hankyoreh

Links to other country sites 다른 나라 사이트 링크

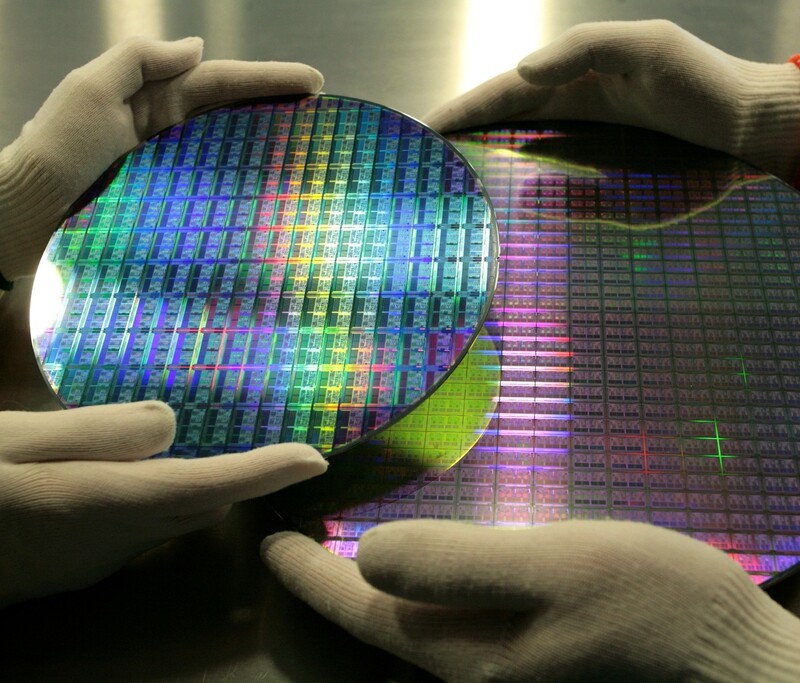

Experts warn of South Korea’s semiconductor boom

South Korea’s semiconductor boom is a bubble, and the current supply shortage is set to become a glut once Chinese companies finish building their own semiconductor plants in the second half of 2018, experts are warning.

The warning is draw attention for going a step farther than previous arguments that the semiconductor boom has resulted in an “optical illusion” giving the impression that the South Korean economy is performing strongly as a whole.

“The current semiconductor boom is a bubble,” declared Hana Institute of Finance research fellow Lee Ju-wan while speaking at a June 20 seminar on “Ideas on Boosting Semiconductor Industry Competitiveness for Innovative Growth” organized by the Korea Economic Research Institute (KERI) at FKI Tower in Seoul’s Yeouido neighborhood.

“While semiconductor exports did rise by 57 percent last year, DRAM exports in terms of volumes reflecting actual demand were down 1.4 percent, and the overall growth rate with memory capacity converted into bit units was a long way from any kind of boom,” he said.

Lee continued: “This boom is fueled by an undersupply, and there’s no telling when it will come to an end. The memory semiconductor production facilities that will be completed by Chinese companies in the second half of this year will be enough by themselves to convert the undersupply to an oversupply that will be further exacerbated by South Korean companies’ expansion of production in 2019 and early 2020.” He also predicted that China’s share of the semiconductor market would rise above 18 percent by 2025, when the Chinese government completes its facility investment.

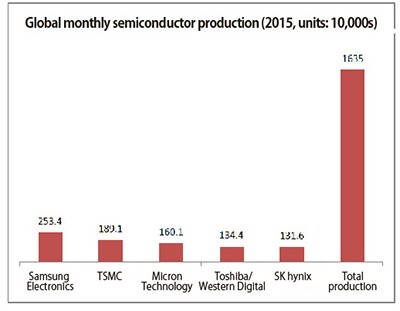

“The semiconductor industry is getting tangible results – it is South Korea’s top-ranked domestic export product; South Korea has the second biggest market share in the global semiconductor market; and the industry supports 165,000 jobs. But this is limited to the memory semiconductor sector, which is dominated by large conglomerates. More than 70 percent of the global semiconductor market consists of system semiconductors, but South Korean ‘fabless’ companies – which specialize in development and design without actually producing any semiconductors themselves – control less than 1 percent of the global market,” said Song Yong-ho, a professor at Hanyang University.

“The domestic semiconductor equipment industry’s share of the global market was just 3.5 percent in 2016, and it was highly dependent on foreign companies for key parts because of a lack of original technology. We don’t have enough government support for R&D and the training for researchers that would be necessary to energize the system semiconductor sector,” Song added.

“The development of new technologies such as artificial intelligence and the Internet of Things that are part of the Fourth Industrial Revolution requires advanced semiconductor performance, which brings with it new opportunities. Artificial intelligence in particular will create new demand throughout the entire sector of information technology – spanning the production, transmission, storage and application of information – and will become an engine for new growth in the semiconductor market,” Song said.

By Kwack Jung-soo, business correspondent

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Does Yoon think the Korean public is wrong? [Editorial] Does Yoon think the Korean public is wrong?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/8517133419684774.jpg) [Editorial] Does Yoon think the Korean public is wrong?

[Editorial] Does Yoon think the Korean public is wrong?![[Editorial] As it bolsters its alliance with US, Japan must be accountable for past [Editorial] As it bolsters its alliance with US, Japan must be accountable for past](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/6817133413968321.jpg) [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

[Editorial] As it bolsters its alliance with US, Japan must be accountable for past- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Samsung barricades office as unionized workers strike for better conditions

- 3[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes

- 4[News analysis] After elections, prosecutorial reform will likely make legislative agenda

- 5Why Israel isn’t hitting Iran with immediate retaliation

- 6S. Korea, Japan reaffirm commitment to strengthening trilateral ties with US

- 7[Editorial] Does Yoon think the Korean public is wrong?

- 8[Guest essay] How Korea turned its trainee doctors into monsters

- 9[Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- 10Strong dollar isn’t all that’s pushing won exchange rate into to 1,400 range