hankyoreh

Links to other country sites 다른 나라 사이트 링크

Labor cost ratio rises at South Korean firms

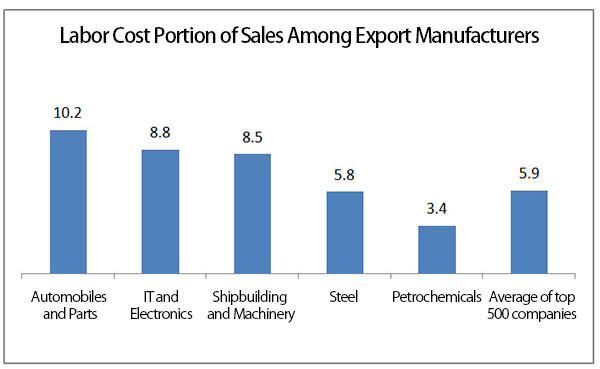

The ratio of labor costs to revenue at South Korea’s top 500 companies has reached 5.9%, a new analysis shows. According to figures accessed on Aug. 16 at CEO Score, a website that assesses companies’ business performance, labor costs (defined as total annual wages) at South Korea’s top 500 companies amounted to a total of 94.26 trillion (about US $94 billion) won last year, forming a ratio of 5.9% relative to those companies’ revenue of 1,607.65 trillion won (about US $1.6 trillion).

The labor cost ratio is 0.5 percentage points higher than it was in 2014, two years prior to the survey being conducted. Sales have declined 1.9% over the same period, while the number of workers and labor costs increased by 0.4% and 6.4%, respectively.

In South Korea’s five main export industries, the ratio of labor costs to sales was highest (10.2%) in automobiles and parts. The labor cost ratio at South Korea’s three major

automakers was 13.0%, more than twice the average across all companies.

Other industries in which the labor cost ratio exceeded the average were IT, electricity and electronics (8.8%) and shipbuilding, machines and equipment (8.5%). The labor cost ratio was below average in steel (5.8%) and petrochemicals (3.4%).

An analysis of 111 companies that belong to South Korea’s five main export industries found that the labor cost ratio was highest at LG Siltron, at 18.9%. Other companies where the ratio topped 15% were Nexen Tire (17.7%), Samsung SDI (17.1%), Samsung Electro-Mechanics (16.7%), Hanwha Techwin (15.6%), SL (15.5%) and the Hyundai Motor Company (15.2%).

In contrast, companies in the petrochemical industry had a labor cost ratio in the lower single digits. SK Energy, SK Global Chemical and Hyundai Oilbank had a ratio of 1.4%, while S-Oil was at 2.1% and Hanwha Total was at 2.2%.

Among the 111 companies, the labor cost ratio had increased at 84 companies (75.7% of the total) and decreased at 22 companies (19.8%). The ratio remained the same at the other five companies.

By Kwack Jung-soo, Business Correspondent

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 3‘Weddingflation’ breaks the bank for Korean couples-to-be

- 4Korea sees more deaths than births for 52nd consecutive month in February

- 546% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 6Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 7[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 8[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 9Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 10“Parental care contracts” increasingly common in South Korea