hankyoreh

Links to other country sites 다른 나라 사이트 링크

South Korea and Russia to conduct joint study for natural gas pipeline running through N. Korea

Technical preparations are underway for a joint study by South Korea and Russia aimed at reviewing the economic feasibility of a plan to lay a natural gas pipeline that would run through North Korea, connecting Russia and South Korea. If this huge project is actually carried out, it would create an “energy artery” linking South and North Korea. Since the trilateral cooperation on natural gas resources potentially represents the triple boon of economic benefits, peace on the Korean Peninsula and co-prosperity of South and North Korea, eyes are fixed on when South Korea and Russia will initiate their joint study.

On Oct. 24, the Korea Gas Corporation (KOGAS) announced that it had undertaken the technical preparations that are one of the preliminary phases for a joint study between South Korea and Russia on piped natural gas (PNG) for a trilateral natural gas project in which natural gas extracted from gas wells in Siberia and the Russian Far East would be supplied through overland pipes in North Korea to South Korea. “The PNG joint research is unconnected to sanctions on North Korea, and we are carrying out technical preparations for creating future conditions without violating the sanctions,” KOGAS said.

During a summit between South Korean President Moon Jae-in and the leader of Russia in June, the two leaders agreed to move forward with a joint gas study aimed at trilateral cooperation with North Korea. They also agreed that KOGAS and Russian state-owned gas company Gazprom would conduct joint research into the economic feasibility and technical aspects of laying a pipeline. Recently, the two gas companies have held a number of working-level deliberations aimed at launching the joint study.

The plan to run a pipeline through North Korea to pipe Siberian natural gas into South Korea has been periodically discussed both in the private sector and in the government since the 1990s, but it was effectively scuttled by a number of volatile factors, such as North Korea’s nuclear program.

A report reviewing a 2010 joint study by South Korea and Russia stated that an annual 7.5 million tons of natural gas produced by Siberian gas wells would be supplied to South Korea through an overland pipeline. In regard to the length of the pipeline, Samjong KPMG estimated in 2015 at the request of KOGAS that the shortest route (running from the North Korea-Russian border through Wonsan, Cheolwon, Paju and Incheon to Pyeongtaek) would be 1,202km long. If the pipeline ran through Pyongyang and Kaesong, in consideration of North Korea’s potential demand for natural gas, the length would extend to 1,505km. Though North Korea uses hardly any natural gas at present, it’s highly likely to add natural gas to its energy supply moving forward.

Negotiations with North Korea, geological survey and US approval required for study

Naturally, there are limitations to what can be achieved through joint research by South Korea and Russia alone, and they’ll have to enter negotiations with North Korea. It will also be necessary to carry out a geological survey for the route of the pipeline in North Korea, as well as to review its price competitiveness if the gas had to be liquefied and shipped in the event of an unexpected incident.

“Before a South Korean and Russian joint research project can take the form of a ‘due diligence’ in which researchers enter North Korea directly and investigate the conditions for an overland pipeline, they would have to deliberate with North Korea as well as gain approval from the US [for the due diligence]. If there is no due diligence in North Korean territory, the research could also consist of South Korea and Russia preparing and sharing the latest data about long-term demand for natural gas [in South Korea] and supply capability [in Russia],” said Lee Seong-gyu, head of the northern energy cooperation team at the Korea Energy Economics Institute.

Estimation of transshipment fees to North Korea

KOGAS is also estimating the transshipment fees. Considering the gas transit tariff contracts that Gazprom has made with Ukraine and Slovakia, it’s estimated that South Korea would pay North Korea US$2 for every 100km that 1,000m3 of natural gas is transported (assuming a usage-based fee), in which case the annual gas transit tariff would amount to about 180.4 billion won (US$158.7 million).

“There are no international agreements or universal standards pertaining to overland pipelines, and transshipment fee agreements are typically negotiated and confidential,” KOGAS noted. North Korea could also be compensated for the gas transit in kind instead of cash and use the natural gas it receives domestically.

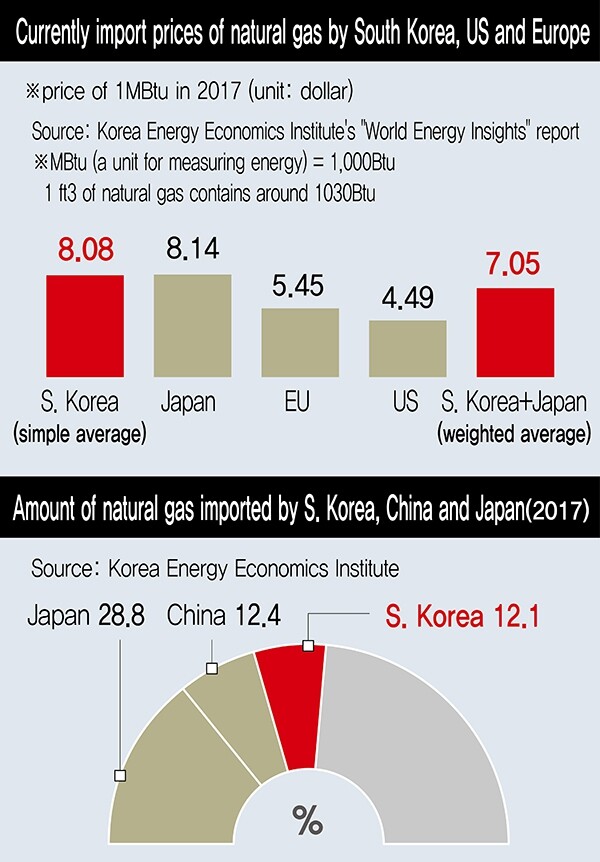

For South Korea, the government’s policy of converting to environmentally friendly energy is one of the reasons for moving forward with this joint research project. KOGAS expects that this project would not only secure a stable supply of natural gas but also help lower the price of LNG. The price of LNG in Japan, China and South Korea, which are the world’s three biggest importers of natural gas, is nearly twice that of prices in the US (US$4.49) and European markets because of contracts that are linked to international crude oil prices and because of unfavorable conditions that are called the “Asian premium.”

In 2017, the average price of LNG in South Korea was US$8.08 per 1MBtu. Currently, KOGAS is importing natural gas that is produced in wells in countries such as Qatar and Australia and then liquefied for transport by ship, but with a pipeline, the natural gas could be transported in its original gaseous state. This is also expected to greatly reduce the current price set in negotiations with LNG suppliers.

By Cho Kye-wan, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Does Yoon think the Korean public is wrong? [Editorial] Does Yoon think the Korean public is wrong?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/8517133419684774.jpg) [Editorial] Does Yoon think the Korean public is wrong?

[Editorial] Does Yoon think the Korean public is wrong?![[Editorial] As it bolsters its alliance with US, Japan must be accountable for past [Editorial] As it bolsters its alliance with US, Japan must be accountable for past](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/6817133413968321.jpg) [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

[Editorial] As it bolsters its alliance with US, Japan must be accountable for past- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes

- 3[Guest essay] How Korea turned its trainee doctors into monsters

- 4[Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- 5S. Korea, Japan reaffirm commitment to strengthening trilateral ties with US

- 6Korea, Japan jointly vow response to FX volatility as currencies tumble

- 7Gangnam murderer says he killed “because women have always ignored me”

- 8Japan officially says compensation of Korean forced laborers isn’t its responsibility

- 9[News analysis] After elections, prosecutorial reform will likely make legislative agenda

- 10‘Right direction’: After judgment day from voters, Yoon shrugs off calls for change