hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea on alert after China announces countermeasures against US sanctions against Huawei

South Korean companies signaled a cautious mood after the Chinese government announced plans to avoid imports of items “contrary to national security” in response to US measures against the company Huawei.

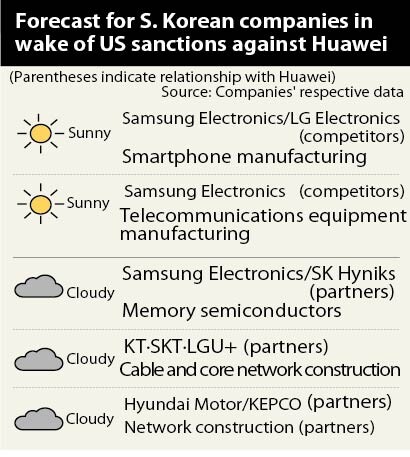

According to accounts from industry sources on May 27, the Cyberspace Administration of China (CAC), which oversees all internet information management for the country, announced a new regulation plan for “internet safety review methods” through its homepage on May 24. The plan indicated that “national security” considerations would be taken into account when importing components for key information technology infrastructure. It amounts to a declaration that China will not be purchasing US products either – essentially making official a suspension of transactions between the two sides. While dark clouds loom on the horizon for parts suppliers, smartphone makers are poised to reap the rewards of increased demand to replace Huawei devices.

To begin with, the action could spell trouble for Samsung Electronics and LG Innotek, which sell camera modules to Huawei; Samsung Display, which supplies it with screen panels; and Samsung Electronics and SK Hynix, which sell it memory semiconductors. Huawei’s own calculations put the scale of South Korean component purchasing at 5–7 trillion won (US$4.21-5.89 billion) per year.

“Whether it’s parts or semiconductors, Huawei is definitely a big customer for some domestic companies,” an industry source in Seoul said.

“While Huawei not having access to the US market hasn’t been a huge variable [for the South Korean parts companies], their sales are definitely going to drop if they can’t supply products to Huawei at all,” the source added.

Huawei’s client companies – which have more room to maneuver than the parts suppliers – have shown signs of hoping to sustain ties with Huawei in light of their presence in the Chinese market. In response to calls from Nonghyup and other clients, KT is currently weighing whether to exclude Huawei equipment from its financial network advancement efforts. LG U+ also opted not to use Huawei equipment when setting up a 5G communications network supply chain around US military bases. SK Telecom made plans to use Huawei for only a portion of its cable network, without using it for the construction of its backbone or core network. But all three telecoms stressed that nothing had been finalized, adding that they would still be using the equipment they had previously acquired.

The same situation was seen among companies using Huawei network equipment. Hyundai Motor, which uses Huawei equipment for its Chinese joint venture’s intranet, announced that it would continue using the items, which it said were unrelated to its automobile products. The Korea Electric Power Corporation (KEPCO), which used Huawei equipment to establish its network, said there was “no reason to leave Huawei out of competitive bidding” for the replacement of its equipment later this year.

“If they were to explicitly shut Huawei out for whatever reason, they’d basically be kindling an international dispute,” another industry source in Seoul said.

“These domestic companies all have close relationship with China, so none of them are free from [the Huawei situation],” the observer added.

Meanwhile, one area has been reaping rewards from the deepening divide between Huawei and the US: the Samsung Electronics smartphone and communications equipment manufacturing sector, which now enjoys an opportunity to capture the Southeast Asian and European markets previously held down by Huawei. Already, some customers are taking their Huawei mobile phone devices to second-hand markets over fears that they won’t link up with Google; device prices have fallen by the equivalent of anywhere from 100,000 to 300,000 won (US$84.15-252.44). Samsung Electronics’ Singapore office is currently selling smartphones at a discount in a move to target Huawei device users.

By Shin Da-eun, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/8317138574257878.jpg) [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father![[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms? [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0423/3617138579390322.jpg) [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

- [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

Most viewed articles

- 1[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 2Senior doctors cut hours, prepare to resign as government refuses to scrap medical reform plan

- 3[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5[Column] The clock is ticking for Korea’s first lady

- 6Opposition calls Yoon’s chief of staff appointment a ‘slap in the face’

- 7New AI-based translation tools make their way into everyday life in Korea

- 8Terry Anderson, AP reporter who informed world of massacre in Gwangju, dies at 76

- 9Korean government’s compromise plan for medical reform swiftly rejected by doctors

- 10[Editorial] Japan’s rewriting of history with Korea has gone too far