hankyoreh

Links to other country sites 다른 나라 사이트 링크

Household debt named biggest challenge for South Korean economy

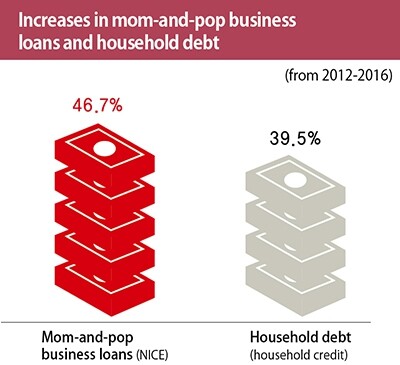

Finance and investment experts in South Korea and overseas named household debt and North Korea-related geopolitical risks as the biggest risks facing the South Korean economy in the second half of 2017. A system risk survey for the second half of 2017 released by the Bank of Korea (BOK) on Nov. 20 showed 87% of respondents citing household debt as a major risk factor for the South Korean financial system. North Korea-related geopolitical risks were named by 82%, normalization of overseas monetary policy (including an increase in the US Federal Reserve interest rate) by 75%, and real estate market reliability by 56%.

The system risk survey is a telephone study conducted by BOK twice a year since 2012 to determine risks to South Korea’s financial system as perceived by domestic and overseas financial experts. The survey for the second half of 2017 was conducted between Oct. 30 and Nov. 6 with eight South Korean investment officials for overseas financial institutions and 60 management strategy/risk department chiefs, stock/security/foreign exchange officials, and other financial market participants at South Korean financial institutions.

Household debt also ranked first when respondents were asked to name the single largest risk. It was cited by 35% of participants, followed by North Korea-related geopolitical risks (28%) and normalization of overseas monetary policy (24%). Household debt and North Korea-related issues were also frequently named as risks that stand to cause serious shocks, while normalization of overseas monetary policy was frequently named as a risk that was likely to actually occur.

When asked to predict when they were likely to occur, respondents tend to give a short time frame of one year for North Korea-related risks and monetary policy normalization, and a medium term of one to three years for household debt and real estate market uncertainty.

“The survey for the first half of the year also showed household debt (85%) and geopolitical risk (71%) as the biggest risks, but the number of responses naming those factors was higher in this survey,” BOK reported.

“Also, while increasing global protectionism (51%) and corporate restructuring in vulnerable industries (44%) were named as major risks in the survey for the first half of the year, neither was mentioned this time, and real estate market uncertainty emerged as a new major risk,” it added.

By Lee Soon-hyuk, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/8317138574257878.jpg) [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father![[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms? [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/3617138579390322.jpg) [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

Most viewed articles

- 1[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 2Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 3[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5Opposition calls Yoon’s chief of staff appointment a ‘slap in the face’

- 6New AI-based translation tools make their way into everyday life in Korea

- 7Terry Anderson, AP reporter who informed world of massacre in Gwangju, dies at 76

- 8[Column] The clock is ticking for Korea’s first lady

- 9Samsung barricades office as unionized workers strike for better conditions

- 10Korean government’s compromise plan for medical reform swiftly rejected by doctors