hankyoreh

Links to other country sites 다른 나라 사이트 링크

Chaebols account for 0.2% of S. Korean companies but 41% of operating profits

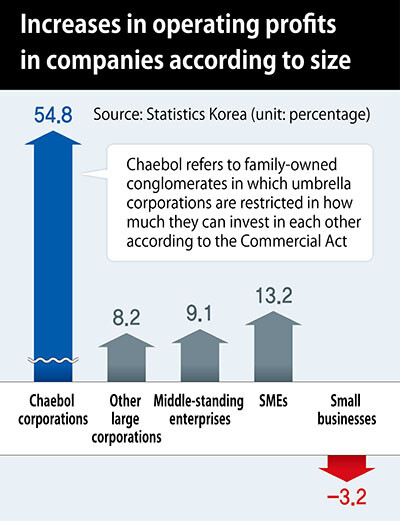

Chaebol businesses accounted for just 0.2% of South Korea’s companies but 41% of company operating profits last year, statistics show. With much of the growth coming in the low-job creation area of semiconductors, employment at chaebol businesses has in fact declined. Experts said the pathway by which unbalanced growth focused on semiconductors leads to jobless growth has become even more pronounced this year.

On Dec. 6, Statistics Korea published provisional findings from administrative statistics on for-profit corporations in 2017. Its results showed the 666,163 for-profit corporations examined representing 290.631 trillion won (US$260.0 billion) in operating profits last year, up 23.5% from 235.244 trillion won (US$210.4 billion) the year before. The increase was the largest since related statistics were first compiled in 2010. Sales also increased by 7.7% from 2016 to reach 4.76 quadrillion won (US$4.3 trillion), their highest level since 2011.

For the study, Statistics Korea used administrative data on value-added taxes, business registration, and social insurance for for-profit corporations subject to corporate taxes. It assigned companies by scale according to assets and sales for their industry, while separating large corporations into business groups subject to cross-investment restrictions (chaebol businesses) and other corporations.

Semiconductor industry accounts for most of chaebol operating profits

Overall company management performance was found to have improved last year – thanks to a large increase in operating profits for chaebol businesses, particularly in semiconductors. Operating profits for chaebol businesses totaled 118.63 trillion won (US$106.1 billion), a rise of fully 54.8% from the year before. The percentage of corporation operating profits represented by chaebol businesses was also up sharply to 40.8%, an increase of 32.6% from 2016.

“The sharp rise in operating profits for the semiconductor sector accounts for the majority of the increase in chaebol business operating profits,” Statistics Korea explained. Operating profits for chaebol manufacturing companies rose by 71.8% between 2016 and 2017. In terms of manufacturing businesses, corporations (chaebol and other) in the area of “electronics, computers, video, sound, and communications equipment” – which includes semiconductors – accounted for 57.7% of operating profits, or more than half. In contrast, operating profits fell substantially even for chaebol businesses in the area of hospitality and restaurants (-44.9%), which suffered a blow last year with a decline in Chinese tourism.

The growth for semiconductors and other chaebol businesses last year did not translate into increased employment. The total of 1,403,000 workers employed at chaebol businesses in 2017 was down 0.1% from 2016. The rate stood in contrast with modest rises in employment for other large corporations (6.9%), moderately large-sized businesses (0.4%), medium-sized businesses (3.3%), and small businesses (2.4%). Statistics Korea interpreted this as the “result of last year’s growth being driven mainly by the semiconductor industry, which generates few jobs, and restructuring by large shipbuilding companies with strong employment capacity, which resulted in them reducing their numbers of workers.”

Joblessness could become long-term problem

In its own report on the economic outlook for the second half of 2017, KDI warned last year that the South Korean economy “is very likely to sustain this form of unbalanced growth reliant on semiconductor exports, which means that the delay in improvements for employment could extend into the long term.”

Experts said the imbalance in growth has also influenced the drop-off in employment that has manifested this year.

“While exports have remained at a certain level, particularly in the area of semiconductors, the automobile and service industries – which has large job creation effects – have been hit with a serious slump this year, further exacerbating the decrease in jobs by the slump in the shipbuilding industry. The ripple effects have extended not just to chaebol businesses but also to SMEs,” said Ju Won, director of the economic research office at the Hyundai Research Institute.

“We’re at a moment where lagging core industries desperately need to recover their competitiveness to help us out of a serious employment slump,” Ju said.

By Bang Jun-ho, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/8317138574257878.jpg) [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father![[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms? [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/3617138579390322.jpg) [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

Most viewed articles

- 1[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 2Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 3[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5Terry Anderson, AP reporter who informed world of massacre in Gwangju, dies at 76

- 6New AI-based translation tools make their way into everyday life in Korea

- 7[Column] The clock is ticking for Korea’s first lady

- 8Opposition calls Yoon’s chief of staff appointment a ‘slap in the face’

- 9[Editorial] Japan’s rewriting of history with Korea has gone too far

- 10Korean government’s compromise plan for medical reform swiftly rejected by doctors