hankyoreh

Links to other country sites 다른 나라 사이트 링크

[News analysis] Samsung’s prolonged delay in switching to non-memory semiconductors

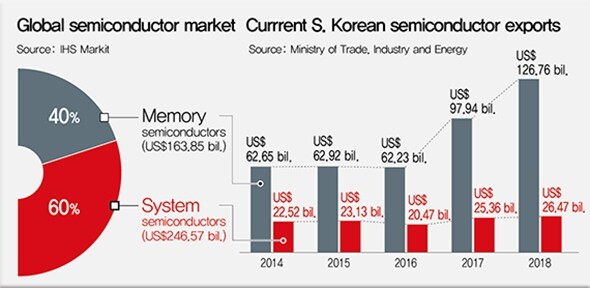

This isn’t the first time that Samsung Electronics has talked about a transition to system semiconductors. For the past 15 years, since 2005, it has faced public pressure to rectify its overreliance on memory semiconductors, and it even launched a foundry project that very year. But the bulk of its investing capacity continued to be concentrated on memory semiconductors, with system semiconductors left on the back burner.

“Intel, which is the leading producer of system semiconductors, produced memory semiconductors through the 1980s. But it abandoned its memory division after concluding that the two processes couldn’t coexist. But Samsung Electronics has been so dependent on a predictable supply curve for semiconductors that it has put off a bold decision, even though other companies were fully capable of following in its footsteps,” said Choe Hyeong-seop, a professor at the Seoul National University of Science and Technology.

Over the past 10 years, every time that Samsung’s semiconductor business has taken a downturn, the company compensated for sluggish performance there by posting more than 10 trillion won (US$8.59 billion) a year in its smartphone business and highlighting its satisfactory performance even in home appliances, which brought in around 1 trillion won (US$858.92 million) a year. But after the global market in smartphones became saturated in the 2010s and the phone replacement cycle grew longer, the company was no longer able to rely solely on smartphone performance. Even the cloud market, which created an unusual demand for memory semiconductors last year, failed to contribute to sales this year.

The prevailing view is that Samsung Electronics’ decision to attempt its long-delayed transition to non-memory semiconductors this year was made possible by the equipment it acquired last year. The equipment for the extreme ultraviolet (EUV) process, which operates on a 5-nanometer and 7-nanometer scale, requires a massive investment, each unit costing more than 200 billion won (US$171.78 million). That’s why system semiconductors only received 2-3 trillion won (US$1.71-2.58 billion), or 5 trillion won (US$4.29 billion) at the most, of the 10 trillion won (US$8.59 billion) that Samsung Electronics invested each year in semiconductors. But when memory semiconductors performed strongly in 2017 and 2018, the company boosted its semiconductor investment to 20 trillion won (US$17.18 billion), and the amount invested in system semiconductors went up accordingly.

“Although Samsung Electronics hasn’t provided a concrete breakdown of its latest investments, it has prioritized memory semiconductors in its investment, with most of the money going to build memory semiconductor factories until recently. Meaningful investment in system semiconductors and foundries appears to have taken place in the past two years,” said Ahn Gi-hyeon, a senior executive at the Korea Semiconductor Industry Association.

With South Korea’s semiconductor ecosystem focused on memory semiconductors, system semiconductor designers in the country have had little to do, and many have gone overseas.

“Memory semiconductors are based on capital, but non-memory semiconductors require the talents of creative designers. Given the domestic market’s concentration on the memory business, the fact is that we have a lot of workers trained for memory processes, but not enough designers,” said Lee Jeong-don, a professor of industrial engineering at Seoul National University and special economic and scientific advisor for the Blue House.

Another criticism is that Samsung Electronics was trying to inflate its investments by announcing the amount it will invest over 10 years, even though the amount invested on a yearly basis remains largely the same. This is the first time the company had announced a medium- to long-term vision since “Vision 2020,” which Samsung Electronics Chairman Lee Kun-hee unveiled after receiving a personal pardon from then president Lee Myung-bak in 2009. Ironically enough, Vice Chairman Lee Jae-yong abruptly unveiled “Vision 2030” shortly before the Supreme Court was set to announce its verdict in his own trial involving embezzlement accusations. If the 133 trillion won (US$114.26 billion) that Samsung Electronics announced it will invest over a decade is broken down into one-year increments, it works out to 13 trillion won (US$11.17 billion) a year. That’s not much different from the 10-20 trillion won (US$8.59-17.18 billion) that the company has invested in semiconductors every year over the past decade.

By Shin Da-eun, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0507/7217150679227807.jpg) [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war![[Column] The state is back — but is it in business? [Column] The state is back — but is it in business?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0506/8217149564092725.jpg) [Column] The state is back — but is it in business?

[Column] The state is back — but is it in business?- [Column] Life on our Trisolaris

- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

Most viewed articles

- 1Behind-the-times gender change regulations leave trans Koreans in the lurch

- 2Yoon’s revival of civil affairs senior secretary criticized as shield against judicial scrutiny

- 3South Korean ambassador attends Putin’s inauguration as US and others boycott

- 4Family that exposed military cover-up of loved one’s death reflect on Marine’s death

- 5Hybe-Ador dispute shines light on pervasive issues behind K-pop’s tidy facade

- 6[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

- 7[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- 8‘Weddingflation’ breaks the bank for Korean couples-to-be

- 9Yoon’s broken-compass diplomacy is steering Korea into serving US, Japanese interests

- 10U.S. band that performed in N. Korea looking forward to going back