hankyoreh

Links to other country sites 다른 나라 사이트 링크

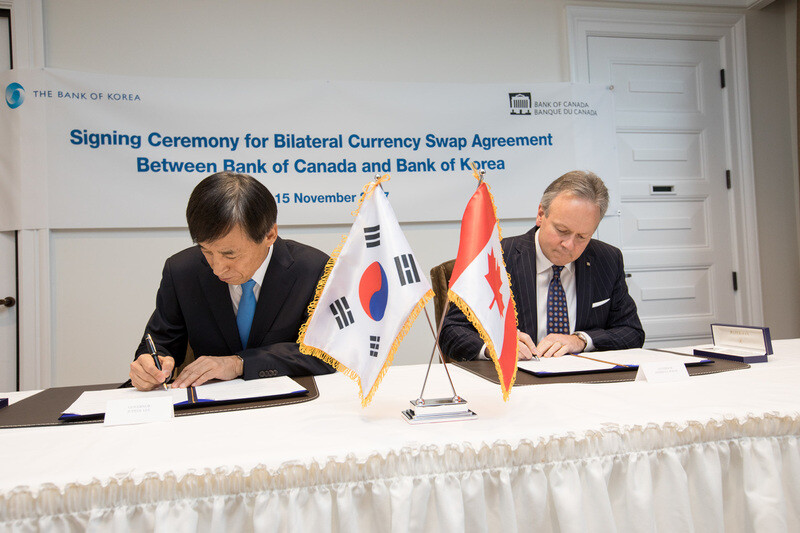

South Korea agrees to first-ever unlimited currency swap with Canada

South Korea has signed an agreement for an unlimited currency swap with Canada that includes no ceiling or end date. With the Canadian dollar effectively serving as a key currency, observers said the deal means Seoul has acquired a powerful safety value in the event of a foreign exchange crisis.

The Bank of Korea (BOK) announced on Nov. 15 that governor Lee Ju-yeol had visited the Bank of Canada in Ottawa to conclude the won-Canadian dollar swap deal with its governor Stephen Poloz. A currency swap is a credit agreement between central banks for the exchange of their respective currencies, which is designed to use foreign currency to ensure financial stability and a liquidity supply for financial institutions at home if a foreign exchange crisis occurs.

The swap deal is a permanent contract that does not specify a ceiling or end date in advance. The BOK explained that it was the “same format as the currency swaps among the six major key currencies (the US, Eurozone, Japan, the UK, Switzerland, and Canada), which are known to provide indefinite and unlimited support.”

“This is the first time South Korea has signed a currency swap like this,” it said.

The BOK described Canada as an “advanced economy with a stable economy and financial market that has earned the highest national credit rating,” and the Canadian dollar as “a major international currency that ranks sixth for foreign exchange transaction scale.” Canada’s currency swap deal with South Korea is its second with a country that does not account for one of the five key currencies, after China.

South Korea has reached currency swap deals totaling US$116.8 billion, including US$56.0 billion with China, US$10.0 billion with Indonesia, US$7.7 billion with Australia, US$4.7 billion with Malaysia, and US$3.84 billion with the Chiang Mai Initiative Multilateralization (CMIM), a multilateral financial safety net with China, Japan, and ASEAN members. It is also in talks with the United Arab Emirates (UAE) to extend a US$5.4 billion swap.

The BOK described the deal as “recognition of South Korea’s economic and financial stability and future development potential by a major advanced economy” and predicted it would have a “positive effect in boosting our credit rating.” It also predicted the deal would “contribute to promoting mutual economic and financial sector cooperation with Canada as a major trading partner.” Trade between South Korea and Canada amounted to US$8.83 billion last year (US$4.89 billion in exports and US$3.94 billion in imports), with a Free Trade Agreement (FTA) in effect since 2015. South Korea is Canada’s ninth biggest trade partner, while Canada is South Korea’s 21st.

“We had been having discussions for several months, and recently the pace picked up sharply and we saw results,” said Lee Ju-yeol.

“It amounts to a promise by Canada as a key currency nation to back South Korea up if its finances are in trouble, and because there is no end date, we do not need to have discussions on an extension every few years,” he explained.

“We’ve arranged a great safety valve [in the event of a foreign exchange crisis],” he said.

By Lee Soon-hyuk, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/8317138574257878.jpg) [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father![[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms? [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/3617138579390322.jpg) [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

Most viewed articles

- 1[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 2[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 3Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 4Terry Anderson, AP reporter who informed world of massacre in Gwangju, dies at 76

- 5[Column] The clock is ticking for Korea’s first lady

- 6[Editorial] Japan’s rewriting of history with Korea has gone too far

- 7Opposition calls Yoon’s chief of staff appointment a ‘slap in the face’

- 8Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 9[Column] The president’s questionable capacity for dialogue

- 10Video evidence surfaces showing Korean comfort women were massacred by Japanese military