hankyoreh

Links to other country sites 다른 나라 사이트 링크

Value of Lee Kun-hee’s hidden Samsung Electronics shares surpasses $5 billion

“The borrowed-name accounts at issue for tax evasion under the special prosecutor were registered under a third-party name in the past to protect management rights and are now being converted to chairman Lee Kun-hee’s actual name. Mr. Lee has indicated that he wishes to find a way to use the money beneficially rather than for himself or his family once the unpaid taxes have been paid. In terms of the specific usage, we plan to develop something over time that is suited to the chairman’s aims.” – Then-Samsung Electronics vice chairman Lee Hak-soo, Apr. 22, 2008

Ten years have passed since the Samsung Group promised to “give back to society” assets found by a special prosecutor to have been concealed under borrowed names. During that time, the value of Samsung Electronics shares – which accounted for the bulk of the assets – has multiplied to an estimated 6 trillion won (US$5.6 billion).

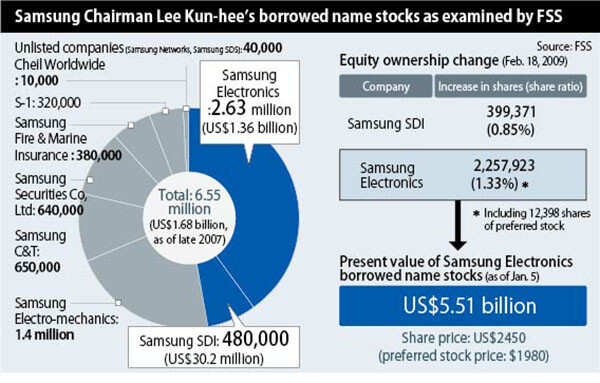

According a Financial Supervisory Service (FSS) report to the National Assembly on Jan. 7 from its review of Lee Kun-hee’s borrowed-name accounts, Lee held 2.1646 trillion won (US$2.03 billion) in 1,229 borrowed-name accounts as of late 2007, including 291.8 billion won (US$274.3 million) in deposits, 1.7829 trillion won (US$1.68 billion) in stocks, and 89.9 billion won (US$84.5 million) in bonds.

The number differed from the 4.5 trillion won (US$4.2 billion) in borrowed-name assets found for Lee by the Samsung special prosecutor in 2008 – a difference stemming from roughly 2.3 trillion won (US$2.2 billion) in Samsung Life stocks possessed by Lee as real borrowed-name shares. The latest FSS inspection uncovered additional borrowed-name stocks for Lee at three Samsung affiliates, as well as the number of stocks for each affiliate.

In terms of amount, Lee possessed a total of 6.55 million shares in Samsung Electronics and seven other listed companies, as well as two non-listed companies. Specifically, this included 2.63 million shares in Samsung Electronics; 380,000 in Samsung Fire & Marine Insurance; 1.4 million in Samsung Electro-Mechanics; 640,000 in Samsung Securities; 650,000 in C&T; 480,000 in Samsung SDI; 320,000 in S-1; and 10,000 in Cheil Worldwide. Lee also owned 40,000 shares in non-listed Samsung Networks and Samsung SDS. The value at the time stood at 1.7829 trillion won (US$1.68 billion).

These stocks were the subject of then-Samsung Electronics vice president Hak-soo’s 2008 promise to “give back to society.” A simple calculation places their current value at well over 6 trillion won.

With no recapitalization or other important management changes in the intervening years, the 2.63 million Samsung Electronics shares alone would have a current value far above 6 trillion won, with a closing price of 2,606,000 won (US$2,450) as of Jan. 5. The value of the Samsung Electro-Mechanics, Samsung Fire, and other stocks is also estimated at over 100 billion won (US$94 million).

It remains unclear whether the real-name conversion pledged by Lee actually happened. Among the shares to be “given back,” Lee was only confirmed to have converted to his real name in the Samsung Electronics and SDI cases. A Samsung Electronics report on changes in the majority shareholder and other stock ownership from Feb. 18, 2009, showed Lee obtaining an additional 2,245,525 common stocks and 12,398 preferred stocks.

The reason for the change was the real name adoption, with Lee’s stock ownership rising from 1.86% to 3.38%. The shares in question are still owned by Lee, with a value of 5.878 trillion won (US$5.53 billion). In the Samsung SDI case, Lee was announced the same day as having acquired an additional 399,371 shares (0.85%) for the same reason; that October, he was reported as selling all of them for over 57.1 billion won (US$53.7 million). Respective reductions of 470,000 and 80,000 shares from the borrowed-name assets in the reported numbers are also believed to be the result of their liquidation.

Article 83 of the listing regulations for the stock market states that changes in the majority shareholder’s stake must be reported without delay. In 2008, Lee withdrew the bulk of his borrowed-name account stocks, deposits, and bonds – a total of 1.9787 trillion won (US$1.86 billion). The increase from 2007 appears to reflect changing stock values. Lee is believed to have violated the regulations by reporting only belatedly in Feb. 2009. No information is available on the fate of the shares in Samsung Electro-Mechanics, Samsung Fire, or other affiliates.

No word has emerged either on Lee’s pledge to give back to society. At a National Assembly hearing in Dec. 2016, Samsung Electronics vice president Lee Jae-yong said he would “need to discuss it with my mother and siblings,” but promised to “spend [the money] on really good things when the time comes for us to make a decision.” A Samsung Electronics source reported “no progress” since Lee stated his intentions during the hearing.

“Samsung needs to honor its pledge and quickly give back to society in terms of [the assets’] current value,” said accountant Kim Gyeong-yul, who heads the steering committee for the group People’s Solidarity for Participatory Democracy.

By Choi Hyun-joon, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 2Thursday to mark start of resignations by senior doctors amid standoff with government

- 3[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 4Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 5Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 6[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 7Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South

- 8[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 9N. Korean hackers breached 10 defense contractors in South for months, police say

- 10[Column] Yoon’s first 100 days should open our eyes to pitfalls of presidential system