hankyoreh

Links to other country sites 다른 나라 사이트 링크

Convenience store owners express frustration at practices of franchise headquarters

A backlash is growing among convenience store owners and other franchisers after a decision to raise the minimum wage to 8,350 won (US$7.40) an hour next year, up 10.9 percent from its 2018 level. Notably, the anger has tended to be directed less at the minimum wage hike per se than toward unfair transaction practices by franchise headquarters. In an increasing number of cases, the issue has moved beyond a “battle among the little guys” to take aim at major corporations and franchise headquarters.

On July 16, the National Convenience Store Franchise Association held a press conference at its headquarters in Seoul’s Bomun neighborhood to issue a list of demands, including adjusted minimum wages for workplaces with under five employees, reduced franchising fees, a halt to the opening of new convenience stores within 250 meters of existing ones, and lower credit card processing fees.

“The conflict will only grow again if we can’t come up with basic institutional reforms and alternatives on the minimum wage decision,” they warned.

The association’s members include the owners of 4,000 to 5,000 convenience stores throughout South Korea, including CU, GS25, and 7-Eleven stores. The group also backed off from its previous warning of “solidarity closures.”

“We don’t want infighting among the victims here,” they said, adding that they would “consider [the measure] carefully.”

The calls that day for lower franchising fees and halting the opening of nearby stores represent new demands from the convenience store owners. According to industry sources, convenience stores pay franchising fees averaging 30–35 percent of sales to headquarters. This is one of the burdens the owners want to see reduced.

“We can’t take issue with the minimum wage hike alone without a discussion on the appropriateness of the other costs,” said Ahn Jin-geol, director of the People’s Economy Research Institute.

“Even after the administration’s adjustment of its tempo with the minimum wage hike it failed to honor its pledge for a 10,000-won (US$8.87) minimum wage by 2020. We’re seeing a battle between the “little guys” represented by the store owners and the “downtrodden” represented by their part-time employees,” Ahn noted.

Indiscriminate expansion by corporate headquartersAnother threat to the franchise operators is a strategy of indiscriminate expansion by the convenience stores’ corporate-led headquarters.

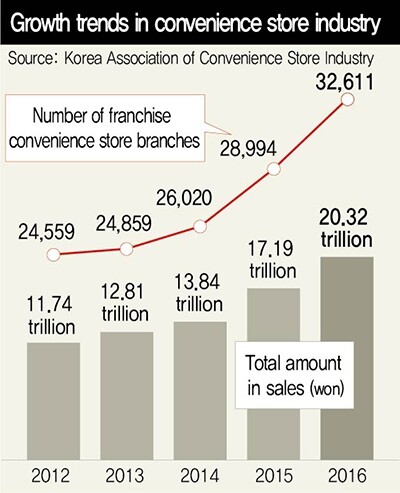

Convenience stores have proliferated at a fast rate, with some complaining about a “store across from every home.” Between 2010 and 2016, the number of convenience stores nearly doubled from 17,000 to 32,600. Recent estimates suggest the number may have already passed 40,000. Japan – which has been nicknamed the “convenience store kingdom” and has a substantially higher population than South Korea – has 56,000.

Credit card and franchising feesConversely, the ratio of population to convenience stores fell from 2,983 in 2010 to 1,585 in 2016. This naturally leads to fiercer competition and a decline in individual stores’ profits. The average credit card processing fee of 2.3 percent for convenience stores is also higher than the 0.7 percent for large supermarkets.

At the July 16 press conference, the National Convenience Store Franchise Association – a group created by operators for Paris Baguette, Tous Les Jours, Bonjuk, Sulbing, and other franchises – insisted that it was “not right to portray things as though the franchisers’ problems are all due to the minimum wage.”

Jeong Jong-yeol, who heads the group’s policy bureau, said, “While it is true that owners have been struggling due to the minimum wage hike, franchising fees are another big source of their pain.”

“South Korea’s franchisers pay some 2.5 trillion won (US$2.2 billion) in franchising fees to their head office. The head offices need to work to give part of that back to the store owners,” Jeong said.

In a statement, the association noted, “Credit card processing fees have been reduced by just 0.2 percent, and there has been no reduction at all in franchising fees or rents.”

“We urge the ruling class not to encourage fighting among the weaker members of society or turn them into outlaws for the sake of their own bottom line,” it added.

In particular, the statement called for “allowing franchiser groups to directly negotiate credit card processing fees, minimizing the scope of ‘essential items’ for franchises to prohibit the improper foisting of items, and strengthening commercial renter protection, including an extension of commercial rental renewal demand rights to ten years from their current five.”

Of South Korea’s six million self-employed business owners, around 1.6 million employ at least one other worker. The remaining 4.4 million are not directly impacted by the minimum wage hike. For this reason, observers have claimed that the arguments about all self-employed business owners going bust because of the higher minimum wage are an exaggeration. Among the convenience store owners themselves, the issues of franchising fees, real estate costs, and credit card processing fees have been mentioned as more pressing concerns than the minimum wage.

“If the franchising fees to the head office were lowered by just one percent, I could afford to pay a part-time worker an average of 200,000 won [US$177] more a month,” said one convenience store owner.

Responses from convenience store headquartersSince last year, convenience store companies have come out with measures for “shared benefits” to support franchises, including support for electricity charges, minimum income guarantees, and cost of living support. But none of them has yet announced a reduction in franchising fees.

“The demand to lower franchising fees on top of everything else is impossible to agree to when the operating profit ratio falls in the range of just 3–4 percent,” said a source with the head office of one major convenience store.

Another industry source said, “Around one-third of operating profits are already being used as funding for ‘shared benefits,’ which has the same practical effect as a franchising fee reduction.”

An official with the Korea Association of Convenience Store Industry, an interest group for convenience store companies, said the issue of franchising fees “is based on individual contracts between the company and owners, which is not an area the association can really intervene in.”

By Lee Jung-gook, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Has Korea, too, crossed the Rubicon on China? [Column] Has Korea, too, crossed the Rubicon on China?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/9317135153409185.jpg) [Column] Has Korea, too, crossed the Rubicon on China?

[Column] Has Korea, too, crossed the Rubicon on China?![[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0419/2317135166563519.jpg) [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Samsung barricades office as unionized workers strike for better conditions

- 3After 2 months of delayed, denied medical care, Koreans worry worst may be yet to come

- 4[Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- 5[Column] Has Korea, too, crossed the Rubicon on China?

- 6Hong Se-hwa, voice for tolerance whose memoir of exile touched a chord, dies at 76

- 7[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes

- 8Constitutional Court rules to disband left-wing Unified Progressive Party

- 9Nearly 1 in 5 N. Korean defectors say they regret coming to S. Korea

- 10‘Right direction’: After judgment day from voters, Yoon shrugs off calls for change