hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korean companies engage in investment race in electric car battery industry targeting European market

An intense investment competition has taken shape among three South Korean battery companies – with the direct motivation behind the increased investment lying in predictions of electric car market growth in Europe.

Some analysts are calling the move an inevitable choice to assume dominance and avoid falling behind Chinese companies like global battery market heavyweight CATL, as well as a bold investment to establish a new next-generation growth driver to follow semiconductors. But others are cautiously predicting the companies could get burned playing a “chicken race.”

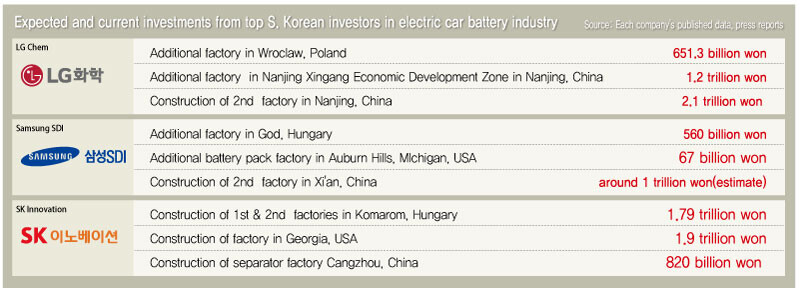

LG Chem announced on Mar. 7 that it planned to issue one trillion won (US$882.9 million) in corporate bonds. The initial plan was to issue 500 billion won (US$441.45 million), but the amount was expanded when a Mar. 5 demand projection for institutional investors showed some 2.64 trillion won (US$2.33 billion) pouring in. The company said it plans to use the funds procured through the bonds to expand its electric car battery production capabilities. LG Chem has been investing aggressively, with plans to increase its battery production capabilities from their current 35GWh to 100–110GWh by 2020. The company is targeting Europe and China in particular.

Kim Jong-hyeon, president and head of LG Chem’s battery project division, recently announced plans to “expand European production capabilities to 70Gwh within the next two to three years.” LG Chem also signed an investment contract worth 1.2 trillion won (US$1.06 billion) in January with the Chinese city of Nanjing. In the fourth quarter of 2018, its large-sized battery project division finished in the black for the first time.

Samsung SDI and SK Innovation have also been moving quickly. At a board meeting last December, Samsung SDI decided to invest an addition 500 billion won (US$441.45 million) in an electric car battery factory built in Hungary at a cost of 400 billion won (US$353.11 million). According to reports in the foreign press, it is also expanding a battery pack factory in Michigan that it invested 67 billion won (US$59.14 million) in last November and building two electric car battery factories in the Chinese city of Xi’an with an investment of over one trillion won (US$882.9 million).

SK Innovation is leading with its battery project, investing with an aggressiveness that belies its “late starter” label. On the heels of its 1.9 trillion won (US$1.68 billion) investment in an electric car battery factory in the US state of Georgia, it announced plans on Feb. 27 to invest 950 billion won (US$838.9 million) in building a second plant in Hungary.

Many observers are predicting the global electric car battery market could turn into a “winners take all” environment with a select handful of victors in a wide-ranging competition with a flood of small-scale Chinese companies. The reason the three South Korean battery producers are paying close attention to recent reports that China’s CATL, the world’s top-ranked battery manufacturer, plans to expand the scale of its Thuringia factory in Germany to 100GWh from its current 14GW is their prediction that those who fall behind will end up losing out.

“The futures of the different battery companies are going to depend on what happens with the European electric vehicle market over the next two to three years,” said one industry official.

“While it does appear clear that demand will rise for now, the only way to reduce the risk associated with major investment is to a good job with predicting the market over the intermediate and long term, establishing relationships with electric car manufacturers, and conduct business in a stable manner over the process from orders to delivery and the associated track record,” the official added.

By Choi Ha-yan, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/8317138574257878.jpg) [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father![[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms? [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/3617138579390322.jpg) [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

Most viewed articles

- 1[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 2Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 3Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 4[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 5Opposition calls Yoon’s chief of staff appointment a ‘slap in the face’

- 6[Column] The clock is ticking for Korea’s first lady

- 7Terry Anderson, AP reporter who informed world of massacre in Gwangju, dies at 76

- 8New AI-based translation tools make their way into everyday life in Korea

- 9Samsung barricades office as unionized workers strike for better conditions

- 10Korea ranks among 10 countries going backward on coal power, report shows