hankyoreh

Links to other country sites 다른 나라 사이트 링크

Prices of S. Korean NAND flash and memory semiconductors continue to fall

As prices of NAND flash and other memory semiconductors continue to fall, the market is watching to see how the Japanese government’s imposition of export controls on semiconductor materials affects semiconductor production and price fluctuations.

According to sources in the South Korean semiconductor industry who spoke with the Hankyoreh on July 10, the expectation that it will be difficult to acquire high-purity hydrogen fluoride and other semiconductor materials made in Japan is leading to rumors about reduced production and higher prices of NAND flash. Source say that output will be slashed to adjust inventory amid an expected shortage of components and that reduced supply will cause prices to rise. Boosted by these expectations, stock prices at Samsung Electronics and SK Hynix continued to perform strongly, rising 1% and 4.4%, respectively, on Wednesday.

But a cut in memory semiconductor production had already been in the works, for reasons unrelated to Japan’s export controls. Profitability in the memory semiconductor industry has continued to decrease as prices fell and inventory grew, already causing some manufacturers to reduce production this year. On Apr. 25, shortly after announcing its first-quarter profits, SK Hynix said that it might cut production by reducing input of NAND flash wafers by 10% year on year. Samsung Electronics also hinted at lower production during a conference call on Apr. 30 in which it announced its first-quarter performance. “We’re planning to aggressively optimize our line, and that will have an impact on output,” a company representative said.

“Falling prices and ballooning inventory in NAND flash has driven profitability down, prompting some cuts in production this year. Japan’s announcement of the export controls won’t cause any changes, such as further production cuts,” an industry source said.

The view inside the semiconductor industry is that Japan’s export controls won’t have a major impact, at least for now, on the memory semiconductor market. The specific kind of photoresist that’s subject to the restrictions (with a wavelength of less than 193 nanometers) doesn’t have any major impact on memory semiconductor production, and the industry can also compensate to some extent for the controls on high-purity hydrogen fluoride by turning to alternative providers during the delay in Japan’s export review.

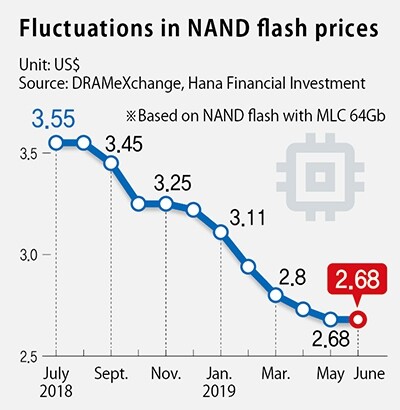

The industry is also watching to see when the price of memory semiconductors will rebound. Material provided by DRAMeXchange, a semiconductor market research organization, shows that the price of NAND flash (MLC 64Gb) has fallen from US$3.55 last August to US$2.68 this June. As the price of DRAM continues to fall, the dominant prediction is that the price will bottom out in the latter half of this year and then rebound after that. Since Japan’s export controls will serve to shrink the supply of semiconductors, the timing of that rebound could end up being earlier than expected, some predict. But semiconductor firms are hesitant to jump to conclusions, pointing out that their warehouses are still full of product.

On Wednesday, Lee Seung-woo, an analyst with the Eugene Investment Company, drew attention to a rebound in some commodity prices for low-capacity wafers. “Samsung Electronics and other NAND companies are starting to lose money, and Samsung Electronics and SK Hynix are reportedly toying with the option of reducing production now that Japan has tightened regulations on export procedures. We’re hearing that more inquiries are coming in from anxious buyers,” Lee said.

By Song Gyung-hwa, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Does Yoon think the Korean public is wrong? [Editorial] Does Yoon think the Korean public is wrong?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/8517133419684774.jpg) [Editorial] Does Yoon think the Korean public is wrong?

[Editorial] Does Yoon think the Korean public is wrong?![[Editorial] As it bolsters its alliance with US, Japan must be accountable for past [Editorial] As it bolsters its alliance with US, Japan must be accountable for past](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/6817133413968321.jpg) [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

[Editorial] As it bolsters its alliance with US, Japan must be accountable for past- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

Most viewed articles

- 1‘Right direction’: After judgment day from voters, Yoon shrugs off calls for change

- 2[Editorial] Does Yoon think the Korean public is wrong?

- 3[Editorial] As it bolsters its alliance with US, Japan must be accountable for past

- 4Where Sewol sank 10 years ago, a sea of tears as parents mourn lost children

- 5Japan officially says compensation of Korean forced laborers isn’t its responsibility

- 6[Guest essay] How Korea turned its trainee doctors into monsters

- 7Strong dollar isn’t all that’s pushing won exchange rate into to 1,400 range

- 8Umbrella with holes: New NK missiles prove Seoul’s defense system to be faulty at best

- 9Exchange rate, oil prices, inflation: Can Korea overcome an economic triple whammy?

- 10[News analysis] Watershed augmentation of US-Japan alliance to put Korea’s diplomacy to the test