hankyoreh

Links to other country sites 다른 나라 사이트 링크

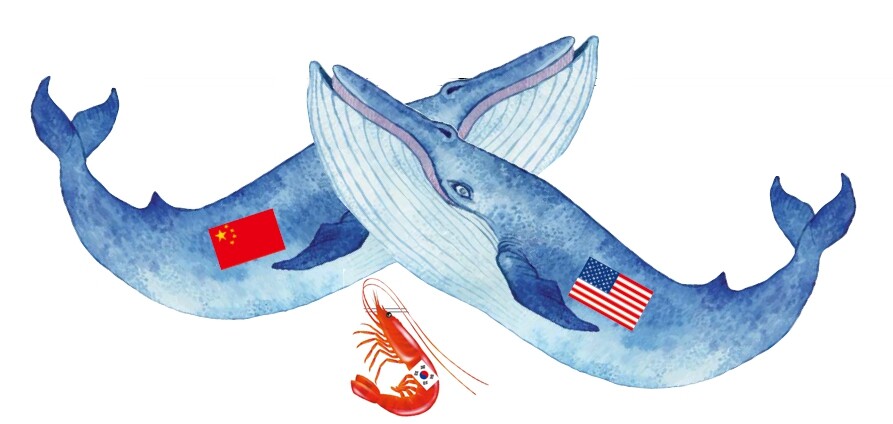

In US-China trade war, South Korea losing out

In 2009, US market imports for Chinese oil well casing steel pipes totaled some US$2.75 billion. That same year, the US International Trade Commission (ITC) launched a surprise antidumping investigation on Chinese steel. In May 2010, it instituted antidumping duties. Soon after the regulations took effect, Chinese steel exports to the US fell to almost zero. They have not recovered since.

Around the time China was being hit with an antidumping bomb, US imports of South Korean oil well casing steel pipes totaled just US$370 million. That number immediately skyrocketed, reaching US$1.34 billion by 2014. In September of that year, South Korean steel was also listed as being subject to US antidumping regulations. Last year, exports of South Korean oil well casings dropped to US$190 million.

A report titled “Response to US Import Regulations” published by the Korea International Trade Association (KITA) on Aug. 8 shared concerns that South Korea could end up the biggest victim in the trade battle between two major economic powers amid looming signs of trade retaliation, with the US Donald Trump administration threatening to involve the “Super 301” provision on Chinese imports.

With South Korea and China competing over the US market, more are more cases are falling into the same pattern as the oil well casing situation: China suffers antidumping measures first, leading to a rise in South Korean exports, which are then subjected to antidumping measures of their own.

“There has been an ongoing relationship of export competition between South Korean and Chinese products in the US market,” KITA explained.

“The repeating pattern is one in which South Korean companies meet demand after import regulations cause Chinese imports to fall sharply. As South Korean exports rise, South Korea ends up being targeted for regulations as well,” it said.

Indeed, of the 21 items for which South Korea is subject to antidumping regulations from the US, 14 are shared with China. Ten of them - all involving steel products - are cases where regulations were placed on South Korean items after or at the same time as regulations on Chinese items. It’s evidence of situation where South Korea and China, which have similar industry structures, are involved in an intense price competition for several items in the US market.

It also means that fallout from the US-China conflict has affected South Korean items as well. According to the KITA report, a June report by the US-based Peterson Institute for International Economics titled “Steel, Aluminum, Lumber, Solar: Trump's Stealth Trade Protection” estimated US$8.9 billion of US imports of South Korean products this year (US$69.9 billion as of 2016) as being in areas either under investigation or actually subject to import regulations such as antidumping measures or countervailing duties. The number amounts to around 12.2% of total imports of South Korean products in the US market - 12.4% if imports of South Korean washing machines, the subject of a safeguard investigation unexpectedly launched in June, are factored in.

In contrast, China predicted US$52.3 billion imports this year for items subject to import regulation measures, amounting to 10.9% of its total imports in the US market. Even though the US imported six times more Chinese products than South Korean products last year - US$462.8 billion to US$69.9 billion - the number of antidumping investigations launched since last year has been roughly the same: 16 for China and 12 for South Korea.

“The US is using every means at its disposal to increase trade restrictions on China, but it could be South Korea that ends up the biggest victim of that,” said KITA international trade cooperation department director Lee Mi-hyeon.

“South Korean businesses that rapidly increase their exports of certain products to China to earn short-term profits after Chinese products are hit with import regulations run the risk of being hit with the same import regulations and suffering greater losses,” Lee said.

“They need to strategically adjust their export volumes from a long-term perspective,” she advised.

By Cho Kye-wan, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2Why Kim Jong-un is scrapping the term ‘Day of the Sun’ and toning down fanfare for predecessors

- 3Two factors that’ll decide if Korea’s economy keeps on its upward trend

- 4BTS says it wants to continue to “speak out against anti-Asian hate”

- 5After election rout, Yoon’s left with 3 choices for dealing with the opposition

- 6Gangnam murderer says he killed “because women have always ignored me”

- 7South Korea officially an aged society just 17 years after becoming aging society

- 8AI is catching up with humans at a ‘shocking’ rate

- 9Ethnic Koreans in Japan's Utoro village wait for Seoul's help

- 1046% of cases of violence against women in Korea perpetrated by intimate partner, study finds