at Ewha Womans University.

“The Trump administration is likely to create a unified model during the renegotiation of NAFTA and present this to South Korea as well. In line with American efforts to save the traditional manufacturing sector, South Korea also needs to redefine the investor-state dispute settlement system and areas where it‘s at a disadvantage, including investing and services, from the perspective of economic democratization,” said Song Gi-ho, chair of the international trade committee for MINBYUN-Lawyers for a Democratic Society.

By Cho Kye-wan, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3‘Weddingflation’ breaks the bank for Korean couples-to-be

- 4Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 546% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 6[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 7“Parental care contracts” increasingly common in South Korea

- 8[Column] Yoon’s first 100 days should open our eyes to pitfalls of presidential system

- 9[Interview] Dear Korean men, It’s OK to admit you’re not always strong

- 10[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent