hankyoreh

Links to other country sites 다른 나라 사이트 링크

[News analysis] World’s top 2 shipbuilders’ merger signals reorganization of Korean shipbuilding industry

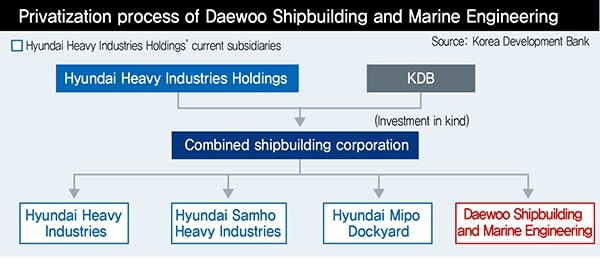

A surprise move by the Hyundai Heavy Industries Group (HHIG) to begin procedures for the de facto acquisition of Daewoo Shipbuilding & Marine Engineering (DSME) signals a shift toward a “big two” system for the South Korean shipbuilding industry. Observers are seeing the new system with one giant and one moderate heavyweight as potentially laying the groundwork for the industry to make a major comeback.

The global shipping industry was surprised on Jan. 31 at the news of the surprise merger between the world’s top two-ranked companies for total shipping orders and building capacity. Management and unions alike were seen moving with urgency at Korea Development Bank (KDB), Hyundai Heavy Industries and Construction, and DSME. The merger of the two companies appears likely to improve profitability by raising shipping order prices and reducing the number of low-cost orders resulting from oversupply and cutthroat competition in the global shipping market to date.

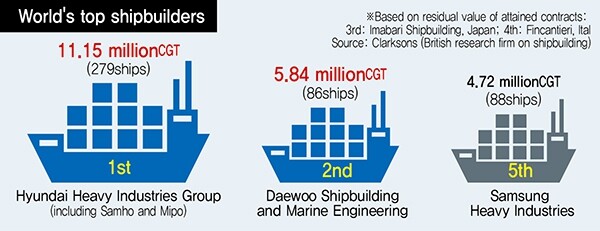

The British shipping market analysis provider Clarksons calculated total HHIG shipbuilding orders (including those for Hyundai Samho Heavy Industries and Hyundai Mipo Dockyard) at 11,1450,000 compensated gross tons, or CGT, (equivalent to 279 ships) as of Dec. 2018, with a shipbuilding capacity of 7,632,000 CGT (16 docks). In both production capacity and total orders, it remains in solid first place globally. DSME ranks second worldwide with 5,844,000 CGT (86 ships) in total orders and 3,095,000 CGT (six docks) in shipbuilding capacity. Samsung Heavy Industries had 4,723,000 CGT (88 ships) in orders and 2,9720,00 CGT (eight docks) in capacity, ranking it fifth behind Japan’s Imabari Shipbuilding in third and Italy’s Ficantieri in fourth.

Last year, South Korea accounted for 12,630,000 out of 28,600,000 CGT in global shipping orders (44%), reclaiming the world number one ranking seven years after losing it to China in 2011.

All three of South Korea’s shipbuilding companies have generally similar order volumes and types of ships, and none can be seen as holding particular technological advantages for the production of specific varieties such as LNG carriers, VLCCs and other oil tankers, and other container ships. Some analysts are suggesting that the merger may not produce much a complementary synergy effect, as the two companies are effectively interchangeable from a shipbuilding customer’s perspective.

Potential to reduce overheated global competition

But the general view among observers is that their merger could yield effects in bringing up order prices by reducing the overheated heated global market competition that has been named as a factor in reducing shipbuilding industry profitability. For the past three to four years, global shipbuilding has been a buyers’ market – resulting in historic lows in the prices for new vessels of every kind. But with a revival for the global industry since last year supplying growing bargaining power to the shipbuilding companies as customers, a merger between the two companies could put them in a better position to leverage their dominance of the market into higher order prices.

Another advantage is the removal of inefficiencies including waste and overlap in their building capabilities and production facilities.

“The three shipbuilding companies have LNG carrier building capabilities totaling around 50 vessels per year, while global orders are around 60 vessels. If a joint venture reduces total capacity to 30, the price of orders will go up,” predicted an industry source.

“The focus of attention is on which types of ships the joint venture will be targeting,” the source added.

DSME currently has a relatively larger volume of orders, but the low prices over the past two to three years have raised questions about their profitability. Some of the DSME volumes could go toward making up for the steep drop-off in work for HHIG. This means both sides could resolve some of their profitability and work drought issues by boosting productivity together through economies of scale and reduced production costs.

Another factor behind KDB’s surprise privatization push is the trade dispute that has emerged amid Japan’s claims that the loans and guarantees to DSME from policy finance organizations is in violation of a WTO agreement banning subsidies. With the emergence of a globally top-ranked shipbuilding giant, the monopoly question could emerge as a matter in need of resolution. A merger between the two companies would give them a market share of nearly 50%. They would need to undergo merger reviews not only by South Korea’s Fair Trade Commission (FTC) but also by other competition authorities in Europe and elsewhere.

“KDB has already given this area ample consideration,” HHIG said, adding that the bank “must have reached the conclusion that there would be no issues with passing the reviews.”

The Hyundai Heavy Industries labor union said on Jan. 31 that the situation was “in pandemonium after the sudden news of this merger.” The DSME union urged a “unilateral halt to the sale,” expressing “opposition to a sale to company in the same [shipping] industry” and calling for “guarantees on participation by stakeholders [unions].”

KDB president Lee Dong-gull explained, “The two companies are not merging per se, but are becoming affiliates of equal standing within a shipbuilding holding company, so there will be no ‘unavoidable’ artificial restructuring.”

By Cho Kye-wan, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] When ‘fairness’ means hate and violence [Column] When ‘fairness’ means hate and violence](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0516/7417158465908824.jpg) [Column] When ‘fairness’ means hate and violence

[Column] When ‘fairness’ means hate and violence![[Editorial] Yoon must stop abusing authority to shield himself from investigation [Editorial] Yoon must stop abusing authority to shield himself from investigation](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0516/4417158464854198.jpg) [Editorial] Yoon must stop abusing authority to shield himself from investigation

[Editorial] Yoon must stop abusing authority to shield himself from investigation- [Column] US troop withdrawal from Korea could be the Acheson Line all over

- [Column] How to win back readers who’ve turned to YouTube for news

- [Column] Welcome to the president’s pity party

- [Editorial] Korea must respond firmly to Japan’s attempt to usurp Line

- [Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

- [Column] Will Seoul’s ties with Moscow really recover on their own?

- [Column] Samsung’s ‘lost decade’ and Lee Jae-yong’s mismatched chopsticks

- [Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’

Most viewed articles

- 1China calls US tariffs ‘madness,’ warns of full-on trade conflict

- 2[Column] When ‘fairness’ means hate and violence

- 3[Column] US troop withdrawal from Korea could be the Acheson Line all over

- 4Could Korea’s Naver lose control of Line to Japan?

- 5[Editorial] Yoon must stop abusing authority to shield himself from investigation

- 6Naver’s union calls for action from government over possible Japanese buyout of Line

- 7[Column] Welcome to the president’s pity party

- 8[Column] How to win back readers who’ve turned to YouTube for news

- 9DongA Ilbo and the government are told to apologize for past civil rights violations

- 10S. Korea’s spy agency ramping up national security investigations to keep itself relevant, critics s