hankyoreh

Links to other country sites 다른 나라 사이트 링크

South Korean companies scramble to gain reliable supplies of cobalt

As the price of cobalt skyrockets, major South Korean companies such as LG Chem and SK Innovation are scrambling to gain a supply of this key ingredient for electric car batteries. Since the metal has become marked as a “conflict mineral” because of the prevalence of child labor in Congo, which accounts for more than half of its global supply, battery producers are looking to secure more stable supply channels.

On Apr. 11, LG Chem announced that it had inked a contract with China’s Huayou Cobalt to set up joint ventures to produce chemical precursors and cathodes. Huayou Cobalt is the global leader in its industry, refining 20,000 tons of cobalt that were imported from Congo in 2017. The company is a member of the Responsible Cobalt Initiative (RCI), which was launched in 2016 to jointly tackle problems in the cobalt supply chain. One of the goals of the initiative is extirpating child labor.

Through 2020, LG will be investing 239.4 billion won (US$220.3 million) in establishing and operating one company to manufacture precursors and another to manufacture cathodes, both as joint ventures with Huayou Cobalt. Chemical precursors, which are upstream from cathode production, are made from a combination of cobalt, nickel and manganese. These precursors are then combined with lithium to make cathodes, which are a material needed for batteries.

According to the agreement, LG Chem will receive cobalt and other raw materials from Huayou Cobalt and will also have priority for receiving precursors and cathodes produced by the joint ventures. This joint venture creates a stable supply chain linking Huayou Cobalt (raw materials), the joint venture (precursors and cathodes) and LG Chem (batteries).

SK Innovation has also taken strides to secure a supply of cobalt. In February, it signed a long-term purchasing contract for cobalt sulfate and nickel sulfate with Australian Mines, a producer of raw materials for batteries. The basic contract lasts for seven years and can be extended for six more. The deal also gives SK Innovation exclusive negotiating rights for future equity investment. Until its Australian supply kicks in, SK Innovation will be receiving smelted cobalt from Chinese and Australian companies that import it from Congo. Since SK Innovation is not yet part of the RCI, it is unable to confirm whether this cobalt contains conflict minerals.

Samsung SDI is also exploring various ways to acquire a stable supply of cobalt. “We are working on long-term supply deals with companies that possess the metal and are pursuing R&D to reduce the percentage of cobalt that we use,” a company spokesperson said.

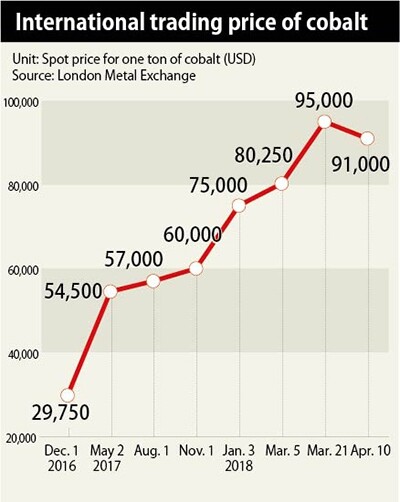

The race to secure a supply of cobalt is closely linked to the extreme volatility of cobalt prices in recent years. According to the Financial Times, Congo’s production of cobalt increased by 15% in 2017, while prices more than tripled. Even this year, the metal’s price on the London Metal Exchange shot up from US$75,000 per ton on Jan. 3 to US$95,000 per ton on Mar. 21. For this reason, electric car battery manufacturers agree that the sharp increase in the prices of key materials is creating a supply crisis, which is driving conglomerates to stake everything on securing a stable supply of these materials through joint investment ventures overseas and purchasing contracts.

By Cho Kye-wan, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 3[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5Thursday to mark start of resignations by senior doctors amid standoff with government

- 6N. Korean hackers breached 10 defense contractors in South for months, police say

- 7[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 8[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 9Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South

- 10[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent