hankyoreh

Links to other country sites 다른 나라 사이트 링크

South Korea would suffer serious damage in US-China trade war, analysts say

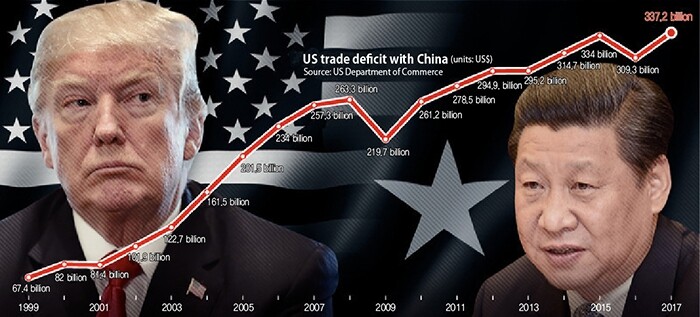

South Korea’s highly export-dependent economy would suffer serious damage in the event of a trade war between the US and China upsetting the global trade order, analysts are predicting.

As of last year, China accounted for 25 percent of South Korea’s trade. Under the circumstances, a blow to the Chinese economy from intensifying trade conflicts with the US would inevitably have an impact on South Korean businesses involved in exports. With the US applying sweeping import regulations in areas including steel and automobiles, the loss of trade with China would usher things from bad to worse for related South Korean industries.

“Our exports are very China-dependent, and because of the large amount of exports in capital goods and intermediate goods, the effects of South Korea from US sanctions against China would be big,” predicted Cho Chul, deputy director of the Korea Institute for International Economic and Trade (KIET) Chinese industry research division.

The Hyundai Research Institute (HRI) estimated South Korean exports to China would fall by US$28.26 billion (31.5 trillion won) with a 10 percent decline in US imports from China. With US President Donald Trump’s “trade war” not only targeting China, the potential impacts are difficult to predict. The Korea International Trade Association (KITA) estimated that if the US-China trade war expands to the European Union (EU) and elsewhere – leading to an average 10 percentage point increase in tariffs for those areas – the result would be a 6 percent decline in global trade volumes and a 6.4 percent decline (US$36.7 billion) in South Korean exports. With current talk of even higher tariff rates – and with the US and China rumbling at each other about possible “additional retaliation” – the damage could end up even bigger.

Experts call for closer attention to an intermediate and long-term strategy

Some analysts also suggested that while the US-China trade war is not an issue that will be resolved over the short term, the losses South Korea stands to suffer could be smaller than anticipated. Last year, China relied on the US for 18 percent of its exports. The US measures apply to 10 percent of items exported to the US, and only around 2 percent of all Chinese exports. In that sense, the short-term decrease in South Korean exports would amount to less than US$200 million, analysts suggested. At the same time, they cautioned that financial market jitters could prove a bigger issue. On July 5, the exchange rate on the Seoul foreign exchange market stood at 1,118.6 won to the dollar, up by 4.1 won from the day before. The KOSPI finished the day at 2257.55, down by 7.91 points (0.35 percent) from the previous trading day.

The US-China trade war has led to a trend of simultaneous decline in the South Korean stock market and the value of the won. The KOSPI’s 2257.55 close on July 5 represented a fall of 7.7 percent from its April level. The value of the won has also fallen by 5.2 percent in the past three months. In the past month, it has dropped more in value than the yuan used in China, one of the parties in the “war.”

Stock markets in Japan, Taiwan, and elsewhere in Asia have fallen by over 3 percent in the past month. Experts attributed the particularly severe blow to the South Korean and other Asian financial markets to the countries’ high level of dependence on exports to China and the US. Last year, China accounted for 24.8 percent of South Korean exports and the US for 11.9 percent, with the combined total of 36.7 percent ranking third highest after Taiwan and Japan. Intermediate goods account for 78.9 percent of South Korea’s exports to China, placing it second after Taiwan (79.9 percent).

With signs pointing to the trade war dragging out into the long term, experts called for closer attention to an intermediate and long-term strategy rather than the immediate damage.

“If Made in China 2025 [a strategic plan for fostering key industries] is put off, it will mean that much more new opportunity for South Korean businesses, and we will also need to respond to the opening of Chinese markets,” said Yang Pyeong-seob, director of the Korea Institute for International Economic Policy (KIEP) Centre for Regional Economic Studies.

“Businesses expanding into China need to look at this as an opportunity to pursue export market diversification, not just Chinese domestic demand,” Yang suggested.

By Hong Dae-seon, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Has Korea, too, crossed the Rubicon on China? [Column] Has Korea, too, crossed the Rubicon on China?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/9317135153409185.jpg) [Column] Has Korea, too, crossed the Rubicon on China?

[Column] Has Korea, too, crossed the Rubicon on China?![[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/2317135166563519.jpg) [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Hong Se-hwa, voice for tolerance whose memoir of exile touched a chord, dies at 76

- 3[Column] Has Korea, too, crossed the Rubicon on China?

- 4After 2 months of delayed, denied medical care, Koreans worry worst may be yet to come

- 5[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- 6All eyes on Xiaomi after it pulls off EV that Apple couldn’t

- 7[Photo] Smile ambassador, you’re on camera

- 8US overtakes China as Korea’s top export market, prompting trade sanction jitters

- 9S. Korea “monitoring developments” after report of secret Chinese police station in Seoul

- 1075% of younger S. Koreans want to leave country