hankyoreh

Links to other country sites 다른 나라 사이트 링크

Trump targets automobile trade deficit in dispute over KORUS FTA

Automobiles are the point of contention chosen by US President Donald Trump as he threatens to withdraw from the South Korea-US Free Trade Agreement (known as the KORUS FTA). Even though German and Japanese vehicles have a much larger share of the US import car market, Trump seems set on attacking South Korean automobile exports because of the free trade agreement.

Statistics accessed on the website of the United States International Trade Commission (USITC) on Sept. 5 show that the import value and trade deficit in the US automobile sector vis-à-vis South Korea, Germany and Japan all increased to a similar degree between 2011 and 2016, around the time that the KORUS FTA took effect (on Mar. 15, 2012). Looking at passenger cars in particular, the import value of South Korean vehicles increased from US$8.6 billion in 2011 to US$16 billion in 2016.

Over the same period, the import value of Japanese cars increased from US$30 billion to US$39.2 billion, and the import value of German cars from US$19.6 billion to US$21.9 billion (US$26.6 billion in 2015). The total import value in the US passenger car market grew from US$123.1 billion to US$171.3 billion. The fact that the increase in import values in the American automobile market is a global phenomenon implies that South Korean automobiles did not receive any unusual benefit from the KORUS FTA.

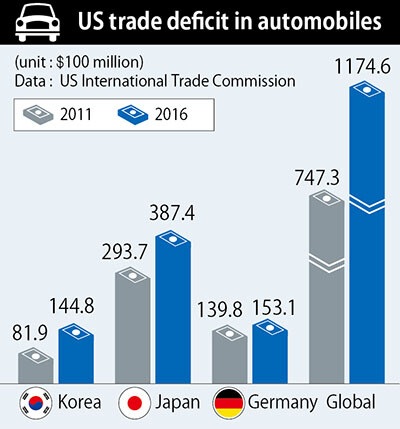

The increasing imports caused the trade deficit in the US automobile sector to grow. The US trade deficit with South Korea in the sector increased from US$8.1 billion in 2011 to US$14.4 billion in 2016. During the same period, the trade deficit in that sector with Japan and Germany increased as well, from US $29.3 billion to US $38.7 billion and from US $13.9 billion to US $15.3 billion (US $20.4 billion in 2015), respectively.

The Office of the US Trade Representative (USTR) emphasizes that the US had a deficit of US $24 billion with South Korea in the automobile category of commodity trade last year, which accounts for 90% of the yearly deficit (US $27.7 billion) in the goods balance with South Korea. But it’s also possible to argue that the US is the country benefiting from the FTA. The US’s rate of tariffs on importing South Korean cars fell to 0% (from 2.5%) in Jan. 2016 in line with the schedule of tariff concessions, but South Korea’s exports of automobiles to the US actually fell 7% year on year.

In contrast, American exported 60,000 automobiles to South Korea last year, up 356% since 2011, while South Korea’s import duties on American automobiles fell from 8% to 4% in 2012 and then down to 0% in Jan. 2016.

By Cho Kye-wan, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/8317138574257878.jpg) [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father![[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms? [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/3617138579390322.jpg) [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

Most viewed articles

- 1[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 2Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 3[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5Terry Anderson, AP reporter who informed world of massacre in Gwangju, dies at 76

- 6New AI-based translation tools make their way into everyday life in Korea

- 7[Column] The clock is ticking for Korea’s first lady

- 8Opposition calls Yoon’s chief of staff appointment a ‘slap in the face’

- 9[Editorial] Japan’s rewriting of history with Korea has gone too far

- 10Korean government’s compromise plan for medical reform swiftly rejected by doctors