hankyoreh

Links to other country sites 다른 나라 사이트 링크

Samsung and Facebook offer cautionary tales for companies who lose public trust

Both Samsung Securities and Facebook are facing their most severe crises since being established. Samsung Securities is currently suffering fallout from the worst dividend payment mistake in history, while Facebook is dealing with the aftershocks of leaking user information to Cambridge Analytica. Despite the similarities, there are some differences between the two companies’ crises, which represent a lack of confidence not only by stockholders but by consumers as a whole.

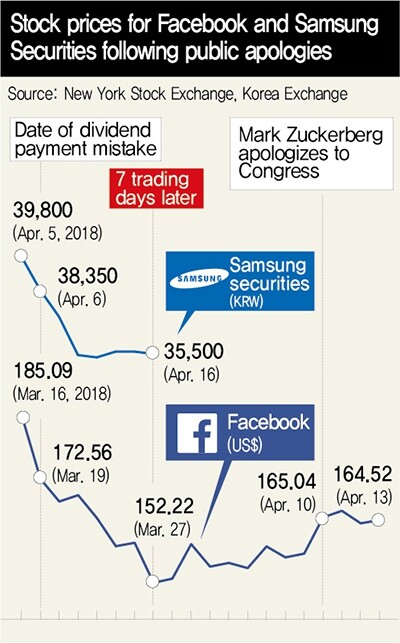

The rate of decline of stock prices at Samsung Securities on Apr. 16 during the seven trading days after the dividend mistake occurred on Apr. 6 was 10.8%. During the seven trading days after Mar. 19, when Wall Street got word that data about Facebook members had been provided to Donald Trump’s campaign during the 2016 presidential election, Facebook’s stock dropped by 17.8%.

The market’s distrust of Facebook led to an exodus of socially responsible mutual funds, which take environmental, social and governance (ESG) factors into account in their investments. One exchange-traded fund (ETF) that invests in companies with sustainable business models dropped Facebook, which accounts for a 3.9% percentage of its holdings, from its transfer list. Nordea, the largest bank in Northern Europe, decided to suspend purchases of Facebook stock in its sustainable investment portfolio.

Last year, Samsung Securities was given a mediocre B+ among five possible grades by the Korea Corporate Governance Service (KCGS) last year, and its transfer ratio at socially responsible mutual funds in South Korea is likely to be based on this year’s assessment. Since the dividend mistake occurred, South Korea’s national pension fund, which has a 12% share in Samsung Securities, and other pension funds have dumped nearly 2 million shares on the market.

Facebook is now the target of class action lawsuits being filed by victims, which 18 such lawsuits filed as of Apr. 4, Bloomberg reported. Lawsuits filed at a federal court in San Francisco and other courts demand damages caused by Facebook’s leaking of private information, deception of consumers and ill-gotten gains. These lawsuits are open to investors who purchased stock in Facebook between Feb. 2017, when the company submitted its yearly performance report, and Mar. 19, when the leaked information came to light.

Samsung Securities is currently in the process of compensating investors who suffered losses through selling and repurchasing shares on the day of the dividend mistake. As of Apr. 13, it was estimated that 361 individual investors had suffered losses, and over 40 of them had been fully compensated.

Even though the two companies are facing similar crises, some subtle differences can be detected. In regard to Facebook, Bank of America Merrill Lynch has continued to downgrade its investment forecast, lowering its target stock price for the company on two occasions. This has led some on Wall Street to see this as a chance to buy Facebook stock. Facebook’s users represent 30% of the global population, and along with Google it controls a majority of the American advertising market (58.5%), suggesting that there is no alternative to the company.

Meanwhile, domestic securities firms have only released two reports providing a brief overview of Samsung Securities’ mistake. This contrasts with overseas-based Morgan Stanley, which set Samsung Securities’ target stock price at 32,000 won (US$30) and advised people to reduce their holdings in the company. Samsung Securities is relatively small in the corporate finance sector, ranking fourth among domestic securities firms in market capitalization, after Mirae Asset Daewoo.

Zuckerberg’s public apology partially restored investor confidence

The two companies are also distinguished by who stepped forward to apologize to the public. After Facebook founder and CEO Mark Zuckerberg attended a congressional hearing on Apr. 10, Facebook’s stock rallied by 4.5%. “Investors’ anxiety was partially relieved by the company founder’s apology at the hearing,” said Yu Dong-won, an analyst for Kiwoom Securities.

On Mar. 25, eight days after reports appeared about the leak, Zuckerberg ran a full-page apology in major newspapers, promising to make sure that this kind of “breach of trust… doesn’t happen again.”

Samsung Securities ran its own apology in newspapers on Apr. 16, ten days after the accident, but this apology was only signed by the company’s chairman, executives and staff. Though Samsung Vice Chairman Lee Jae-yong does not own any stock in Samsung Securities, he is regarded as being a major stockholder through his control of Samsung Life Insurance.

“This seems to be a time when action should be taken by the group as a whole to dispel rumors about the liquidation of Samsung Securities,” said a source at one asset management company.

By Han Gwang-deok, finance correspondent

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 3N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 4Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 5Korea sees more deaths than births for 52nd consecutive month in February

- 6[Reportage] On US campuses, student risk arrest as they call for divestment from Israel

- 7[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 8‘Weddingflation’ breaks the bank for Korean couples-to-be

- 9Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 10[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare